Datadog: How Datadog’s S&P 500 Debut Changes the Game for Investors

Datadog isn't just another software company. It's a capital-light, founder-led, high-margin compounder powering the infrastructure of modern digital enterprises. In a world of microservices, cloud complexity, and AI-native systems, Datadog has quietly become essential.

The Investment Thesis

Mission-critical platform: Observability, security, cost optimization—all in one.

Founder-led: Olivier Pomel and Alexis Lê-Quôc still own 5%+ worth $5.2 billion.

High-margin, low-capex: 80% gross margin, 1% capex-to-revenue.

Index tailwind: Inclusion in the S&P 500 compels index‑tracking funds to buy the stock, typically raising its share price.

Expansion engine: 83% of customers use 2+ products; 51% use 4+.

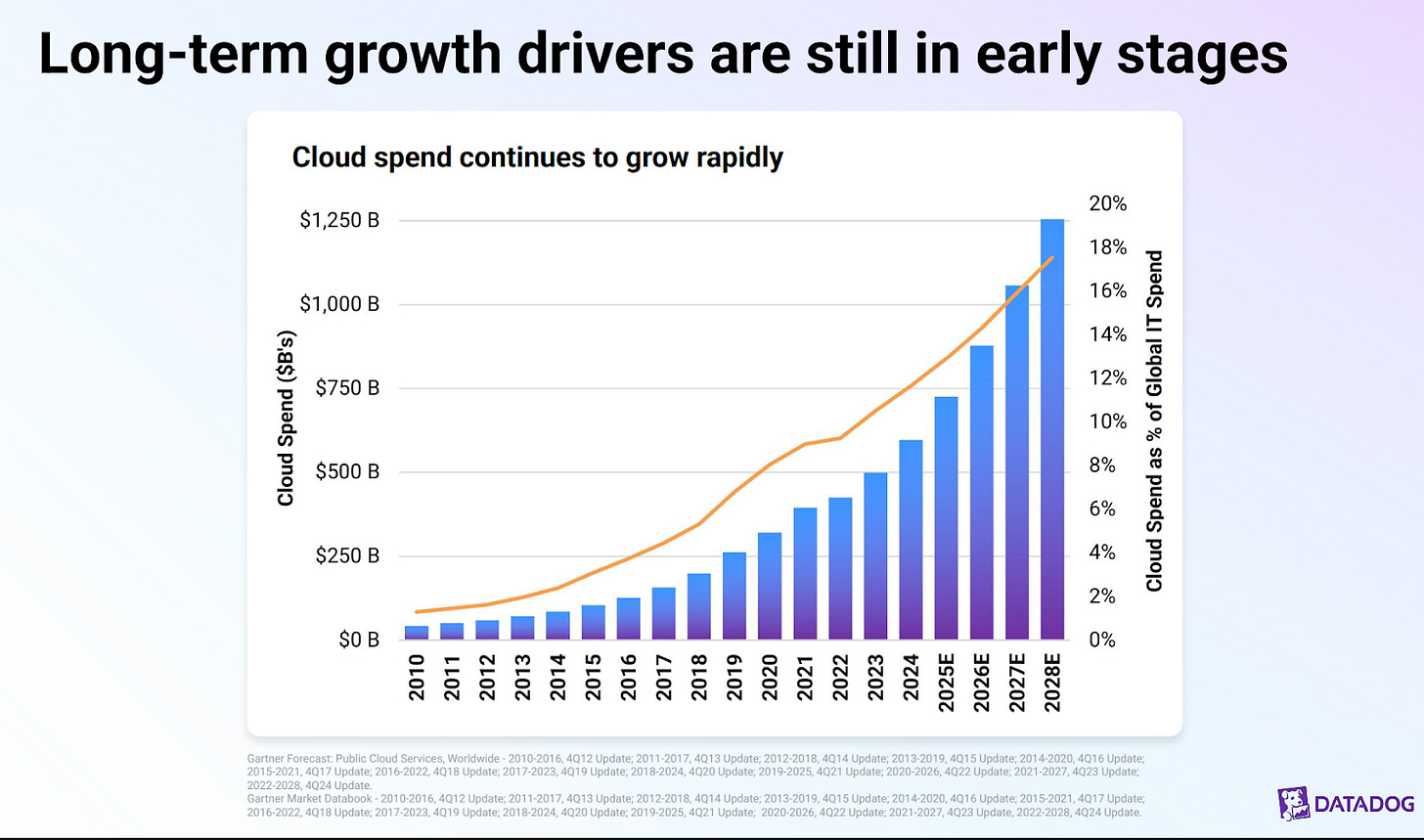

Underpenetrated TAM: Global cloud spend is set to exceed $1.2T by 2028.

How They Make Money

Datadog monetizes a full-stack observability platform via:

Usage-based + subscription pricing

Infrastructure monitoring, APM, Flex Logs, Database Monitoring

Modular expansion: Start small, scale quickly.

88% of ARR comes from customers paying $100K+, with strong upsell momentum.

Management & Culture

Founder-led since 2010

Rejected $7B offer from Cisco pre-IPO

Took the company public in 2019 at $8.7B valuation

Olivier Pomel (CEO) and Alexis Lê-Quôc (CTO) still own ~$5.2B in equity

Source: Forbes. Datadog cofounders Alexis Lê-Quôc left and Olivier Pomel right

They’re not hired guns—they’re owners.

Capital Allocation

Strategic M&A: Acquisitions align tightly with core platform

Redeemed $635M in convertible notes

Heavy reinvestment in R&D and AI features

Datadog’s 5-year average returns are weak but it’s improving:

ROIC: –3.6%

ROE: +0.5%

ROA: +0.4%

The playbook: Build, buy smart, and embed deeper.

Profitability

Free cash flow margin: 32%

FCF conversion: 543%

Gross margin: 80%

We're seeing a positive trend in earnings, and real cash flow continues to come in, which we plan to reinvest into our innovative projects.

Competitive Advantage

Switching costs: Mid-to-high 90s gross retention

Network effects: 5,000+ customers using next-gen products

Intangible assets: Trusted by 7,500+ security clients, including 50% of Fortune 500

Platform advantage: One-stop cloud operations hub

Moat? It's strong—and it’s getting wider.

Source: silvercrosscapital.com

Valuation

P/E (NTM): ~80x

P/FCF: ~53x

DCF-implied upside: ~21% that imply 26% future growth.

Not cheap, but quality rarely is. It’s about sustained excellence, not bargain bins.

Balance Sheet

$2.6B net cash

Interest coverage: 9x

Debt-to-equity: 0.6

Goodwill/assets: 6%

Strong, self-funded, no red flags.

Market Potential

$9.4B cloud monitoring TAM by 2030

Under 20% penetration by 2028

Secular tailwinds: AI, DevOps, hybrid cloud

🌐 Market Growth Snapshot (2020–2028):

🔍 Observability: $53B today, growing at 11% CAGR

🛡️ Cloud Security: $26B, fastest-growing at 16% CAGR

☁️ Public Cloud: $600B behemoth, doubling at 20% CAGR

Observability is still early—and Datadog is leading.

Performance Comparison

+290% total return since IPO (22.3% CAGR)

Outpaced Dynatrace (+142%) and Elastic (+24.3%)

Datadog has created serious long-term value for shareholders.

Risks

Valuation risk: High multiples demand perfect execution

Macro headwinds: IT budget pressure, rate shocks

Competitive pressure: AWS, MSFT, startups

AI volatility: Big upside, but evolving regulation and risk

Great business. Not invincible.

Conclusion: Buy the Backbone

Datadog is what happens when visionary leadership meets elite capital efficiency. Founders are still in charge. Customers locked in. Margins high. Moat growing.

Yes, it’s expensive. But the best compounders usually are.

We rate Datadog 78%. For long-term investors seeking durable, scalable software exposure to AI, cloud, and infrastructure: Buy.

SCC Rating: 78%

Recommendation: ✓ Buy

"You don't sell the rails in a gold rush." Own the platform. Own the future.

Disclaimer: This is not financial advice. Do your own research. Investing involves risk.

For more indepth research please visit www.silvercrosscapital.com