TSMC: Should Long-Term Investors Buy Now?

Back in 1987, Morris Chang, a veteran chip engineer trained in the U.S., started TSMC with a bold idea: a company that makes chips for others, without competing with its customers.

That idea changed the industry — and today, TSMC is the world’s most important chipmaker, powering everything from iPhones to AI data centers.

And it's still delivering.

In 3Q25, TSMC reported $33.1B in revenue (+30% YoY) and record margins (59.5% gross, 45.7% net). Advanced chips now make up 74% of wafer sales, with AI demand pushing growth faster than ever.

Now, the company is at an inflection point — moving beyond scale to price leadership and deeper AI integration.

Why This Matters Now

AI boom = Structural growth: TSMC is the backbone of AI chips. Near-100% share in AI silicon manufacturing. AI revenue is expected to grow 50%+ CAGR through 2028.

Pricing power finally unlocked: TSMC is shifting from volume to value-based pricing, with 5–10% hikes across advanced nodes and CoWoS packaging.

Global scale, deep moat: TSMC dominates leading-edge nodes (3nm/5nm) with ~90% market share. No real alternative at high end sophisticated chips.

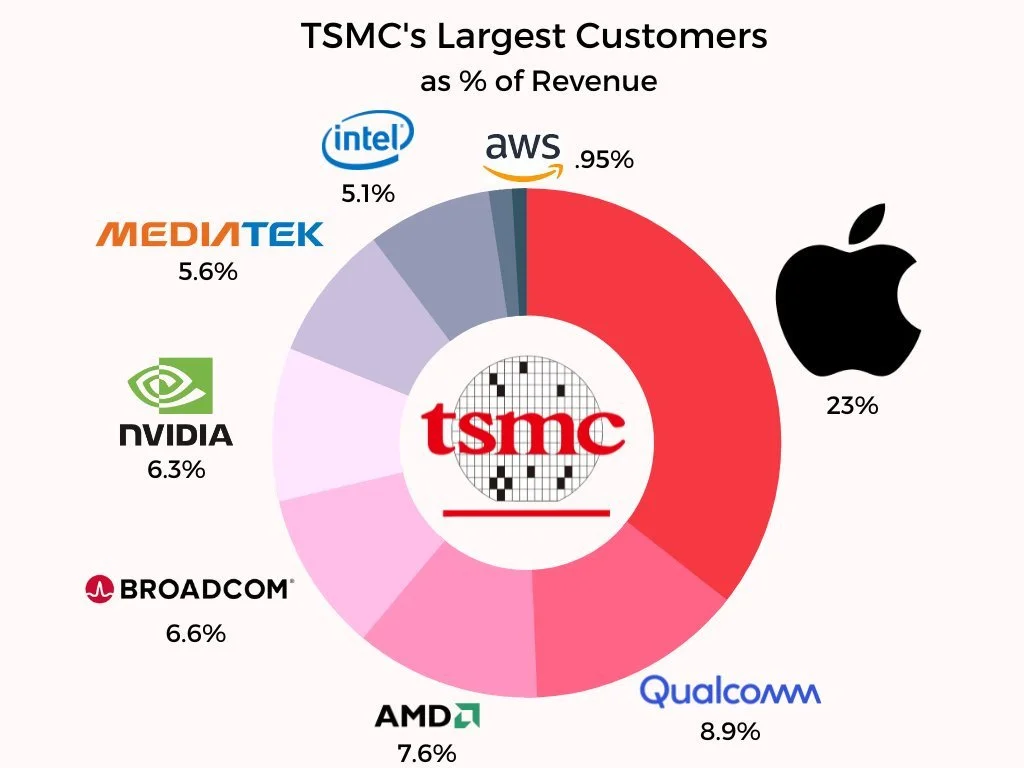

It controls the most critical link in the global tech supply chain — Apple, Nvidia, AMD, and even Intel rely on TSMC; there's no replacement at this scale yet.

Margins are holding strong despite global expansion — 58% gross and 43% net in Q2 2025 while ramping fabs in the US, Japan, and Germany.

Geopolitical risk only highlights its importance — Taiwan is a flashpoint, but TSMC’s position in the chip ecosystem makes it too strategic to ignore.

Next-gen nodes = more pricing power — N2 and A16 nodes launching 2025–26 will drive higher ASPs and stickier customer relationships.

The company is at an inflection point: Structural free cash flow (FCF) breakout + accelerating pricing = compounded upside.

The Business: What They Do

TSMC is the world’s largest, pure-play semiconductor foundry.

It builds chips for NVIDIA, AMD, Apple, Qualcomm, and increasingly Intel.

No internal products → never competes with its customers.

Key segments:

HPC (AI, data centers): 60%

Smartphones: 27%

Auto + IoT + DCE: 13% combined

Source: TSMC

How They Make Money

Charge per wafer produced using TSMC’s proprietary nodes (3nm, 5nm, etc.).

Packaging (CoWoS) is now a major high-margin contributor, especially for AI.

Revenue Breakdown (2024)

By Tech: 74% from 7nm or better

By Geography: 70% North America

By Customer: Top 10 = 76% of sales

Source: TSMC

Management & Alignment

C.C. Wei: CEO + Chairman since 2024. Clear mandate: scale, price, lead.

Strong governance: 70% independent board.

Skin in the game: Wei owns >6M shares; execs must hold 18x salary in stock.

Despite holding just 0.12%, management’s strategic role is crucial — e.g., Apple’s chips built by TSMC, assembled by Foxconn.

Capital Allocation Discipline

$60B+ CapEx in 2024, focused on leading-edge nodes + global fab expansion.

Investing in Taiwan, US (Arizona), Japan, Germany.

R&D = 7% of sales. Tech leadership is non-negotiable.

Dividends rising steadily. Small but growing buybacks to offset stock dilution.

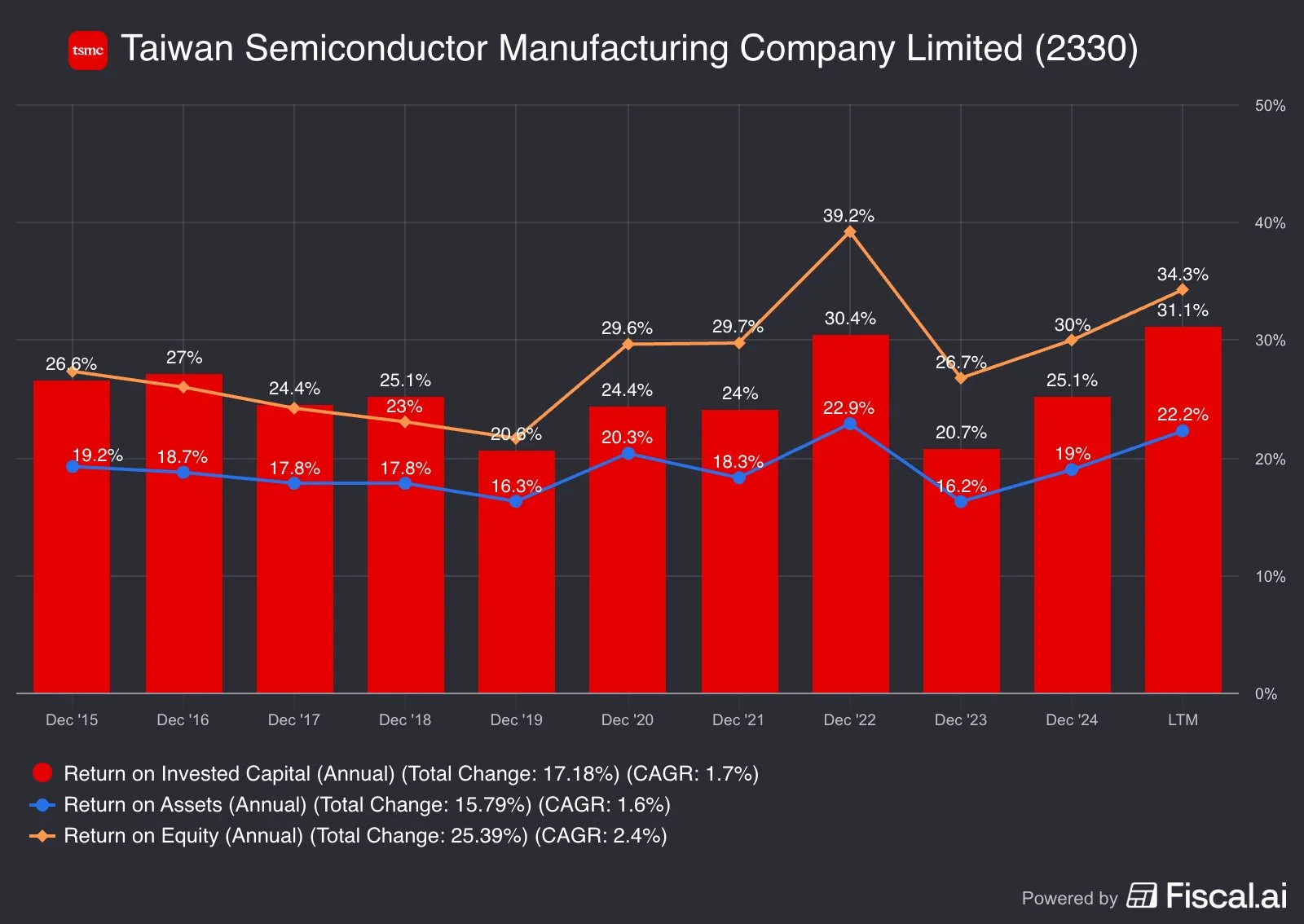

📊 Strong, Steady Returns

ROIC: Held strong between 20–30%, peaking at 30.4% in 2022. Still healthy at 31.1% LTM.

ROA: Consistent at 16–19%, hitting a high of 22.2% LTM.

ROE: Climbed from 26.6% to 34.3%, peaking at 39.2% in 2022.

Even while building fabs globally, returns stayed elevated — that’s rare.

Profitability Snapshot

Despite global expansion, TSMC is defending profitability better than most companies — that proves the discipline they have in a capital-heavy business.

Gross margin climbed from 48.7% to 58.6%, and operating margin from 38.1% to 48.8%, driven by strong pricing and tight cost control.

Free cash flow as a % of net income dropped from 89.9% to 64.9%, bottoming at 34.3% in 2023 due to heavy CapEx — but signs of recovery are clear.

Competitive Moat

Tech leadership: Always first to new nodes (3nm, 2nm, A16).

Customer entanglement: Co-design, co-optimization → high switching costs.

Scale = cost edge: Massive R&D + fab scale → higher yields, lower costs.

Trust moat: Never competes. Partners deeply with customers like Apple, Nvidia.

Intel & Samsung simply can't catch up. Customers stick with what's proven.

Source:Data Gravity

Valuation & Upside

P/E ~40×

Market is pricing in strong, sustained earnings — TSMC is seen as a structural AI winner, not a cyclical chip stock.P/FCF ~26×

Despite heavy CapEx, FCF multiple remains high — market expects a rebound as investments normalize.DCF backs it up

Implied growth expectations ~20% — in line with AI demand, pricing power, and product mix shift.

TSMC is priced for execution. So far, it’s delivering. You’re buying a monopolistic, mission-critical asset and it's rarely cheap.

Market Potential

AI accelerator revenue growing at 45% CAGR.

Management guides AI to be ~20% of total revenue by 2028.

Foundry 2.0 (including advanced packaging) is a $250B+ TAM.

Semiconductor market ex-memory: $514B in 2024, MSD-HSD% CAGR to 2030.

Risks

🇨🇳 China-Taiwan conflict – Low probability, massive downside if China invade Taiwan.

🧠 AI CapEx pullback – Possible mid-term dip, long-term trend intact.

📉 Intel foundry threat – Low execution credibility, losing money, still reliant on TSMC.

📱 Huawei rebound – Risk to Apple volumes; indirect exposure.

🇺🇸 US tariffs – China tariffs help; Taiwan-specific tariffs pass to customers.

Conclusion

You’re not just buying a chip factory — you're owning the backbone of the AI era.

TSMC has unmatched scale, customer stickiness, pricing power, and optionality via AI.

TSMC is a monopoly in one of the most critical tech infrastructures of the next decade — and of course that deserves a premium.

SCC Rating: 85% | Buy

At Silvercrosscapital we built the Outlier Portfolio on one truth: a handful of stocks create nearly all long-term wealth. Apple already did it.

Our mission? Find the next Apple before Wall St. does.