Solana (SOL): Why Solana is Set to Dominate Web3

Source: Investopedia

What is Solana (SOL)?

Solana is a high-performance blockchain designed to solve the scalability and speed challenges that have long plagued earlier platforms like Ethereum. It’s a smart contract platform known for its blazing speed, low fees, and scalability, making it a favorite for decentralized applications (dApps), DeFi protocols, and NFTs.

📜 The Story Behind Solana

Origins: Solana was launched in 2020 by Anatoly Yakovenko, a former Qualcomm engineer, and Raj Gokal. Built to break the limits of blockchain scalability, Solana aims to process thousands of transactions per second (TPS) without compromising security or decentralization.

Vision: Yakovenko’s vision was simple yet ambitious – to create a decentralized network capable of supporting real-world financial systems. Solana’s blend of Proof of Stake (PoS) and Proof of History (PoH) was a breakthrough, enabling unparalleled speed and efficiency.

Evolution: Since its launch, Solana has rapidly grown into one of the largest blockchain ecosystems, supporting a wide range of applications from DeFi and NFTs to payments and gaming.

🔧 How Solana Works

Consensus Mechanism: Solana’s innovative Proof of History (PoH) is the backbone of its speed and scalability, setting it apart from other blockchain architectures. Unlike traditional systems that rely solely on consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS), Solana uses PoH as a cryptographic clock to order transactions before consensus. This unique approach drastically reduces the time required to confirm transactions by establishing a verifiable time order without direct coordination between nodes.

Speed and Scalability Comparison:

Solana: Capable of up to 710,000 TPS on a 1 Gbps network, with sub-second finality. This high throughput is enabled by PoH and Solana’s Turbine block propagation protocol, which breaks data into smaller packets for efficient distribution.

Ethereum: Currently supports around 30 TPS, aiming for up to 100,000 TPS with Ethereum 2.0 upgrades like sharding and rollups, but still struggles with latency due to its reliance on global state updates.

Bitcoin: Approximately 7 TPS, with 10-minute block times, making it slow and costly for everyday transactions. Bitcoin’s design prioritizes security and decentralization over speed.

Blockchain Structure: Solana is a standalone, layer-1 blockchain, meaning it doesn’t rely on other networks for security or scalability. This independence, combined with its high-speed architecture, makes it particularly suited for high-throughput applications like DeFi, NFTs, and real-time payments.

Tokenomics:

Total Supply: Approximately 600 million SOL

Circulating Supply: Around 519 million SOL

Inflation: Starts at 8% annually, decreasing by 15% each year until it stabilizes at 1.5%

Distribution: Primarily through staking rewards, with early backers and the community holding a significant share.

🏆 Competitive Advantage

Speed and Cost:

Speed: Capable of processing up to 65,000 TPS

Low Fees: Typically less than $0.0025 per transaction

Ecosystem Growth:

DeFi platforms like Serum and Raydium

NFT marketplaces like Magic Eden

Payments and micropayments due to low fees

📊 Financial Metrics

Market Cap: Approximately $90.5 billion, making it one of the top cryptocurrencies globally.

Liquidity: High daily trading volumes ensure strong market liquidity.

Price Performance: Rapid growth since launch, reflecting rising adoption and investor confidence.

📈 Performance

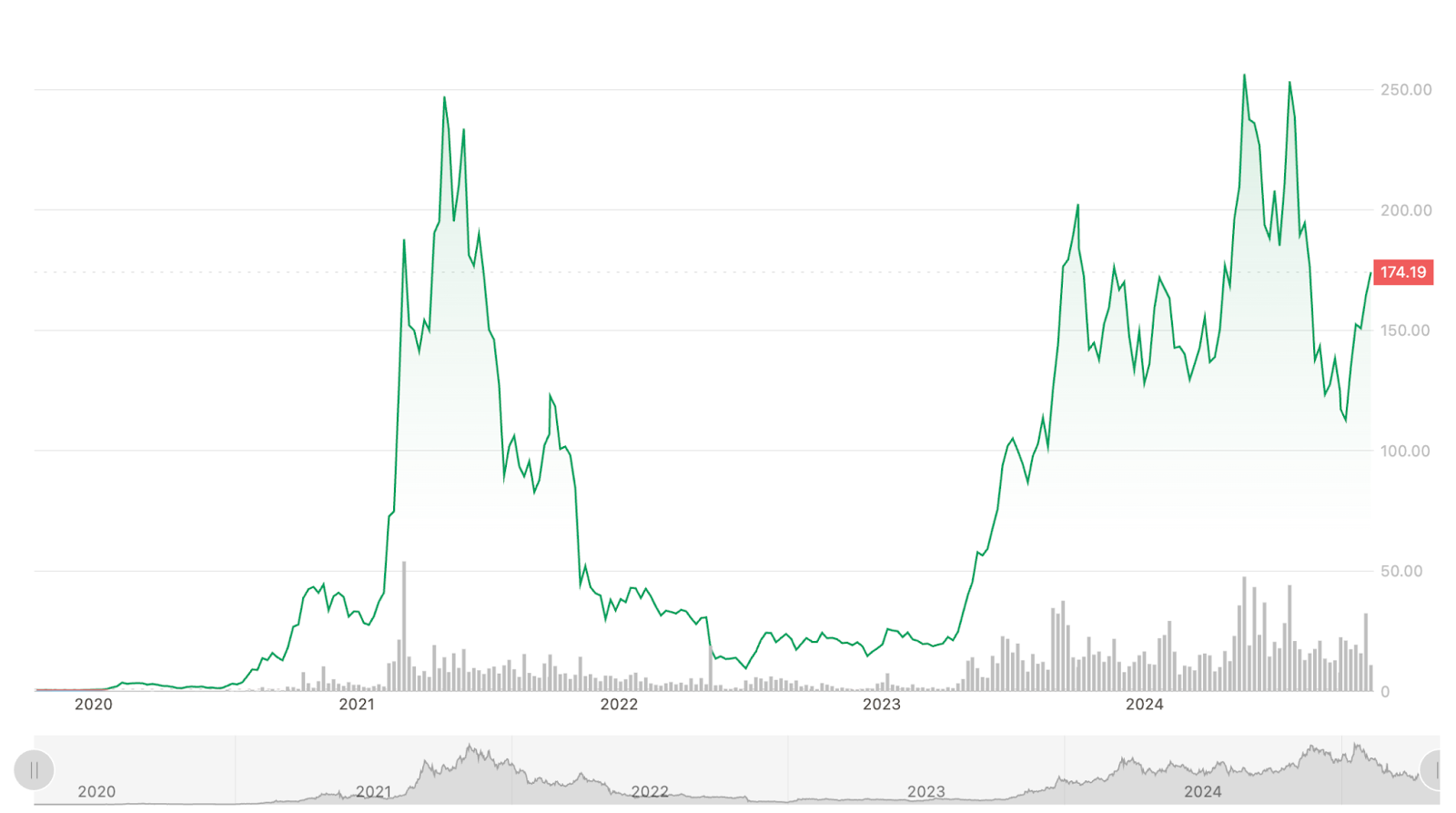

Solana experienced a rapid price surge starting in early 2021, reaching an all-time high near $250.

This rally was driven by the booming interest in DeFi, NFTs, and Solana's perceived competitive advantage over Ethereum, particularly in transaction speed and scalability.

Since 2020, Solana has experienced an exceptional average compound growth rate of 140%.

🚧 Key Risks

Network Stability: Past outages have raised concerns about reliability.

Regulatory Challenges: Uncertainty around its classification as a security.

Security: Fast innovation requires constant vigilance against potential vulnerabilities.

🌱 Growth Potential

Market Penetration: Solana continues to capture a significant share of the DeFi and NFT markets.

Institutional Interest: Increasing interest from institutional investors and developers.

Ecosystem Expansion: Ongoing growth in dApps, smart contracts, and other integrations.

📝 Final Thoughts

Solana stands out as a high-speed, low-cost blockchain with a vibrant ecosystem. Its unique consensus model, rapid transaction speed, and active developer community make it a promising platform for the future. However, it faces significant challenges, including regulatory scrutiny and technical stability issues. For investors, Solana presents both a high-risk, high-reward opportunity in the ever-evolving world of blockchain technology.