Novo Nordisk: The Obesity Giant Built for Long-Term Compounding

Introduction

Novo Nordisk has quietly become one of the most dominant and profitable companies in global healthcare. Founded a century ago through a medical breakthrough and a love story, it now leads the charge in treating diabetes, obesity, and chronic diseases. If you've heard of Ozempic or Wegovy, you already know part of the story. But the full picture is even more compelling.

💰 How Do They Make Money?

Core business: Biological drugs for diabetes, obesity, and rare endocrine disorders

Revenue engine: Chronic-use treatments ensure consistent, recurring cash flow

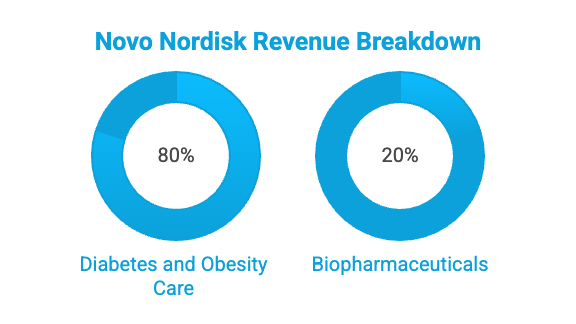

Segments:

Diabetes & Obesity: ~80% of revenue (GLP-1s, insulin)

Biopharma: ~20% (rare blood and hormonal diseases)

Global footprint: 77,000+ employees in 168 countries

👥 Management, Culture & Skin in the Game

CEO: Lars Fruergaard Jørgensen

Insider ownership: Very low (~0.24% total, $101M in value)

Control: 77.3% voting rights via Novo Holdings A/S, owned by the Novo Nordisk Foundation

Culture: Mission-driven, long-term focused, promotes ethical and sustainable growth

Verdict: High integrity and discipline, but lacks founder-style audacity

📈 Capital Allocation

R&D investment: Deep commitment to innovation (oral GLP-1s, CagriSema, Amycretin)

Manufacturing scale-up: $24B+ in U.S. buildout

Selective M&A: Acquisitions to accelerate drug development and production

Shareholder returns: Regular dividends and share buybacks

💲 Profitability

Gross margin: 84.6%

Operating margin: 48.4%

FCF margin: 26%

Cash conversion: 96%

ROIC (5-yr avg): 29.3% | ROE: 81.3%

These are elite margins—rare even among tech giants

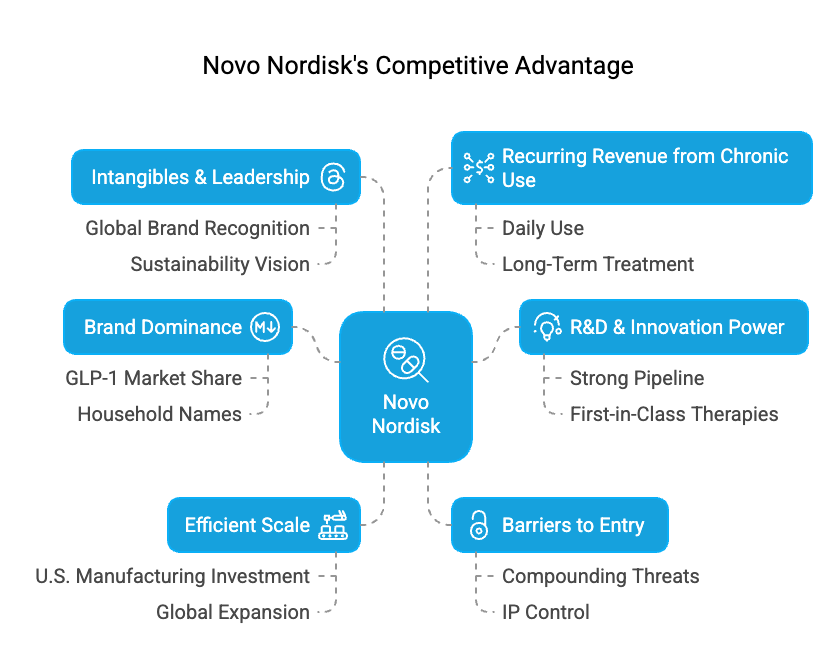

Competitive Advantage

Brand dominance: 70%+ of global GLP-1 market

Pipeline strength: CagriSema, Amycretin, and oral semaglutide are category leaders

Scale moat: Efficient global manufacturing and distribution

Barriers to entry: IP, legal defense, and brand trust

Recurring revenue: Built-in demand from chronic use drugs

source: www.silvercrosscapital.com

📊 Valuation

P/E: 18x | P/FCF: 25x

DCF margin of safety: ~35% assuming 16% growth

Context: Trades at discount to Eli Lilly, but with comparable upside

View: High-quality compounder trading at a reasonable price

💳 Balance Sheet

Net cash: DKK 23.2B (~$3.5B)

Interest coverage: 44.4x

FCF/Total Debt: 1.1x

Goodwill/Assets: Just 4.3%

Conclusion: Financial fortress with optionality to invest, acquire, or return capital

🌎 Market Potential

Obesity market (2024): $15.9B, growing at 22.3% CAGR

800M+ people globally with obesity

Novo's advantage: First-mover, 70%+ market share, strong pipeline

Tailwind: Obesity drugs are becoming cultural and economic megatrends

Source: World Bank

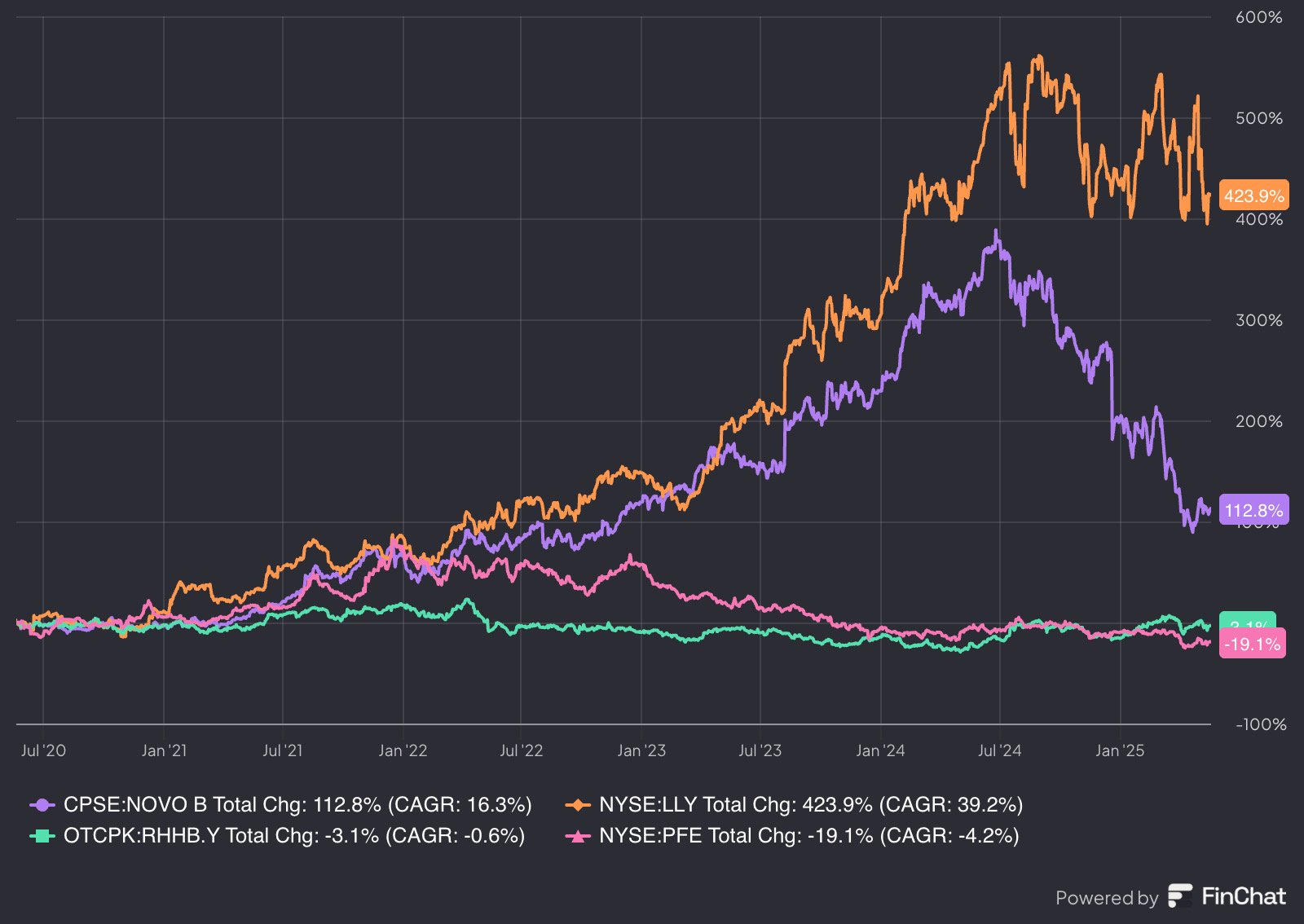

🏆 Performance Comparison

Novo Nordisk (NOVO B): +112.8% since 2020 | CAGR: 16.3%

Eli Lilly: +423.9% | CAGR: 39.2%

S&P 500: +113% | CAGR: 16.3%

Takeaway: Solid long-term performer, with new growth levers in play

⚡ Key Risks

Overdependence on semaglutide (Ozempic/Wegovy)

Regulatory and pricing pressure, especially in the U.S.

Global supply chain complexity and capacity strain

Innovation risk if R&D pipeline falters

Legal/IP risk from compounders and generics

Cybersecurity and digital disruption

🏋️ Conclusion

Novo Nordisk is the rare combination of scale, durability, and growth. With elite margins, dominant market share, a clear expansion roadmap, and a fortress balance sheet, it's built to lead the next decade of global health transformation.

Yes, insider ownership is low. No, it doesn’t have a flamboyant founder. But it has something better: a long-term vision backed by execution and world-class financials.

In a market chasing hype, Novo offers substance. It's a high-conviction buy for investors seeking quality, predictability, and long-term upside in one of the largest medical opportunities of our generation.

SCC Score: 85% ✔ Buy