Should You Invest in VeriSign?

Quick Company Snapshot

Founded: 1995 (spun out from RSA Data Security)

Market Cap: ~$25B

CEO: D. James Bidzos (Founder, RSA co-founder)

Headquarters: Reston, VA

Ticker: VRSN (NASDAQ)

Core Business: Registry operator for .com and .net domains

Every time you type a “.com” or “.net,” you’re using VeriSign’s infrastructure — whether you know it or not.

This is the plumbing of the internet: invisible, indispensable, and built to never fail.

VeriSign (NASDAQ: VRSN) runs the backbone of online identity, managing the .com and .net registries with 100% uptime for nearly 30 years.

In a market obsessed with “what’s next,” VeriSign wins by being what always works.

In a volatile tech market, VRSN’s recurring revenues and high margins offer shelter as the market is currently at a historic high.

Key Investment Thesis: VeriSign (VRSN)

Founder Influence & Leadership Alignment: Veteran founder-CEO Jim Bidzos still steers VeriSign with disciplined execution, backed by Berkshire Hathaway’s 1.5% vote of confidence and pay tightly tied to long-term performance.

Durable Competitive Advantage: VeriSign operates a structural monopoly over .com and .net—an irreplaceable, government-backed internet utility with 27 years of flawless uptime and immense pricing power.

Very Profitability Business Model: With ROIC near 48% 5 years average and ~68% operating margins, VeriSign converts nearly every revenue dollar into profit—one of the world’s most efficient cash machines.

Capital Allocation: Minimal reinvestment needs fuel aggressive buybacks and a new dividend, compounding shareholder value without weakening the balance sheet.

Valuation (Quality at a Price): Trading near 32× earnings, the stock bakes in perfection—investors pay for monopoly quality, not growth, leaving little margin for error.

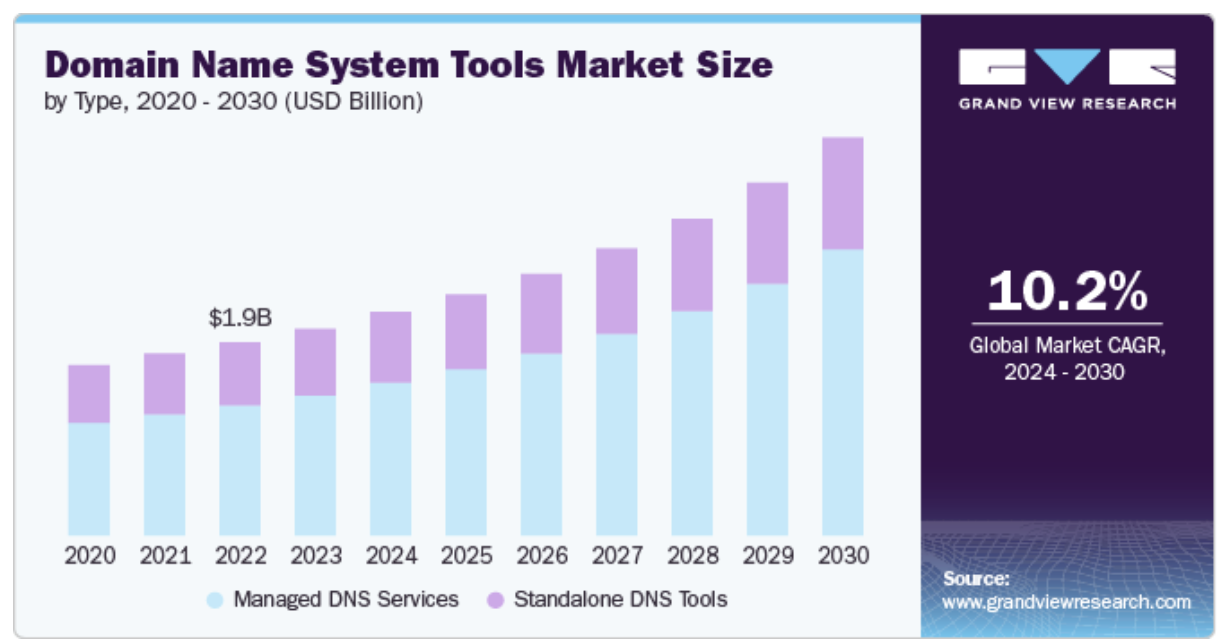

Market Opportunity: The DNS market is expanding, but VeriSign’s growth remains measured (~7% EPS pace); stability, not acceleration, is the real attraction.

How VeriSign Makes Money

1. Domain Registry Services (Core)

Operates .com and .net under long-term ICANN contracts.

Charges ~$10 per year per domain.

Renewal rate ~75%.

Predictable, subscription-like revenue stream.

2. Digital Identity Services (Legacy)

SSL/TLS certificates and authentication tools.

Now a small slice but part of its “trust infrastructure.”

By Geography: Global revenue base; domains are worldwide — no heavy regional exposure.

Management & Culture

CEO: Jim Bidzos — founding visionary still leading.

Insider Ownership: ~0.5% valued $121 million, but Berkshire’s 1.5% stake offsets concerns.

Pay Alignment: 93% of CEO compensation is tied to TSR vs. S&P 500 and operating income CAGR.

Culture: Tight, technical, and ownership-driven. Bidzos has guided VRSN through decades of change with calm precision.

They have a great team — it’s a disciplined operator of mission-critical infrastructure.

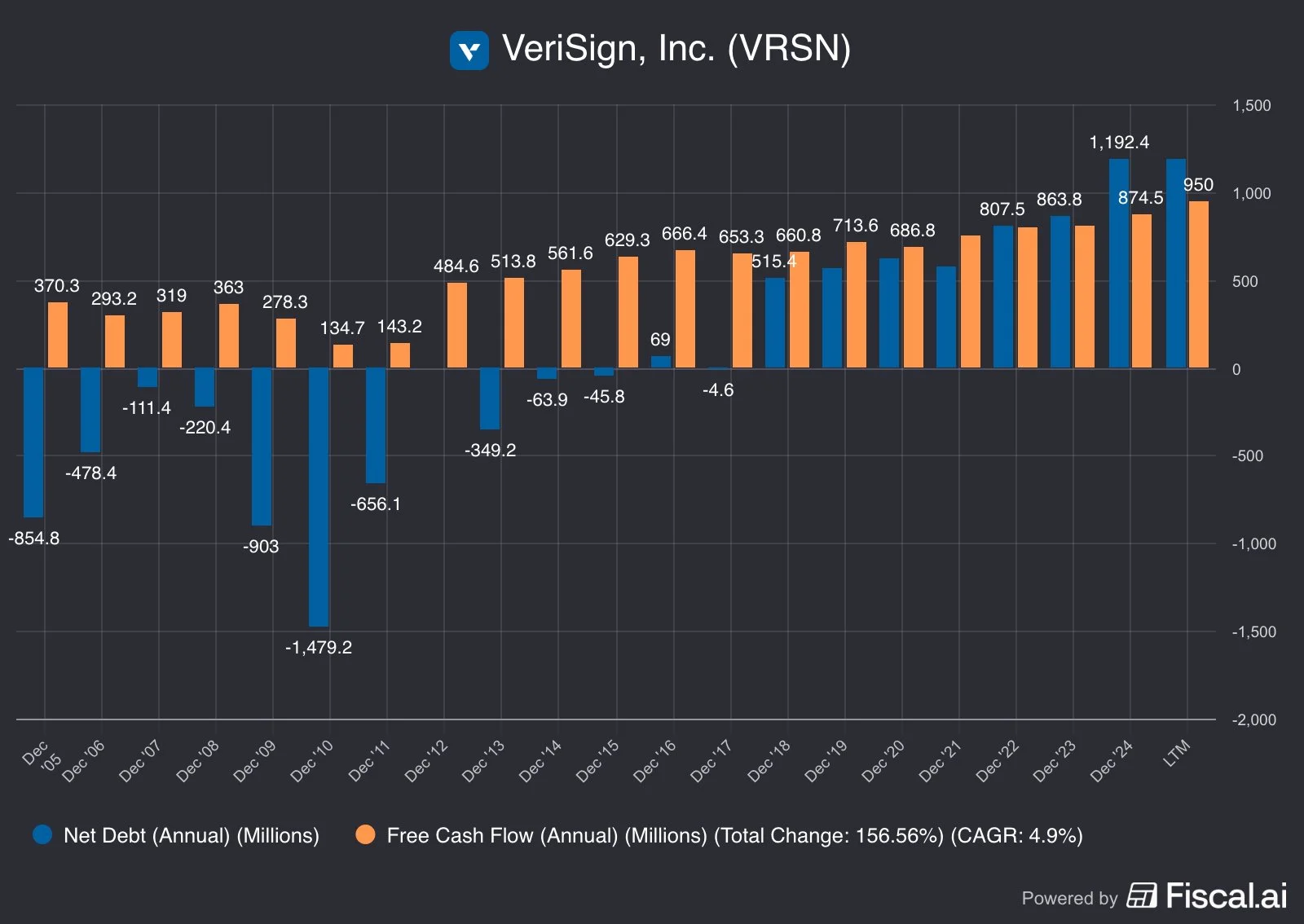

Capital Allocation

CapEx: Just ~3% of OCF — ultra-light.

Buybacks: $301M in Q2; $1.28B still authorized.

New Dividend: $0.77/share quarterly.

ROIC: 48% 5Yr Avg among the highest in tech.

The formula: spend little, buy back stock, return cash. Classic compounding.

Profitability: Off the Charts

Gross Margin: ~88%

Operating Margin: ~68%

Net Margin: ~50%

FCF Conversion: >100% of net incom

VeriSign doesn’t just make money — it barely spends it.

Moat: Structural Monopoly

Contracts: Sole operator for .com and .net under ICANN.

Switching Costs: Businesses can’t risk losing domains; renewal rates near 76%.

Barriers to Entry: Decades of trust, government oversight, and technical complexity.

Brand Power: “.com” is the global standard of legitimacy online.

This isn’t a competitive market. It’s a controlled utility for the digital age.

Valuation & Margin of Safety

P/E: 32×

P/FCF: 27×

Forward P/E: 30×

Expected Growth: ~7% EPS CAGR (4% revenue + 3% buybacks).

DCF: Requires 12% growth to justify today’s price.

In short: premium valuation, thin margin of safety.

The upside is stability, not explosive returns

Balance Sheet Strength

Debt: ~$1193M (easily covered by cash flow).

Free Cash flow: $950M

Interest Coverage: 14×

Built for resilience, not leverage.

Growth Outlook

DNS Market CAGR: 10–18% through 2030.

VeriSign Growth: ~7% annual EPS via pricing and buybacks.

Expansion Capacity: Plenty of FCF and $1.5B buyback firepower.

Realistically: slow, steady, and predictable.

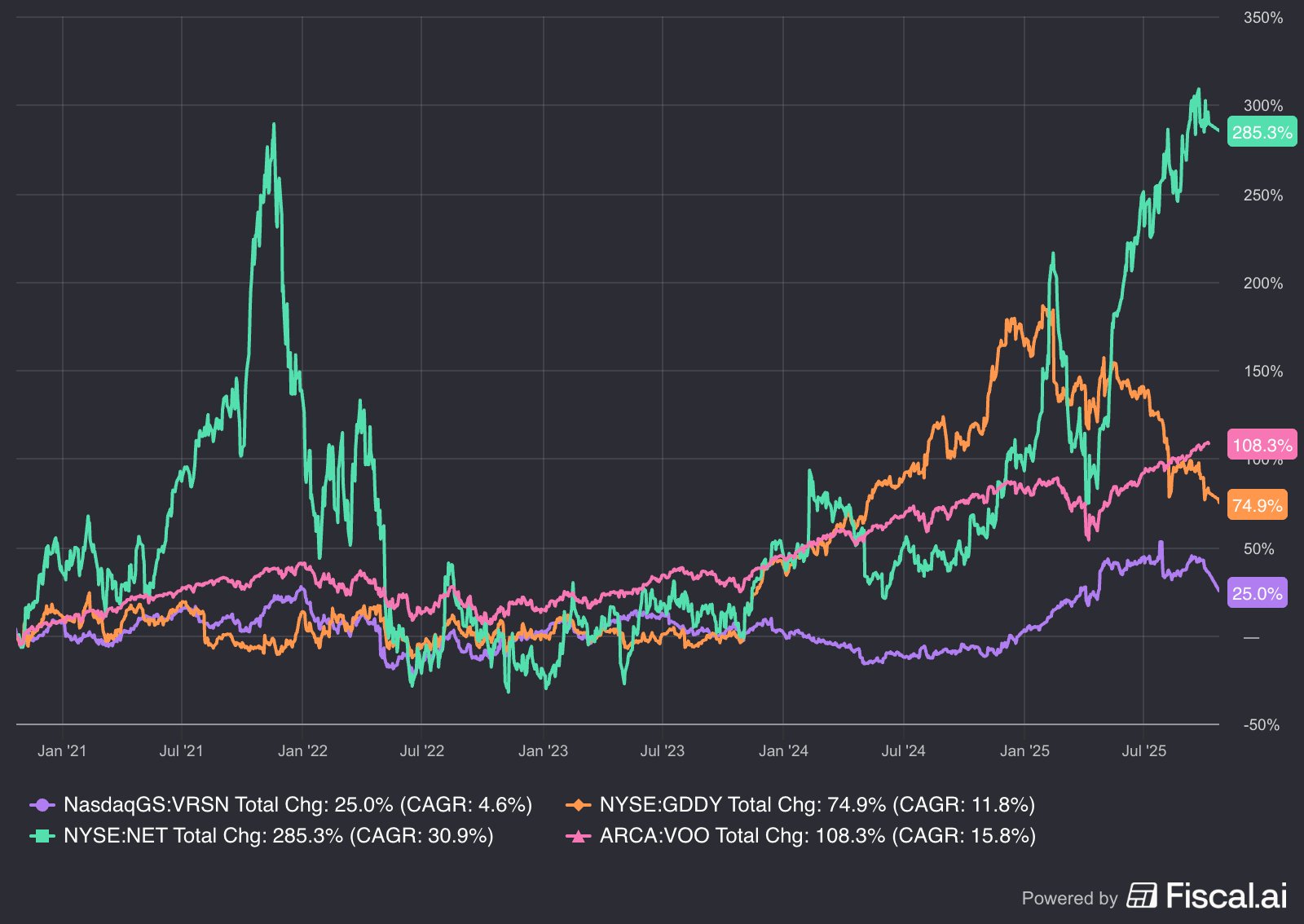

Performance vs. Peers (5-Year Total Return)

Verisign has underperformed the market by all metrics including its peers.

VRSN: +25% (CAGR 4.6%)

GoDaddy (GDDY): +75% (CAGR 12%)

Cloudflare (NET): +285% (CAGR 31%)

S&P 500: +108% (CAGR 16%)

A safe compounder that lagged the market’s flashier names.

Risks to Watch

Domain Saturation: .com growth flattening.

Regulatory Overhang: ICANN and U.S. Commerce control pricing.

Concentration: 90%+ revenue from two domains.

Competition: Cloudflare and others innovating faster.

Tech Shifts: Social and AI reducing reliance on domains.

Geopolitics: China exposure and data compliance.

Even monopolies aren’t bulletproof.

Conclusion:

VeriSign is a monopoly that has compounded 8% in the last 24 years.

Margins near 70%, ROIC in the mid-40s, fortress balance sheet, and flawless operational history.

But at 32× earnings, investors are buying quality, not growth.

My conviction level is high for defensive portfolios.

But my thesis: Own for stability and cash flow. Avoid chasing it for growth.

The Upside is a modest growth, low risk — a solid asymmetry for conservative capital.

Think of it like investing in a low-risk bond.

SCC Rating: 67% | Neutral

At silvercrosscapital we built the Outlier Portfolio on one truth: a handful of stocks create nearly all long-term wealth.

Our mission? Find the next outlier before Wall St. does.

The question: Is this an outlier? Not even close.