Should you Buy ASML Holding?

Latest Quarter (Q3 2025): Still Dominating, Still Delivering

ASML delivered another solid quarter — €7.5B revenue, 51.6% gross margin, and €2.1B net income, right in line with guidance.

Bookings hit €5.4B, with €3.6B from EUV — proof that demand for cutting-edge lithography remains strong.

Full-year 2025 is tracking ~15% growth and ~52% margins, with management expecting 2026 to hold steady or better.

Cash sits at €5.1B, even after buybacks and dividends, showing the strength of ASML’s self-funding model.

Founded in 1984 as a JV between ASM International and Philips, ASML is led by 17-year veteran Christophe Fouquet, whose deep EUV expertise anchors a long-term engineering culture.

The company notes that lithography intensity continues to develop positively, and EUV adoption is gaining momentum, including progress on High NA EUV.

ASML shipped its first product serving Advanced Packaging, the TWINSCAN XT:260 (an i-line scanner), which offers up to 4x productivity compared to existing solutions.

What ASML Does

ASML designs and builds the lithography machines that etch nanometer-scale patterns on silicon wafers — a process essential to chip manufacturing. It’s headquartered in Veldhoven, Netherlands, employs 44,000+ people, and operates in 60+ locations worldwide.

It’s the only company capable of producing Extreme Ultraviolet (EUV) machines — equipment so complex they’re often called the “moonshot of manufacturing.”

The Key Investment Thesis of ASML Holding (ASML)

ASML is the gatekeeper of the digital economy — a monopoly in EUV lithography with unmatched technology, high switching costs, elite profitability, and a fortress balance sheet.

Durable Competitive Advantage: ASML’s monopoly in EUV lithography, coupled with deep integration into TSMC, Intel, and Samsung, creates customer lock-in and near-impenetrable barriers to entry.

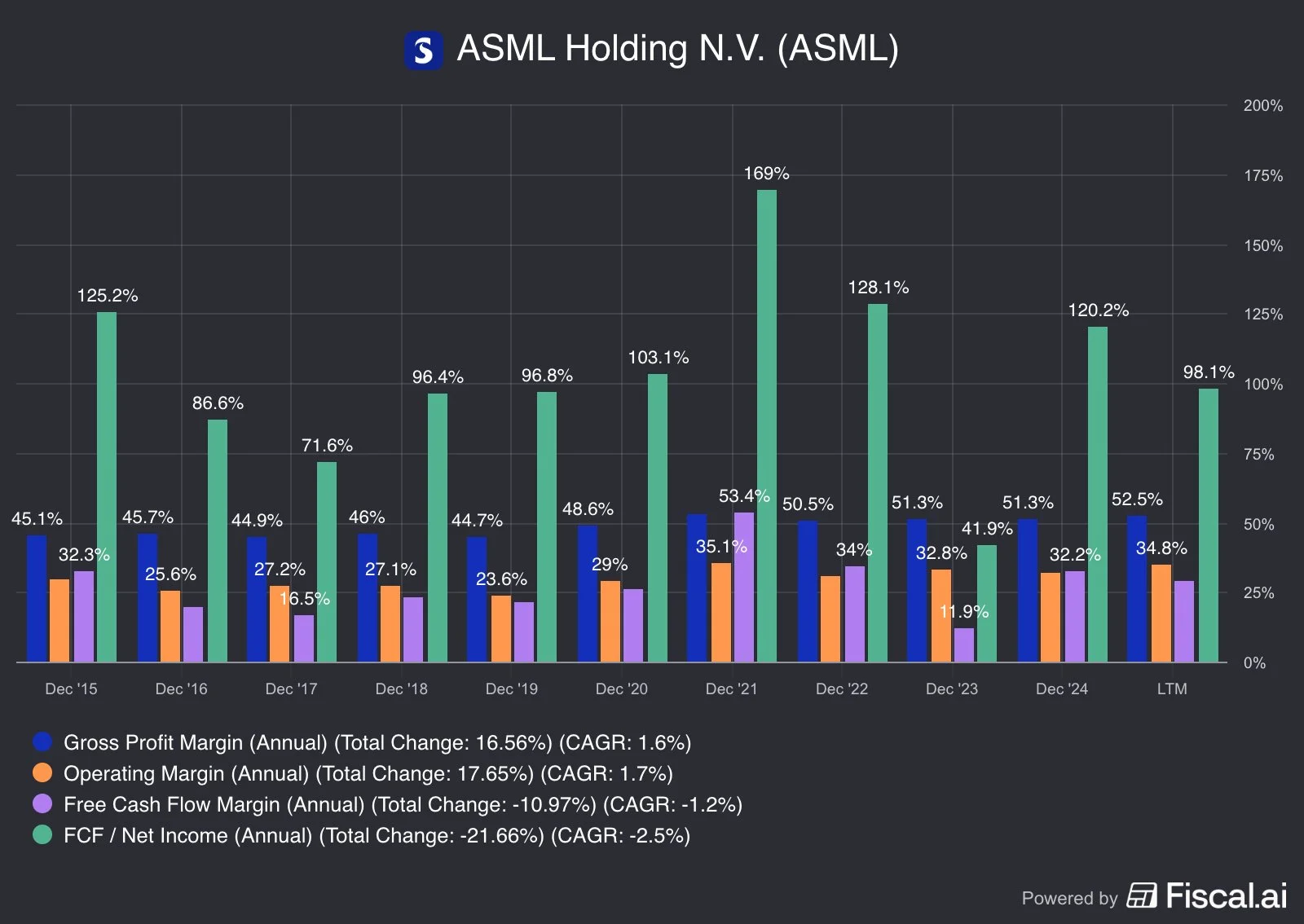

Financial Strength & Profitability: With 52.5% gross margins, 34.8% operating margins, and 98% FCF conversion, ASML delivers world-class profitability and cash generation.

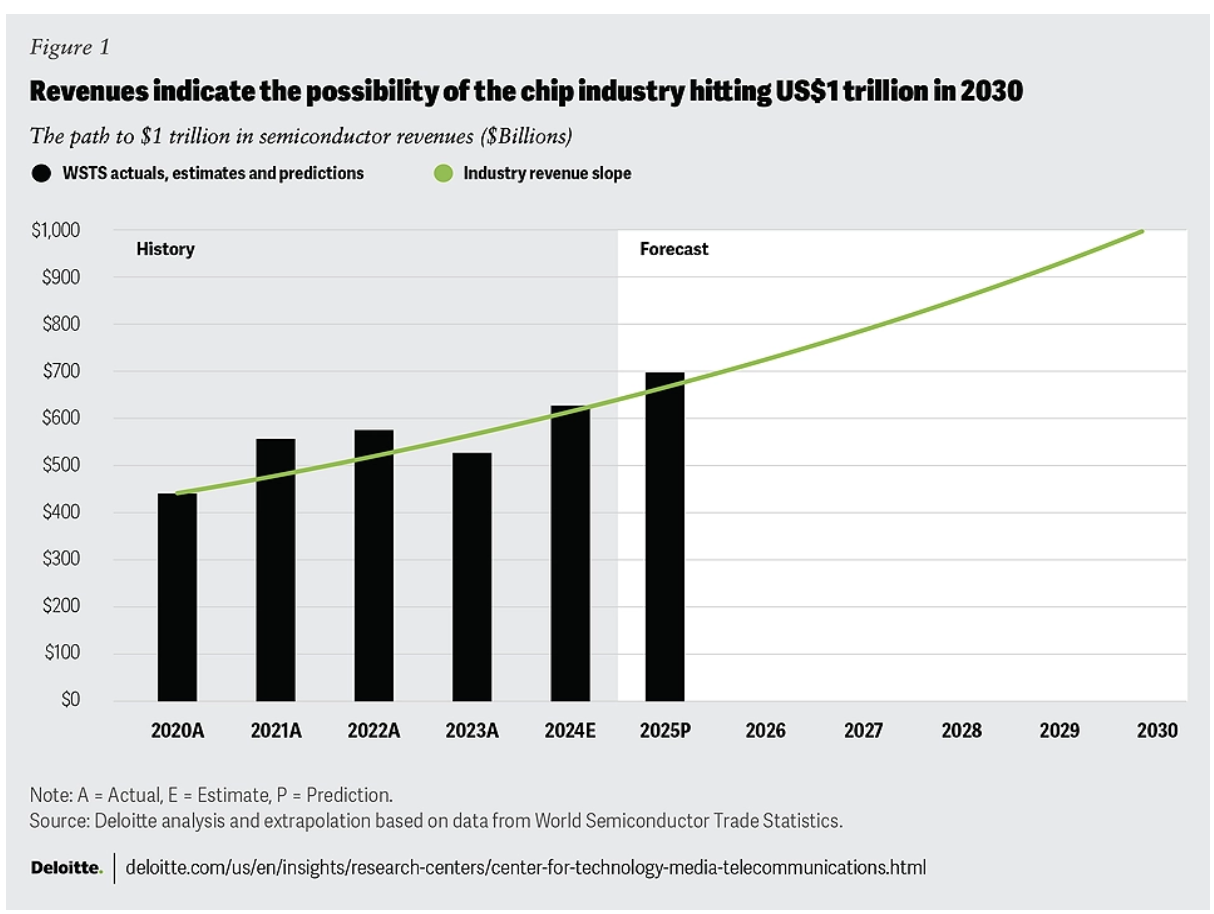

Massive Market Opportunity: Positioned to ride the semiconductor market’s climb to $1T by 2030, ASML’s High-NA EUV roadmap extends its dominance across AI, HPC, and advanced manufacturing.

How ASML Makes Money

ASML generates revenue through three key streams:

Lithography Systems (70%): These $200M machines are the crown jewels of chipmaking. Without ASML, companies like TSMC and Intel can’t manufacture next-gen chips.

Installed Base Management (20%): High-margin revenue from servicing, upgrading, and refurbishing existing machines.

Applications (10%): Precision tools for inspection, metrology, and adjacent markets.

“ASML sells the Ferrari and locks in a lifelong maintenance contract…”

Source: Silver Cross Capital

Management & Culture

Insider Ownership: Low—Just 0.01% ($72M) of shares but tenure and engineering culture ensure alignment.

CEO Stake: ~7k shares ( worth $5M).

CEO Christophe Fouquet, a 17-year ASML veteran, took the helm in 2024.

Deep technical expertise — joined during the early EUV days.

The company’s DNA is rooted in collaboration, challenge, and care — key to sustaining its innovation edge.

While execution is strong, alignment with shareholders could be better.

Capital Allocation Masterclass

Over €40 billion returned to shareholders since 2015.

€6.40 per share dividend in 2024.

€12 billion buyback program running through 2025.

In Q3, ASML purchased around €148 million worth of shares under the current 2022–2025 program.

The company intends to announce a new share buyback program in January 2026.

ASML shines here:

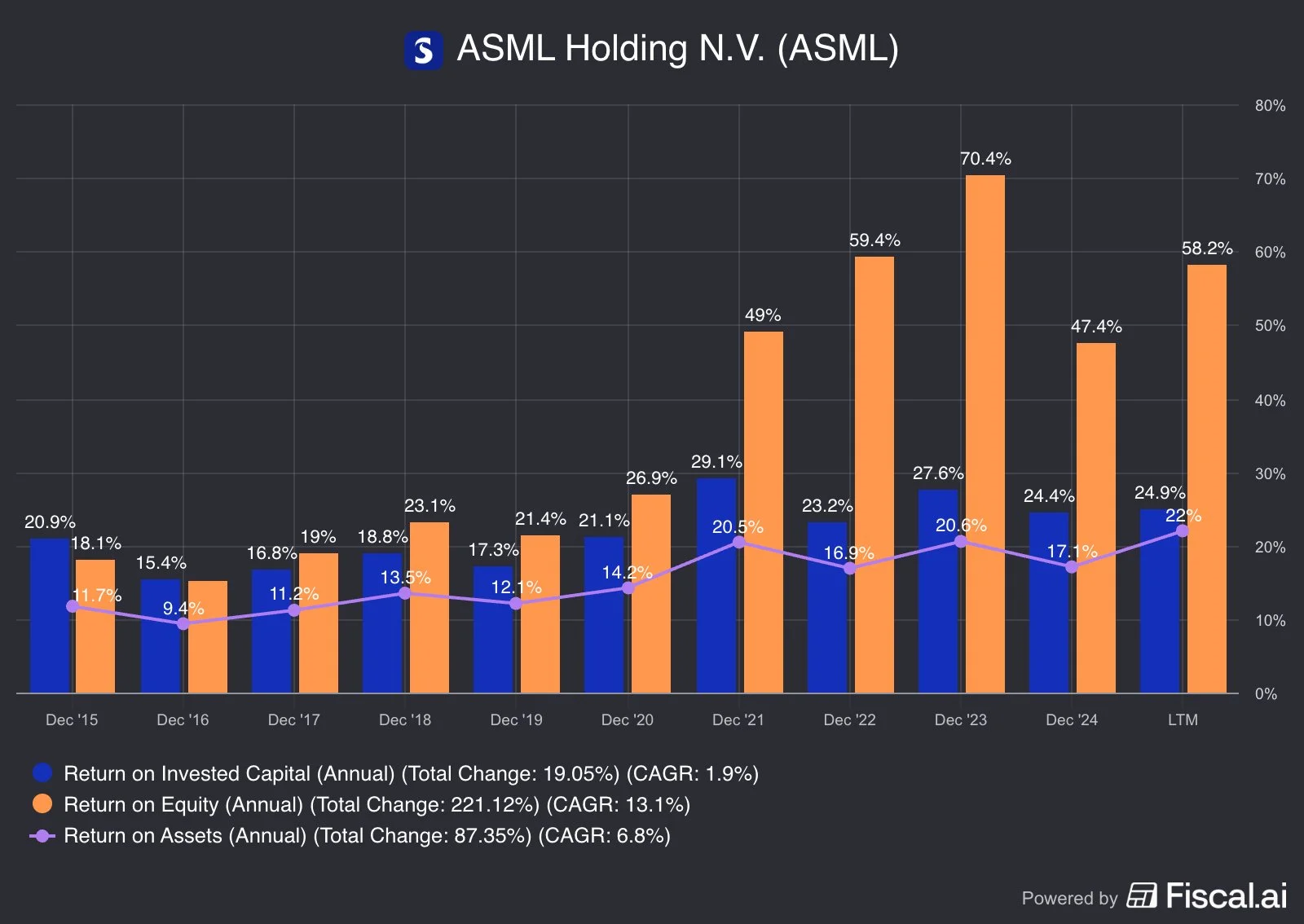

ROIC (5-yr avg): 23.7% – Excellent capital efficiency.

ROE (5-yr avg): 57.8% – World-class shareholder returns.

ROA: 19.4% – ASML's technological dominance allows it to generate significant profits from its substantial assets.

Competitive Advantage

ASML has one of the strongest moats in tech.

Monopoly in EUV lithography.

High switching costs: Once embedded in a fab, replacing ASML equipment is practically impossible.

Network effect: The more fabs rely on ASML, the more valuable its ecosystem becomes.

Technological moat: Building an EUV system requires decades of IP and thousands of suppliers — an entry barrier so steep, it’s practically permanent.

Pricing power: When you’re the only one selling a €200M product everyone needs, you set the price.

Source: Silver Cross Capital

You don’t compete with ASML. You partner or perish.

Valuation: Priced for Quality

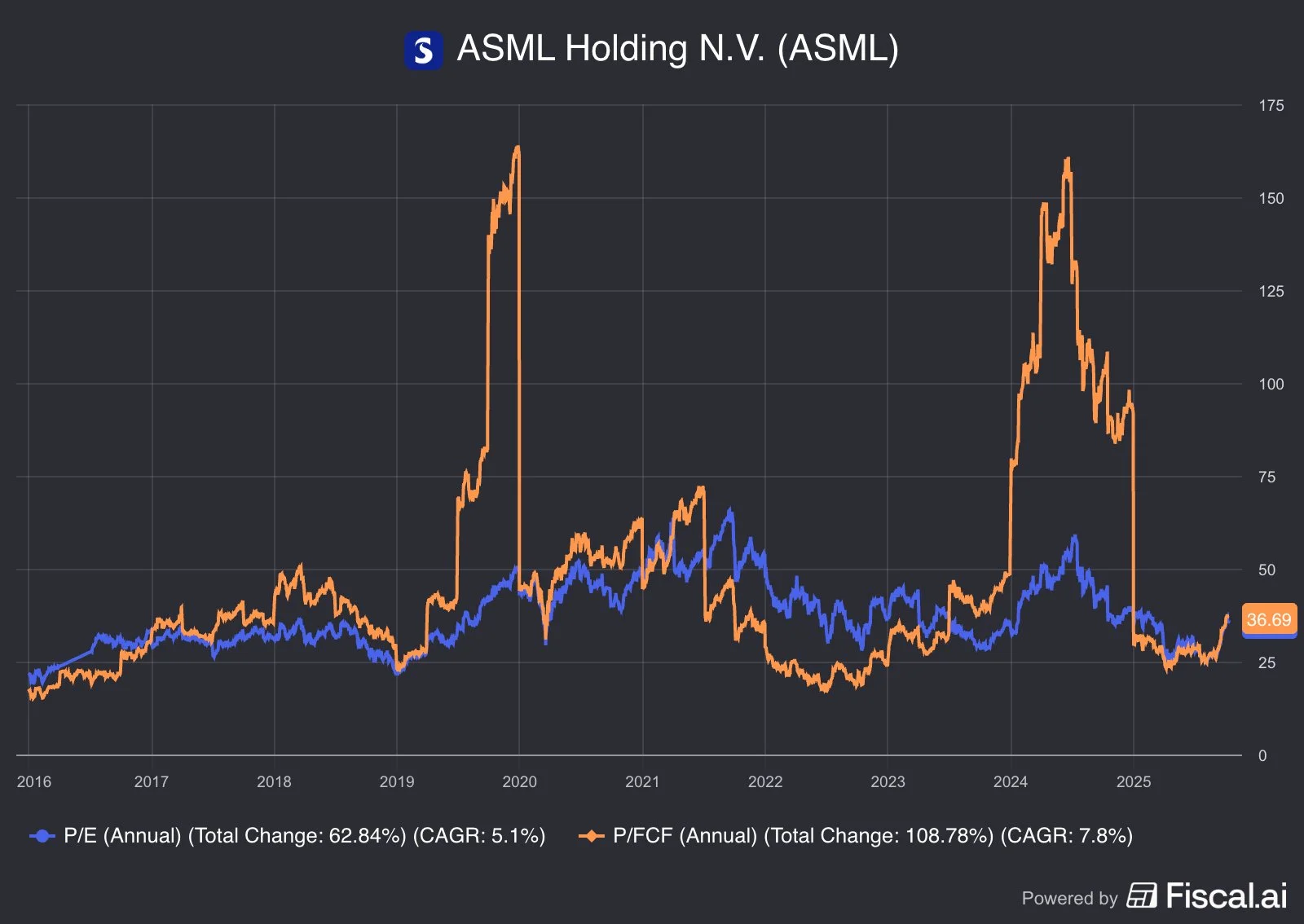

P/E: 36x P/FCF: 37x — premium, but not unreasonable.

Historical Compression: P/FCF down 34.4%, signalling improved entry point.

Market-implied growth: ~17%.

It’s not cheap, but greatness rarely is.

For a business with monopoly economics, 17% expected growth isn’t aggressive.

Balance Sheet: Fortress-Like

ASML’s balance sheet is built like its machines — precise, resilient, and overengineered for safety.

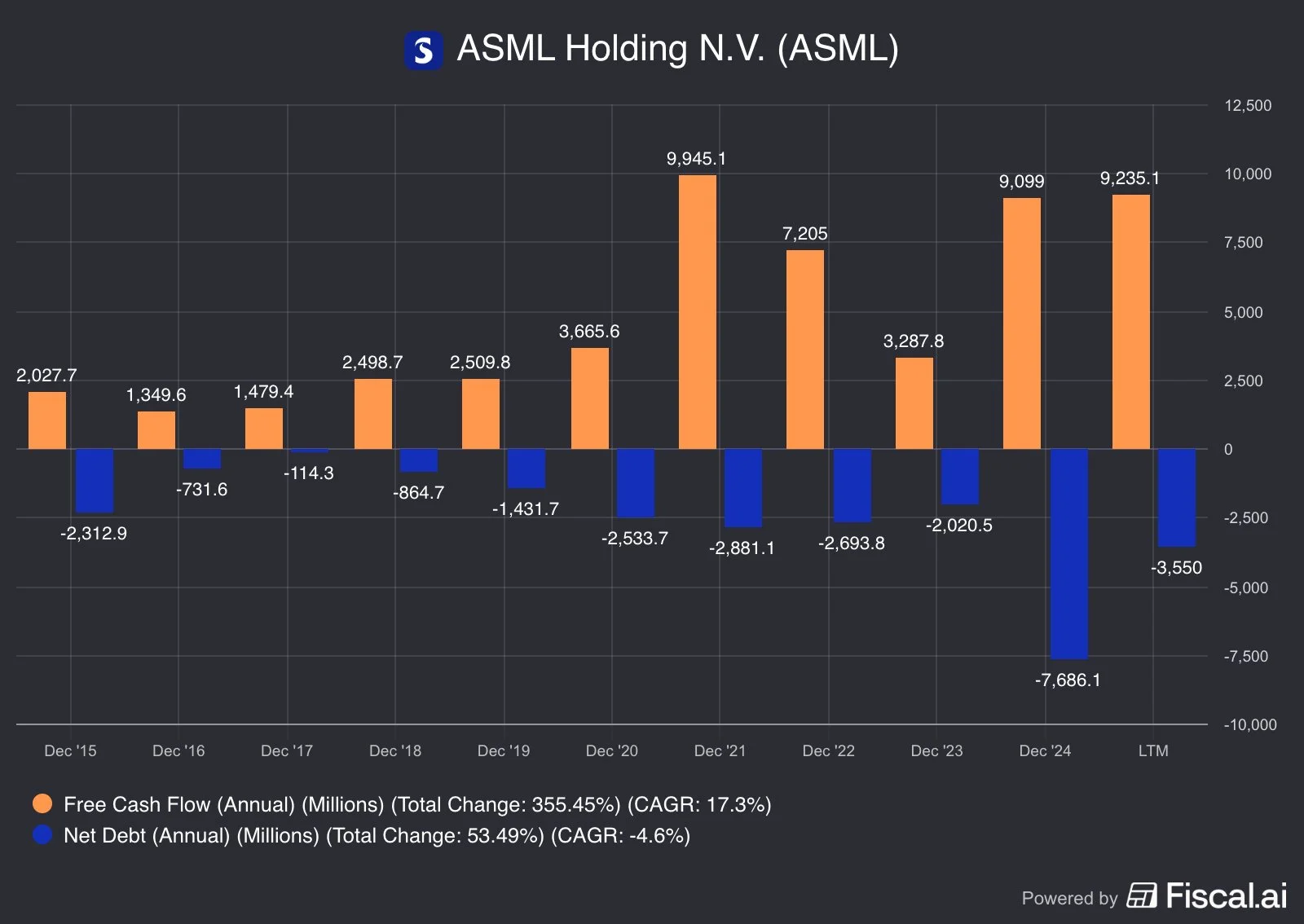

Free cash flow: up 355% since 2015 (17% CAGR).

Debt/equity: just 0.5× — no financial stretch here.

Interest coverage: 60×+, debt is a tool, not a crutch.

Goodwill/assets: down from 26% to ~10%, cleaner and more tangible.

Cash cushion:€7–9B, funding R&D, dividends, and buybacks internally.

This is what balance sheet strength looks like — growth without leverage.

Cash-rich, debt-light, and ready to strike.

Market Potential: Tailwinds Everywhere

AI Chip Demand: $150B in 2025 alone.

End Market Growth: PCs, smartphones, edge devices.

Industry Goal: $1T chip market by 2030.

Tailwinds: AI, edge computing, 5G.

ASML is selling the shovels in a digital gold rush.

Performance vs. the Market

Over the past few years, ASML has been the steady compounder in a high-volatility neighborhood. It hasn’t sprinted like Lam Research (LRCX) or KLA (KLAC) — but it’s been running a different race altogether.

ASML: +160% total return (CAGR: 21%)

KLA: +401% (CAGR: 38%)

Lam Research: +291% (CAGR: 31%)

Profitability: World-Class Margins

Gross margin: ~53% (up from 45% in 2015).

Operating margin: ~35%, rising steadily with EUV mix.

Free cash flow margin: hovering around 30–35% — elite for heavy manufacturing.

FCF / Net income: close to 100%, signaling cash profits are real, not accounting shenanigans.

Across the last decade, ASML has quietly expanded profitability even as complexity and R&D intensity skyrocketed. That’s rare.

They print money—then invest it like pros.

Risks to Watch

Geopolitical: China + Taiwan = 51% of sales.

Supply Chain: Single-source dependencies.

Execution Risk: High-NA EUV rollout must succeed.

Regulatory: Export controls & tariffs.

Even giants need to watch their step.

Conclusion: The One You Can’t Replace

ASML is the most critical player in the semiconductor ecosystem — the bottleneck through which every next-generation chip must pass. Its monopoly in EUV lithography gives it the kind of control most tech companies can only dream of.

With P/E at 36x and P/FCF at 37x, the stock isn’t cheap — but for a company growing at ~17%, with a 52% gross margin and 23% ROIC, it’s not expensive either. Multiples have compressed 34% from their highs, offering one of the better entry points in years.

This is a business that compounds through every cycle: high-ticket systems, sticky service revenue, fortress balance sheet, and relentless R&D. It’s not cyclical — it’s essential.

Yes, geopolitics and supply chain risks linger, but ASML’s moat — built on physics, scale, and trust — is almost impossible to breach.

SCC Rating: 76% | Keep buying during market dip

At Silvercrosscapital we built the Outlier Portfolio on one truth: a handful of stocks create nearly all long-term wealth. Apple already did it.

Our mission? Find the next Apple before Wall St. does.

Join our community of investors to find out more!