XRP: Fast, Cheap, and (Almost) Free—But Is It Free of Risk?

Source: ShutterStock - XRP

"Money moves at the speed of trust—XRP wants to move it faster."

💥 What Makes XRP Different?

Launched in 2012 by Ripple Labs to solve a real pain point: slow, expensive cross-border payments.

Near-instant settlement (3–5 seconds) and tiny fees (fractions of a cent).

$144B market cap, ranked #4 globally—this isn’t some fringe token.

I’ve followed XRP since 2017, and despite the noise, the utility never stopped making sense.

“In a crypto world full of whitepapers and promises, XRP actually delivers…”

💸 Why It Still Matters

Legacy finance still moves money like it’s 1999. XRP wants to change that.

RippleNet is live with 60+ financial partners (Santander, SBI, AmEx).

Liquidity On Demand lets banks move money without pre-funding FX accounts.

XRPL now supports stablecoins, NFTs, and even an Ethereum-compatible sidechain (testnet live 2025).

This isn’t a moonshot dream. It’s a product with adoption.

🔧 How XRP Works

Census: No mining. Uses a Unique Node List—fast, cheap, and low energy.

Ledger: Closes every ~3–5 seconds.

Supply: Fixed at 100B XRP.

45B circulating

55B held by Ripple Labs in escrow (released gradually)

Yes, Ripple still controls a lot—but it's transparent and scheduled.

source: XRP Ledger

📊 By the Numbers

Daily liquidity: ~$4B. Sub-second fills on major exchanges.

Held by institutions across 100+ platforms globally.

I've traded it on both bull runs and boring stretches—it’s liquid, and it moves when headlines do.

Tokenomics

Total Supply: 100 billion XRP.

Inflation: Fixed supply; no new XRP beyond initial issuance.

Distribution:

55 billion held by Ripple Labs (gradual escrow releases).

45 billion in public circulation.

Competitive Advantage (Moat)

Speed & Cost: Faster and cheaper than Bitcoin/Ethereum.

First-Mover in Payments: RippleNet partners include Santander, SBI, American Express.

Network Effect: Growing list of financial institutions testing XRPL rails.

Real-World Use Cases

Cross-Border Remittances: Banks and payment providers.

Liquidity On Demand (ODL): FX conversions without pre-funding.

Micropayments & IoT: Emerging use in streaming and device-to-device payments.

Technology Overview

Innovations

Built-in decentralized exchange.

Native support for tokens and stablecoins.

Development Activity

Frequent XRPL Improvement Proposals (XRIPs).

Major launch: XRPL EVM sidechain (testnet live Q1 2025).

Decentralisation

Validator set increasingly diversified, though Ripple Labs remains influential.

Community & Adoption

Engagement:

Active GitHub, Discord, Twitter communities.

Regular developer grants via XRPL Foundation.

Adoption:

RippleNet spans 60+ institutions.

XRP listed on 100+ global exchanges.

Financial Metrics

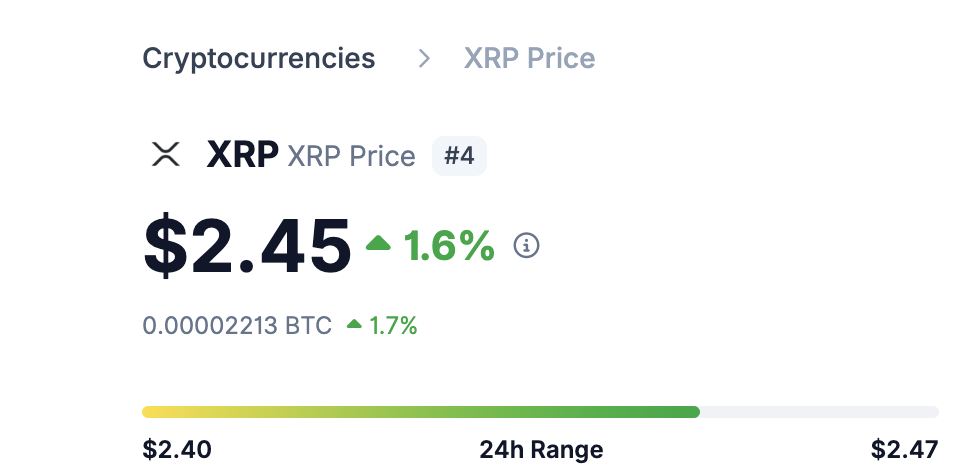

Source: Coingecko.com

Performance:

1 yr: +~50%.

5 yr: +200% (despite 2020–21 legal drag).

10 yr: +5,000% (early-adopter gains).

Holdings Concentration

Ripple’s escrow releases are monitored; whale concentration is moderate.

⚠️ Risks

Volatility: High; typical crypto swings ±10–20% monthly.

Regulatory:

Long-running SEC lawsuit; recent signs of resolution under new SEC leadership.

Global jurisdictional uncertainty remains.

Security: No major breaches of XRPL to date; consensus protocol audited.

Speculation Dependence: Price still driven by news and legal outcomes.

Competitors: Stellar, SWIFT gpi, CBDCs.

Longevity: Dependent on legal clarity and broad corporate adoption.

🌱 Growth Potential

Global payments = $200T/year. XRP has a tiny sliver, but a massive runway.

Tokenization & stablecoins growing on XRPL.

Developer activity up 30% YoY.

Micropayments & IoT use cases gaining traction.

When Ripple moves into tokenized real-world assets, I’ll be paying close attention.

Source: Panagiotis Kriaris

Valuation Metrics

Current Price vs. Utility:

$2.40 reflects a mix of payment utility and speculation.

Relative to Stellar (XLM) and SWIFT, XRP’s volume and partnerships stand out.

Final Assessment

Strengths:

Lightning-fast, low-cost settlement.

Strong real-world traction via RippleNet.

Active ecosystem & minimal energy footprint.

Weaknesses:

Centralization concerns (escrow holdings).

Regulatory cloud (SEC case).

Opportunities:

ODL expansion into new corridors.

Tokenization of real-world assets on XRPL.

Threats:

Adverse legal rulings.

Superior tech from emerging platforms.

Conclusion on XRP

Monitor and invest with caution. XRP’s core technology and adoption story are compelling—especially post-regulatory clarity. However, legal and centralization risks warrant a pragmatic allocation. Stay agile, and revisit after key regulatory milestones.