ASML Holding: The Backbone of the Digital Economy

Introduction

ASML isn’t just another semiconductor company. It’s the linchpin of global chip production, powering the digital revolution from AI to smartphones that powers every chip inside your favorite devices. With a €267 billion market cap and a dominant grip on EUV lithography, this Dutch powerhouse isn’t optional for chipmakers—it’s essential.

How ASML Makes Money

ASML generates revenue through three key streams:

Lithography Systems (70%): These $200M machines are the crown jewels of chipmaking. Without ASML, companies like TSMC and Intel can’t manufacture next-gen chips.

Installed Base Management (20%): High-margin revenue from servicing, upgrading, and refurbishing existing machines.

Applications (10%): Precision tools for inspection, metrology, and adjacent markets.

“ASML sells the Ferrari and locks in a lifelong maintenance contract…”

Management, Culture & Skin in the Game

CEO Christophe Fouquet is a seasoned veteran with deep technical roots since 2008. The leadership team is experienced but light on ownership:

Insider Ownership: Low—Just 0.023% ($72M) of shares.

CEO Stake: ~6.3k shares ( worth $5M).

While execution is strong, alignment with shareholders could be better.

Capital Allocation Masterclass

ASML shines here:

ROIC (5-yr avg): 23.6% – Excellent capital efficiency.

ROE (5-yr avg): 56.5% – World-class shareholder returns.

ROA: 19.2% – ASML's technological dominance allows it to generate significant profits from its substantial assets.

Can ASML Holding Operate With Minimal Capital Reinvestment?

CapEx/Revenue: Only 10%. Low reinvestment needs.

CapEx/Operating Cash Flow: 20%, down 53%—shows rising efficiency.

Share Buybacks: 5.8% reduction in share count over 5 years.

Dividends: Grew from €1.05 in 2015 to €6.40 in 2024. Returned over €40B to shareholders.

This is capital allocation done right: investing in R&D, returning cash, and compounding value.

Competitive Advantages: The Untouchable Moat

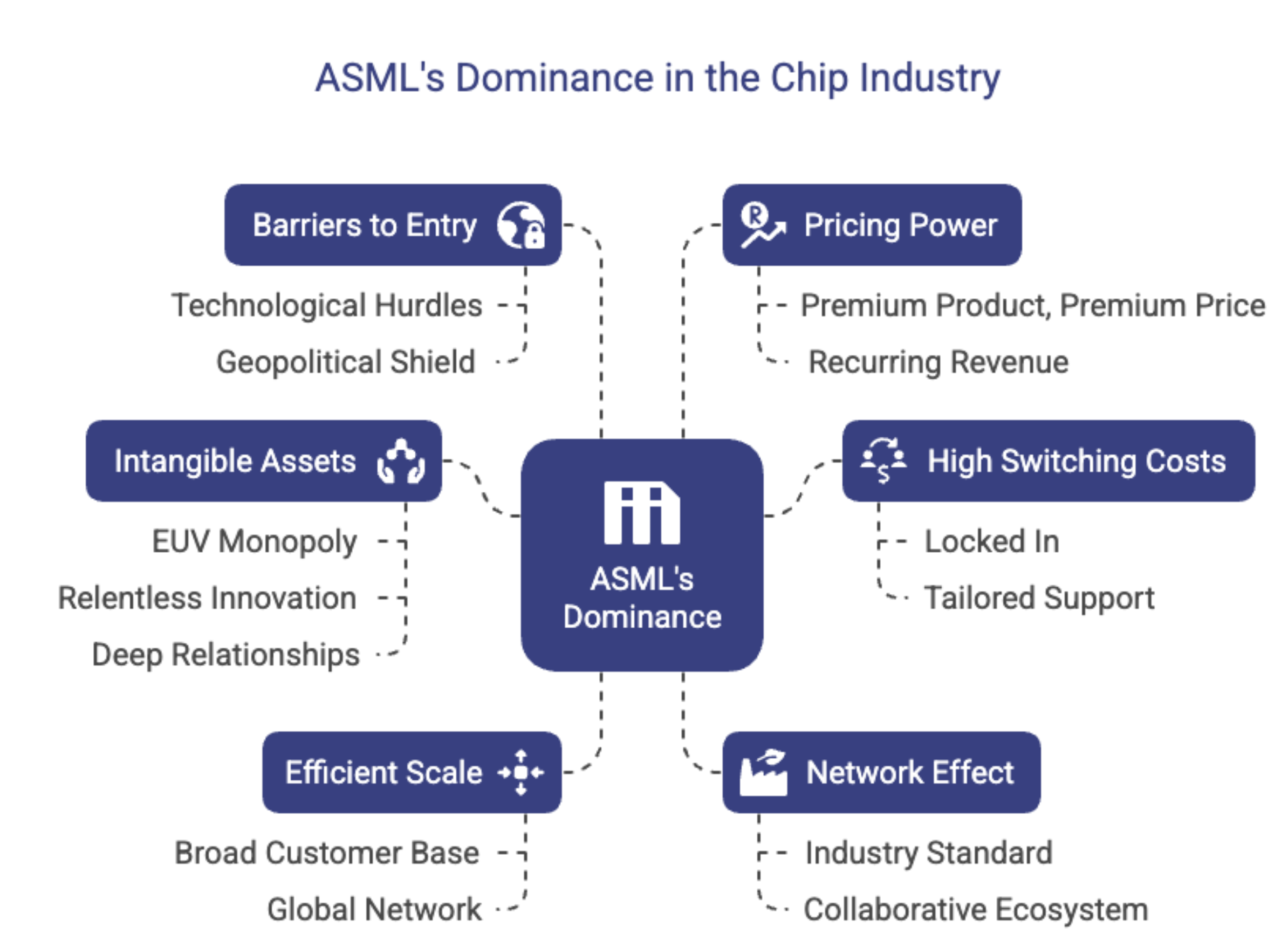

ASML has one of the strongest moats in tech:

Monopoly: Sole producer of EUV lithography systems.

Switching Costs: Deep customer integration makes switching nearly impossible.

Network Effects: Their tools are the industry standard.

Scale & Support: 60 global service centers.

Pricing Power: EUV machines can sell for $200M—demand is unwavering.

Source: Silver Cross Capital

“You don’t compete with ASML. You partner or perish…”

Valuation: Priced for Quality

P/E & P/FCF: 27x — premium, but not unreasonable.

Historical Compression: P/FCF down 34.4%, signaling improved entry point.

DCF Margin of Safety: 14% at 18.8% FCF growth.

It’s not cheap, but greatness rarely is.

Balance Sheet: Fortress-Like

FCF / Total Debt: 3.1x — strong debt coverage.

Interest Coverage: 69.1x — almost debt-free in practice.

Goodwill / Assets: Just 10% — solid asset quality.

Cash-rich, debt-light, and ready to strike.

Market Potential: Tailwinds Everywhere

AI Chip Demand: $150B in 2025 alone.

End Market Growth: PCs, smartphones, edge devices.

Industry Goal: $1T chip market by 2030.

Tailwinds: AI, edge computing, 5G

ASML is selling the shovels in a digital gold rush.

Performance vs. the Market

ASML Total Return (Since 2020): +136.9%

S&P 500 (VOO): +108.6%

ASML CAGR: 18.8% vs. S&P’s 15.8%

“Not just beating the market—redefining it”.

Profitability: World-Class Margins

Gross Margin: 52%

Operating Margin: 33.8%

FCF Margin: 30.3%

Cash Conversion: 106.8%

“They print money—then invest it like pros…”

Risks to Watch

Geopolitical: China + Taiwan = 51% of sales.

Supply Chain: Single-source dependencies.

Execution Risk: High-NA EUV rollout must succeed.

Regulatory: Export controls & tariffs.

“Even giants need to watch their step”.

Conclusion

Buy the Backbone of Tech ASML is the beating heart of global chipmaking, blending monopoly power, margin muscle, capital discipline, and innovation leadership. Despite modest insider ownership, it’s a capital-efficient juggernaut built to scale. With high returns (ROIC 23.6%), solid margins, and market-beating performance, it offers investors exposure to the future of computing.

Yes, there are geopolitical and execution risks. But with a fortress balance sheet, sticky customer base, and a monopoly over the most critical tech in chips, ASML is a compounder you want in your corner.

SCC Rating: Buy ✅

Take Your Investments to the Next Level! We provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.