Should You Buy Tesla Stock?

Only one-third of global energy today delivers any useful work. The rest? Lost as waste heat. That inefficiency defines the fossil fuel era — and Tesla exists to end it.

Think about this: A typical gasoline car converts less than 20% of the energy from the oil into motion; the rest is just waste heat.

A Tesla Model 3, by contrast, is approximately four times more efficient from well-to-wheel than a Toyota Corolla.

Imagine driving a 4,000-pound car over a mile on the energy it takes just to boil water for pasta. That's the power of unwaste.

Tesla’s mission is to accelerate the world’s transition to sustainable energy. They aim to achieve this by designing products that are superior to fossil fuel alternatives in every way—more affordable, reliable, safer, and fun.

Company Snapshot

Founded: 2003

Focus: Electrification across EVs, solar, energy storage, AI, and robotics

2024 Deliveries: ~1.8 million vehicles; 31 GWh of energy storage deployed

Key Products: Model 3/Y, Powerwall, Megapack, Supercharger network, Full Self-Driving (FSD), Optimus robot

Tesla is no longer just an automaker — it’s a vertically integrated energy and intelligence company.

Why Now This is an Opportunity

The global energy transition is inevitable — and cheaper than the status quo. Tesla estimates the full shift to sustainable power will cost around $10 trillion, less than clinging to fossil fuels.

Energy storage and AI-driven software (like Autobidder and Virtual Power Plants) make renewable grids stable and profitable. Tesla’s Megapack business is scaling fast, selling utility-grade batteries that store solar and wind power and then trade electricity dynamically.

Meanwhile, software margins — from FSD subscriptions to energy trading platforms — could redefine Tesla’s profit structure. Once autonomy scales, those high-margin recurring revenues could dwarf car sales.

Tesla’s fleet data advantage and charging standard (NACS) build defensible moats: more data, more reliability, more optionality. It’s essentially a public venture fund — cars, energy, software, AI, and robotics — all wrapped into one ticker.

If autonomy and robotics hit, Tesla becomes a high-margin software and infrastructure giant. If not, it’s still a dominant manufacturer and energy provider — though at a premium valuation.

Tesla: More Than Just a Car Company

Tesla sees its vehicles as “robots on wheels,” each feeding data to improve AI. The broader business spans:

Cars & Software: Vehicle sales, FSD subscriptions, insurance, and service.

Energy: Megapacks for utilities, Powerwalls for homes, Autobidder for energy trading.

Infrastructure: Supercharger fees and licensing of its open-standard plug (NACS).

Today, vehicles drive most of the revenue. But energy is growing fastest — and software margins loom large.

Leadership and Culture

Elon Musk remains Tesla’s driving force — owning 15.3% of the company (worth ~$215B).

His focus on AI and robotics, reinforced by a 2025 incentive grant, keeps Tesla aimed at frontier technologies.

Tesla’s culture obsesses over speed, efficiency, and waste elimination — in design, manufacturing, and management.

This culture produces constant iteration and massive leverage: fewer parts, faster assembly, higher throughput.

Dependence on Musk is a risk — but also a source of Tesla’s unique velocity.

Source: Fiscal.ai

Capital Allocation

Tesla reinvests aggressively — building factories, training AI models, and scaling battery output.

Long-term capex: $150–175 billion to reach 20 million cars per year and 1 TWh of storage.

Buybacks can wait. Growth comes first.

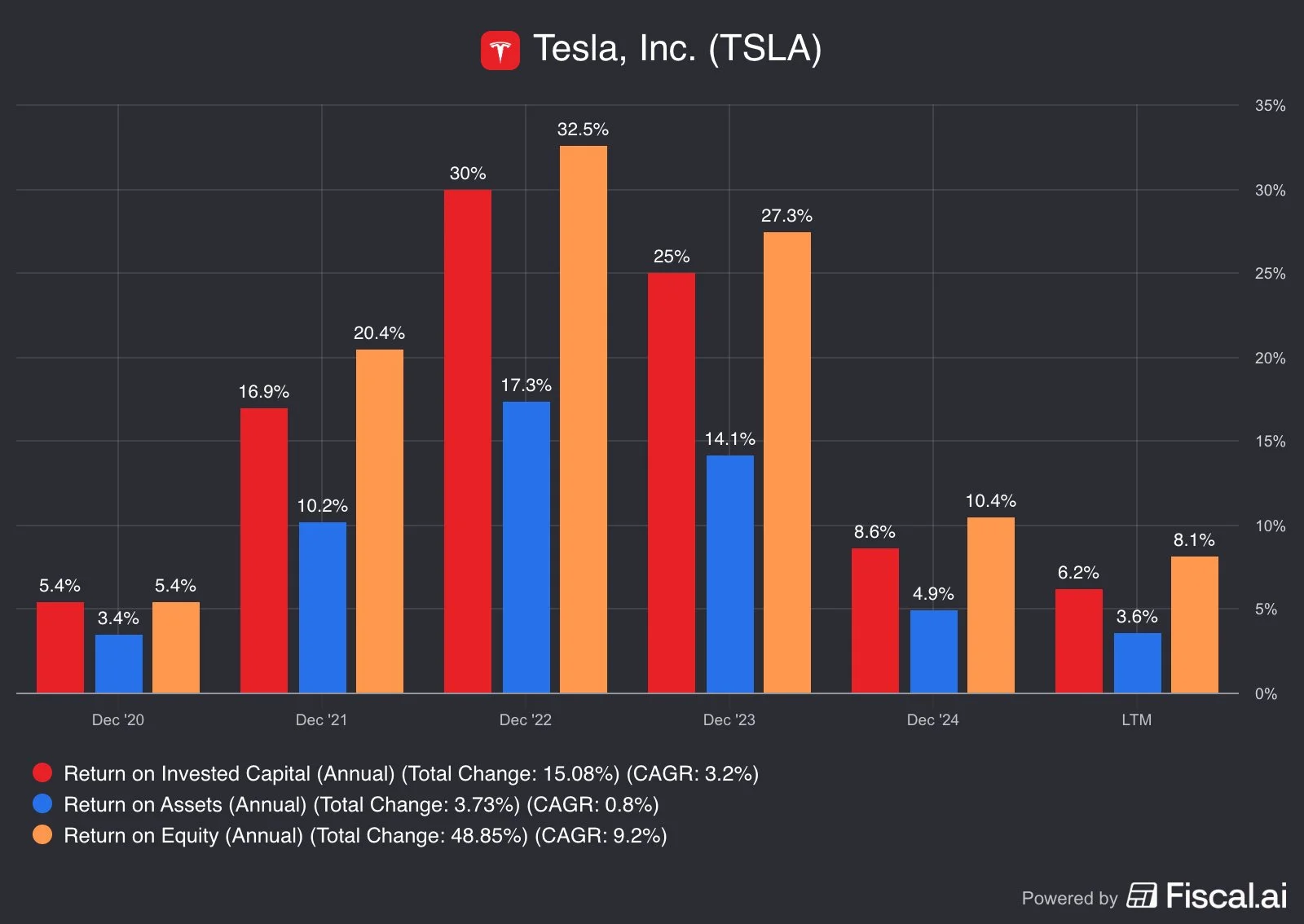

Efficiency metrics show Tesla’s long-term discipline:

ROIC: Peaked at 25% in 2022 before moderating as reinvestment ramped.

ROE: Up from 5% in 2020 to 32%, a CAGR of 9%.

ROA: Improved from 3% to 14%, then stabilized near 5%.

Short-term dips reflect heavy reinvestment, not decline — Tesla is trading near-term returns for future dominance in energy, autonomy, and robotics.

Profitability: The Flywheel Effect

Tesla’s profits come from relentless cost-cutting and smart design.

Cheaper to build each new generation of cars.

No dealer network, no ads, low SG&A.

Margins improve as factories scale and energy software grows.

It’s still one of the few automakers that grows while staying solidly profitable.

Margins have tightened as Tesla reinvests for growth:

Gross Margin: Peaked at 26% in 2022, now ~18%.

Operating Margin: Down from 17% to 6%, still strong for autos.

Free Cash Flow Margin: From 9% to 6%, reflecting expansion spend.

Even with compression, Tesla remains one of the few automakers scaling profitably while funding the next wave of innovation.

Tesla’s Competitive Edge

Tesla’s moat is built on integration, iteration, and intelligence.

Vertical Integration: Control from raw materials to software.

AI & Data: Millions of vehicles provide real-world training for FSD and Optimus.

Manufacturing Innovation: The “unboxed” process and gigacastings cut cost and footprint.

Network Effects: Supercharger dominance and cross-platform software like Autobidder and FSD.

The more Tesla builds, the smarter — and cheaper — it becomes.

Valuation: Betting on Optionality

Tesla is one of the market’s most polarizing assets.

Bears argue its valuation assumes distant sci-fi payoffs.

Bulls argue it’s leading multiple trillion-dollar markets simultaneously.

Think of Tesla as five concurrent bets:

Cars

Software (FSD, insurance)

Energy storage

Robotaxis

AI & Robotics (Optimus)

The market already prices success in all of these.

P/E ≈ 260x | P/FCF ≈ 258x – far above industry norms.

Market implies ~50% earnings growth over the next decade.

Investors pay a premium for Tesla’s growth optionality — not just cars, but AI, autonomy, and energy.

The stock trades on future potential, not current profits.

Balance Sheet and Funding

Tesla’s expansion is mostly self-funded. It has low debt and solid cash generation.

Every dollar aims to drive growth, not dividends.Tesla’s balance sheet remains one of the cleanest in the industry — debt-to-equity of just 0.1 and interest coverage at 31x show ample financial flexibility.

The chart highlights two defining trends:

Net Debt: Deeply negative, at nearly –$30B, reflecting Tesla’s strong cash position.

Free Cash Flow: Grew over 100% since 2020, reaching $5.6B in the latest period.

Tesla funds expansion internally while keeping leverage minimal — a rare position for a company scaling this aggressively.

Market Potential

EVs, energy, and AI are multi-trillion-dollar markets — Tesla sits at the center of all three.

Analysts peg Tesla’s TAM above $2T by 2030.

Even modest gains could yield massive upside; sustained growth in AI and energy could push valuation toward $2–3T.

Stock Performance

Tesla (+213.7%, CAGR 25.7%) outperformed BYD (+135.4%, CAGR 18.7%) over the past five years.

Despite higher volatility, Tesla remains the EV sector benchmark, consistently leading peers in long-term returns.

Risks

Delays in autonomy or regulatory hurdles

China competition and geopolitics

Margin pressure from price cuts

Leadership concentration

Legal and labor scrutiny

Valuation risk with little margin for error

Conclusion

Tesla’s story is about eliminating waste — in energy, materials, and time. It’s not just building cars; it’s dismantling the inefficiencies of the old energy economy.

Whether it evolves into a trillion-dollar AI and robotics powerhouse or remains a dominant automaker depends on one thing: the velocity of innovation.

Investors don’t need faith — they need calculus. Assign probabilities, not dreams. But understand this: few companies are positioned so directly at the intersection of energy, software, and intelligence. Tesla isn’t just making vehicles — it’s rewriting the physics of productivity.

SCC Rating: 60% | Neutral

At silvercrosscapital we built the Outlier Portfolio on one truth: a handful of stocks create nearly all long-term wealth. Apple already did it.

Our mission? Find the next Apple before Wall St. does.