Should You Buy Micron Technology

“The big money is not in the buying or selling, but in the waiting.” – Jesse Livermore

The investment thesis is simple: Micron sits at the center of the AI revolution through high-bandwidth memory (HBM). As HBM ramps, it not only fuels Micron’s direct AI growth but also tightens supply in its legacy DRAM business, lifting prices across the board. This sets up what I believe could be the mother of all memory cycles.

Why This Matters Now

HBM soaks up supply. It takes ~3x as many wafers to produce one bit of HBM vs DDR5. That constraint tightens legacy DRAM supply → better pricing.

Demand locked in. Micron’s HBM is sold out through 2025 under multi-year deals.

AI is memory-hungry. GPUs, AI servers, AI PCs, and phones all drive DRAM content higher.

Proof point: FY25 revenue hit $37.4B (+49% YoY), with Q4 revenue at $11.3B—an all-time high

Margins are turning. Mix, pricing, and scale are pushing gross margins north of 50% by 2026.

This is the strongest memory cycle I’ve seen—and it’s still early.

This is not the usual boom/bust semiconductor story. The market structure has changed. Memory is now an oligopoly, demand is more diverse, and AI is the secular catalyst.

What Micron Does

Headquartered in Boise, Idaho, Micron is one of three global players in DRAM (76% of revenue) and NAND (23%). Its products power data centers, smartphones, PCs, autos, and industrial devices.

Micron sells memory and storage chips. These chips aren’t just parts; they’re the oxygen of modern computing. Without DRAM and NAND, the AI revolution would suffocate.

Management & Culture

CEO Sanjay Mehrotra said in the earnings report “Micron closed out a record-breaking fiscal year with exceptional Q4 performance, underscoring our leadership in technology, products, and operational execution.

CEO Sanjay Mehrotra's 0.09% ownership ($154M) and total management's 0.24% ownership ($410M) indicates minimal "skin in the game.

More disciplined than in past cycles.

Using long-term agreements to smooth volatility.

Willing to cut production when needed—showing pricing discipline.

They are massive HBM-focused investments.

Capital Allocation

Capex is heavy (~35% of revenue), but that’s the nature of semis. $14B FY25 capex, heavily weighted to HBM.

Micron plans to invest $200 billion in the US over 20+ years ($150 billion in manufacturing, $50 billion in R&D), focusing on AI, HBM, and advanced packaging.

Shareholder returns: $5.1 billion already returned via buybacks and dividends in the last three years.

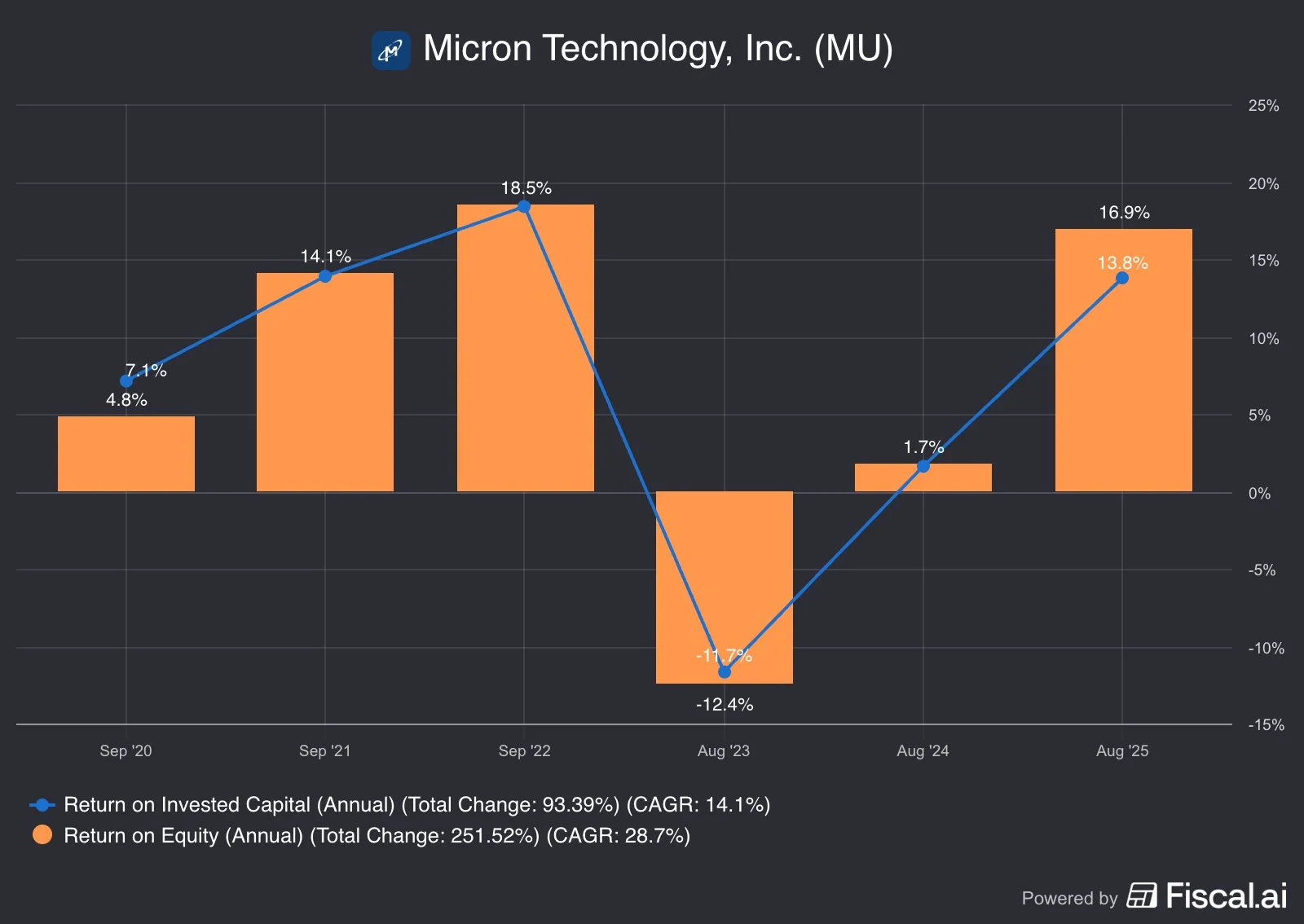

ROIC has compounded at ~34% CAGR since 2016; ROE rebounded to 13.8% in FY25 after the FY23 trough.

Profitability

FY25 non-GAAP EPS: $8.29 vs $1.30 last year

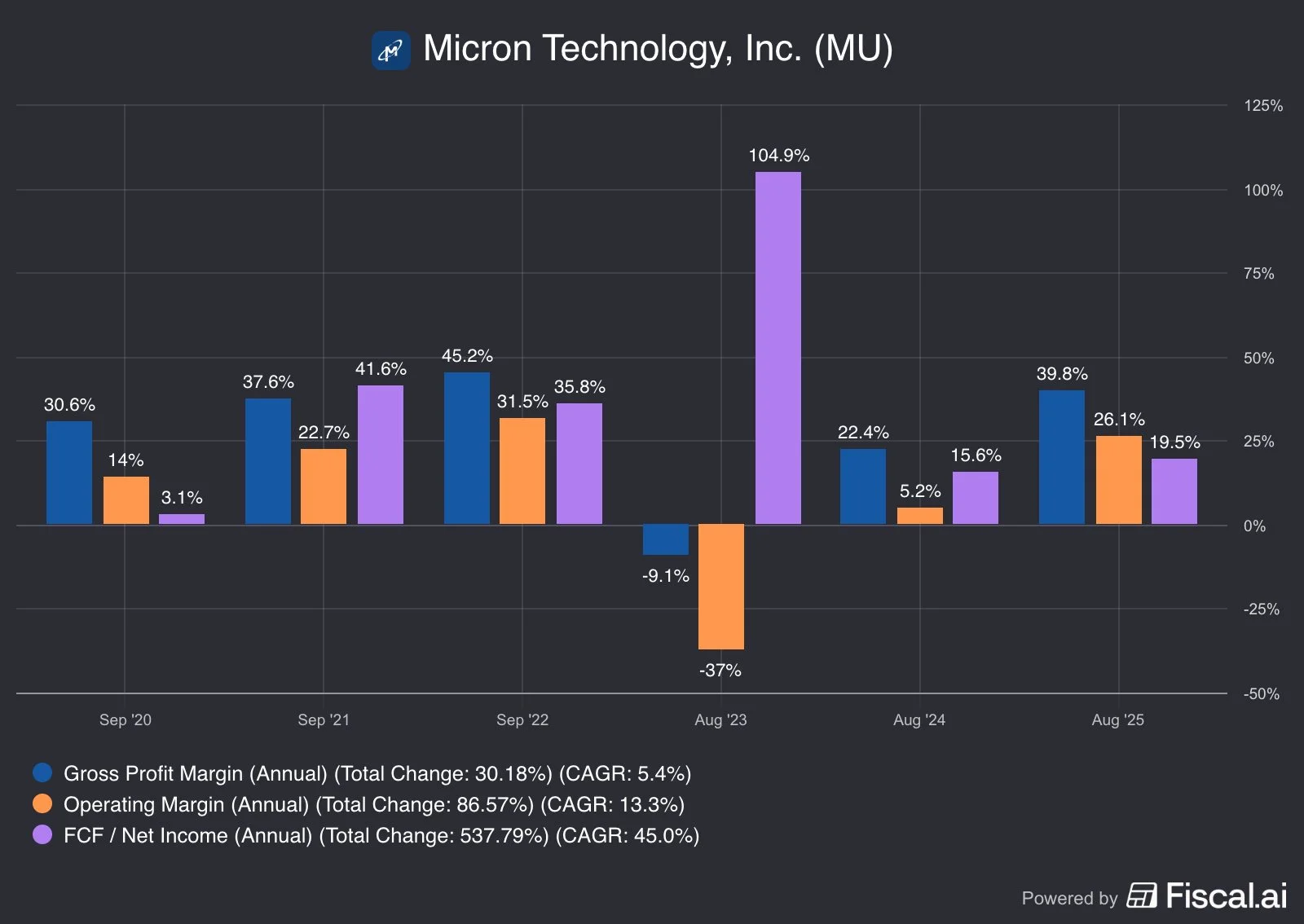

EBIT margins expanding rapidly (29% FY25 vs 8% in FY24).

Guiding Q1 FY26 EPS of $3.75 non-GAAP with >50% gross margins

After the FY23 trough, Micron’s gross, operating, and FCF margins have rebounded sharply—proof that this cycle is stronger, more disciplined, and HBM-driven

Competitive Advantage

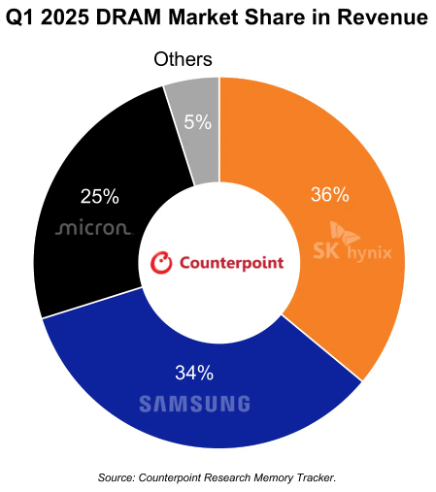

Oligopoly: Micron, Samsung, SK Hynix.

Technology: HBM3E delivers ~30% lower power consumption vs peers, critical as data centers face energy ceilings.

Execution: High yields + advanced packaging = durable moat.

When 65% of an Nvidia GPU’s cost is memory, you want to own the company supplying it.

Valuation

Micron currently trades at a forward P/E of ~13× and a forward P/FCF of ~33×.

Based on our metrics, the market is implying ~35% growth over the next few years—a steep hurdle to clear.

Historically, Micron has grown revenue at ~12% CAGR, though FY25 saw a one-off +49% jump driven by AI/HBM demand.

While we understand the secular memory tailwinds, sustaining market-implied growth looks ambitious.

Micron deserves a higher multiple than past cycles, but expectations of 35% growth may prove difficult to justify unless HBM demand accelerates even faster than modeled.

Balance Sheet

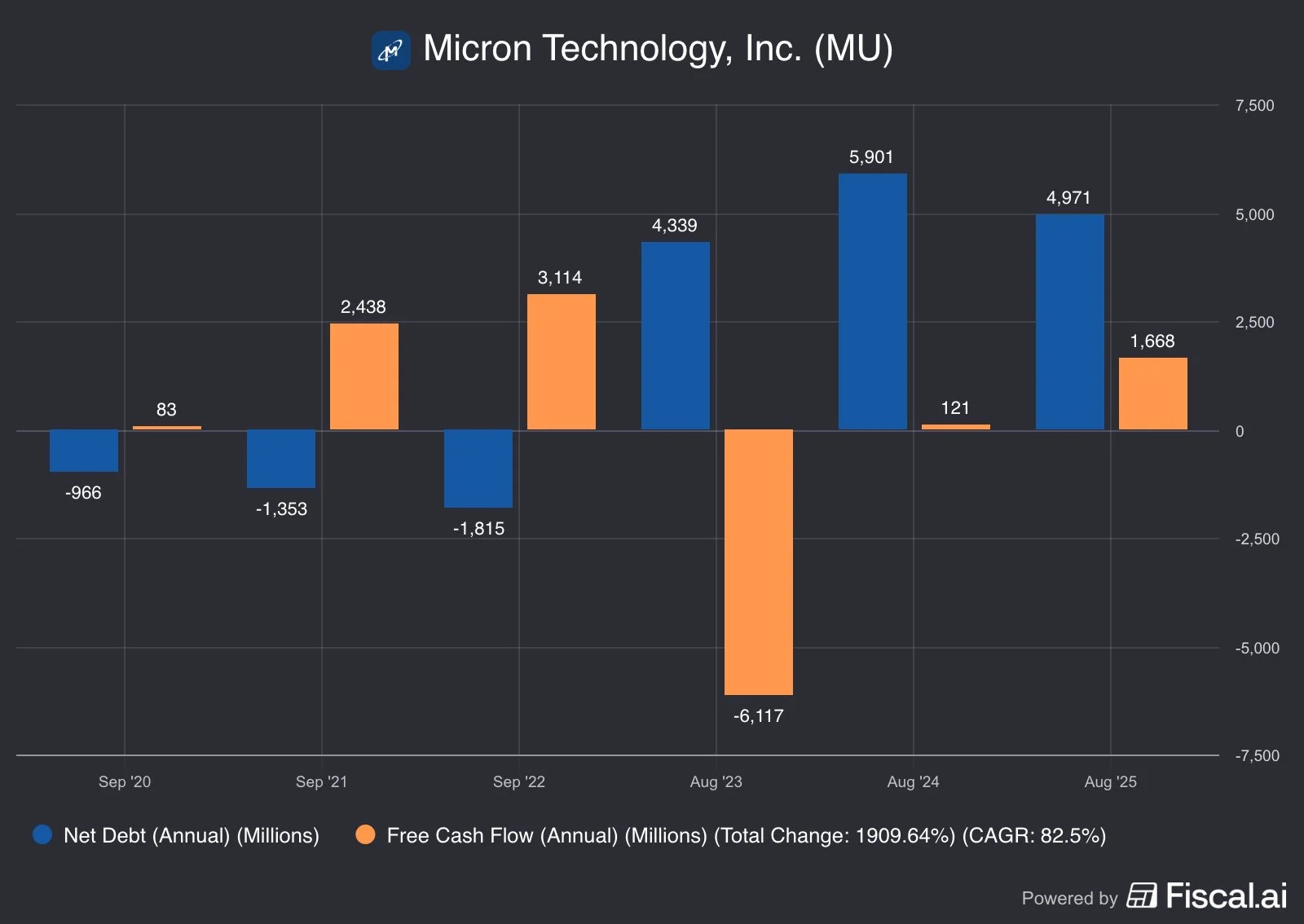

FY25 cash/investments: $11.9B.

Net debt manageable at ~$5B.

Free cash flow volatile but currently at $1.7B.

Balance sheet supports capex + shareholder returns simultaneously.

Financial flexibility to keep investing through cycles

Market Potential

HBM TAM: ~$4B (2023) → >$25B (2025).

Share of DRAM rising from 1.5% → 6% in two years.

Data centers, autos, AI PCs, and AI phones all add layers of incremental demand.

The Dynamic Random Access Memory Market was valued at USD 84.6 billion in 2023 and is projected to exceed 20% CAGR from 2024 to 2032.

Brookfield Research expects data center demand for AI to surge 10x over the next decade.

This isn’t just cyclical recovery – it’s structural growth.

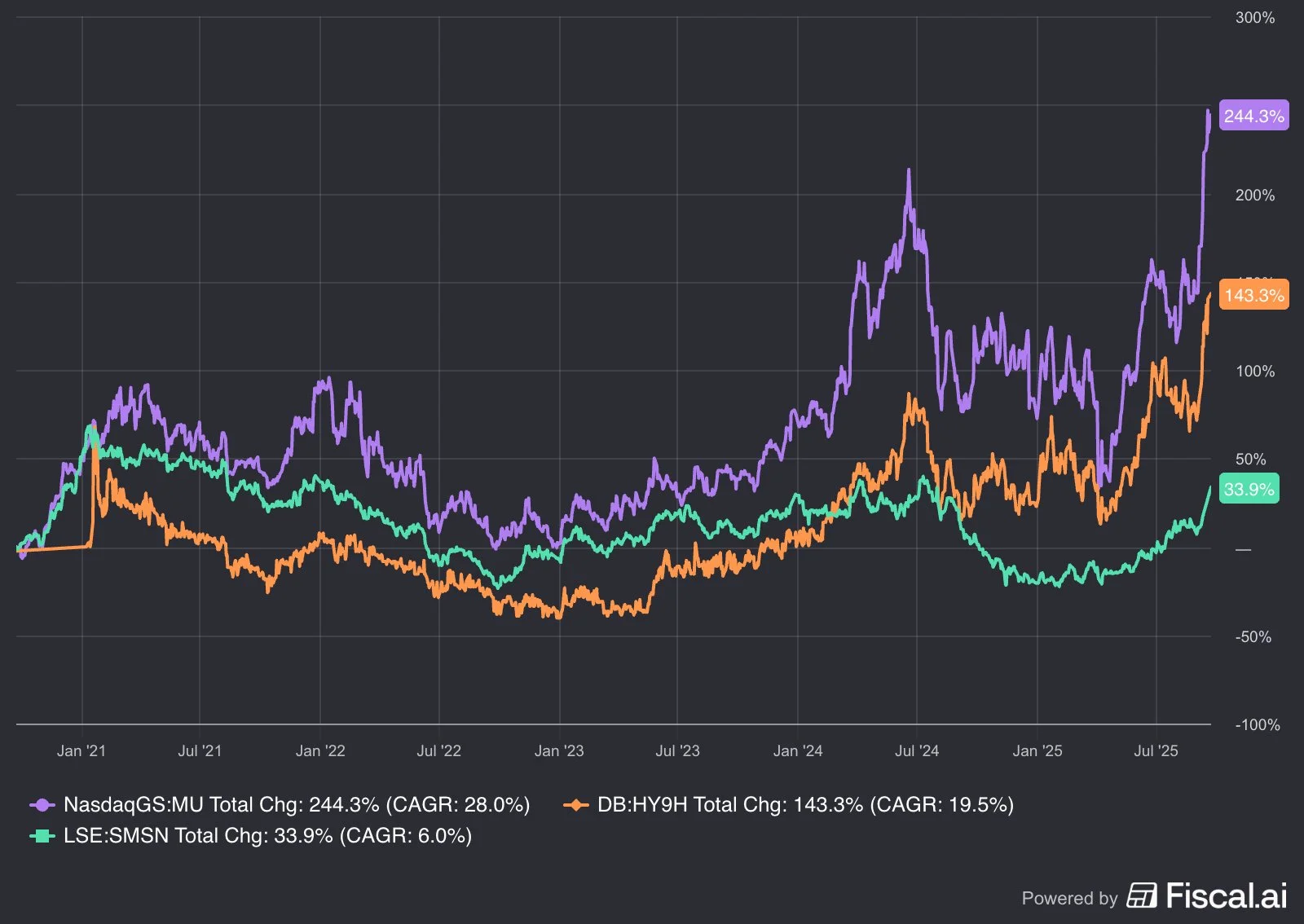

Performance vs Peers

Micron +244% (28% CAGR) has outpaced SK Hynix (+143%) and Samsung (+34%) as AI-driven HBM demand and capital discipline reset the cycle.

After years of lagging, Micron is now leading the pack — but expectations are higher, and sustaining this momentum won’t be easy.

Micron’s HBM ramped later than SK Hynix but is now sold out two years forward, with pricing and yields improving faster than bears expected.

Risks

Cyclicality: Memory is still cyclical, though less brutal than in the past.

Geopolitical: Exposure to Taiwan, China (~30% of revenue).

Capex intensity: Heavy reinvestment required.

Macro: PCs, smartphones, and auto end-markets still volatile.

Execution risk: massive capex ramps must deliver.

But cycles now resemble tides more than tsunamis. And Micron’s financial and strategic discipline gives it more ballast than ever before.

Conclusion

In markets, cycles are inevitable. The key is recognizing when a cycle isn’t just turning, but transforming.

AI has changed the memory business. HBM isn’t a side story – it’s the spine of the AI ecosystem. Micron, once viewed as a commodity memory producer, now stands as a critical enabler of the most important technology wave in decades.

I’ve seen plenty of memory cycles in my career. Most ended the same way: oversupply, collapsing ASPs, crushed investors. But is this one different? Supply is constrained, demand is structural, and management is rational. Success in investing often comes from identifying when an old narrative no longer applies.

Only 2% of stocks created $75 trillion in net wealth.

Will the next 10 years mirror the past 20? Probably not for Micron.

But the next decade looks more likely for the cyclicality to improve as memory will become critical for the advancement of AI.

SCC Rating: 83% | Undervalued