GameStop: The Meme Stock Trying to Become a Digital Asset Empire

Introduction

GameStop Corp was once the world's largest video game retailer—a mall staple synonymous with consoles and trade-ins. Today, it’s something else entirely. After a wild ride from near-bankruptcy to meme-stock fame, GameStop is now pivoting from retail to digital assets under a bold new leader. It’s not a traditional turnaround—it’s a radical reinvention.

💰 How Do They Make Money?

Core business: Brick-and-mortar sales of consoles, games, and accessories

Revenue model: One-off transactions—no subscriptions, no licensing, no recurring income

Segments:

Consoles & games (physical media, not digital)

Collectibles, accessories, and trade-ins (higher margin resale model)

Shift underway: Exiting low-performing countries (e.g., Italy, Germany) and embracing Bitcoin as a treasury asset.

👤 Management, Culture & Skin in the Game

CEO: Ryan Cohen (co-founder of Chewy, took no salary)

Insider ownership: Very high — Cohen owns 8.35% (~$788M)

Leadership style: Founder-like intensity, aggressive cost-cutting, massive Bitcoin buy, and strategic exits

Culture: Contrarian, risk-tolerant, deeply aligned with retail investors (and Reddit traders)

Verdict: Cohen is either the visionary GameStop needed—or the gambler it didn’t.

📈 Capital Allocation

Capital expenditures: Slashed from $62M (2022) to $16.1M (2025)

Free cash flow: Now positive (FCF margin 3.4%), despite shrinking sales

Big bets:

Bitcoin purchase: $500M+ added to the balance sheet

Convertible notes: $1.3B raised to fund crypto exposure

Store closures: 590+ U.S. stores shuttered in 2024

Narrative: Less about reinvesting in retail, more about building a financial fortress with crypto upside

💲 Profitability

Gross margin: 29.1% (up from 22.4% in 2022)

Operating margin: Still negative (-0.5%)

ROIC (5-yr avg): -15.6% | ROE: -13.6% | ROA: -5.3%

These are not the margins of a compounder—but they reflect a business cutting fat and gaining some operating discipline.

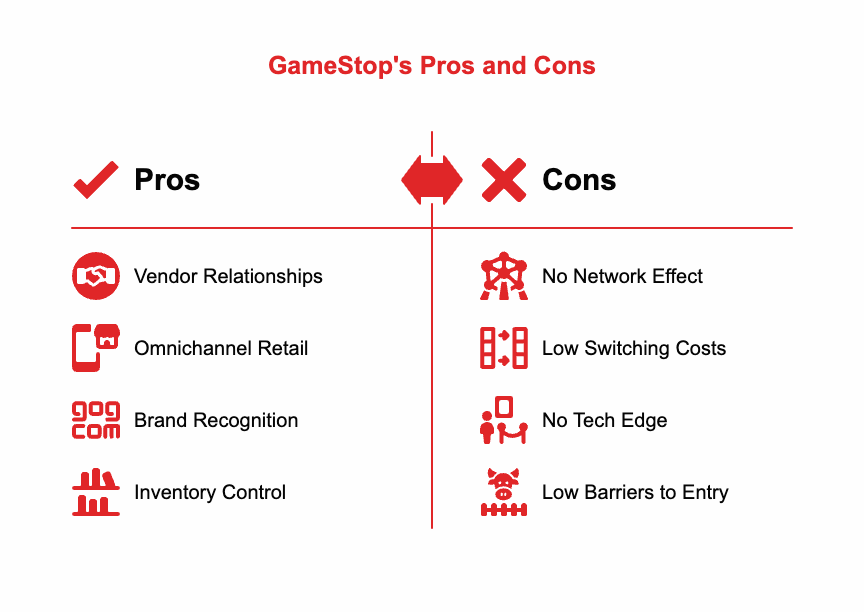

🛡️ Competitive Advantage

✅ What’s working:

Trusted vendor relationships (Sony, Microsoft, Nintendo)

Brand recognition with nostalgic and core gamer audiences

Omnichannel presence (physical + online + trade-ins)

❌ What’s missing:

No pricing power or network effects

No recurring revenue or SaaS

Low switching costs for customers

No durable moat in a digital-first gaming world

📊 Valuation

P/E: ~90

P/FCF: ~103

Historical P/FCF CAGR: 117% — driven by meme stock mania, not earnings

At these multiples, you’re not buying the business—you’re buying the story. There's virtually no margin of safety at current valuations.

💳 Balance Sheet

Net cash: $3.85B

Debt: Minimal ($16.9M)

CapEx: Extremely low

Leases: 1,688 set to expire in FY25—offering further shrink-to-survive flexibility

GameStop is a liquidity fortress, but that doesn’t equal growth. It’s financially durable—but needs a strategy to become economically productive.

🌎 Market Potential

Gaming hardware expected to grow from $40.4B to $65.4B by 2035 (4.9% CAGR)

Yet GameStop’s own revenue is shrinking: down 27.5% YoY, and -6.9% CAGR over 5 years

Exiting entire regions (Italy, Germany) shows defensive posture—not growth ambition

The tailwinds exist, but GameStop isn’t catching them—yet.

📈 Performance Comparison

GameStop (GME): +2,666.7% since 2020 | CAGR: 94.2%

S&P 500: +104.9% | CAGR: 15.4%

This explosive return is the stuff of Reddit legend—but make no mistake: it’s sentiment-driven, not operationally earned.

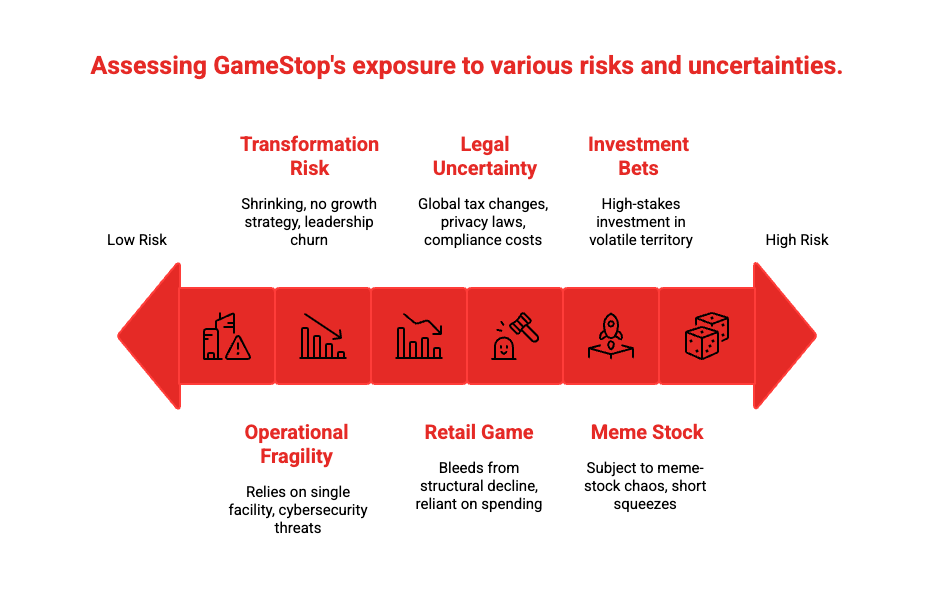

⚠️ Key Risks

Valuation disconnect: No fundamentals support a P/E of 90+

Crypto exposure: Volatile, unproven, and accounting-complicated

Retail decline: Core business faces secular headwinds from digital marketplaces

Legal overhang: Insider trading allegations + meme stock litigation

Dilution: Shares outstanding ballooned +71% since 2021

🏋️ Conclusion

GameStop is one of the boldest reinvention stories in modern investing. With a war chest of cash, deep insider alignment, and a renegade CEO betting on Bitcoin, it’s aiming for a future beyond retail. But the road is treacherous.

The fundamentals remain fragile. Margins are still thin. Revenue is shrinking. And the valuation reflects hope more than earnings.

This is not a quality compounder like Novo Nordisk. This is a volatile, high-risk optionality play. It may work. It may crash. Either way, it’s not boring.

SCC Score: 40% | Rating: Underweight