Should You Buy Costco at This High Valuation?

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

Costco is one of the best retailers on earth. But at 55x earnings, investors are paying for perfection. That rarely ends well.

Latest Quarterly Results (Q4 FY25)

Sales rose 8% to $84B, with comps up 5.7%. Traffic grew 4%, tickets a bit under 2%.

E-commerce jumped 14%, a bright spot as Costco leans more into digital.

Earnings were strong: EPS up 11%, net income up 11% to $2.6B. Margins ticked higher.

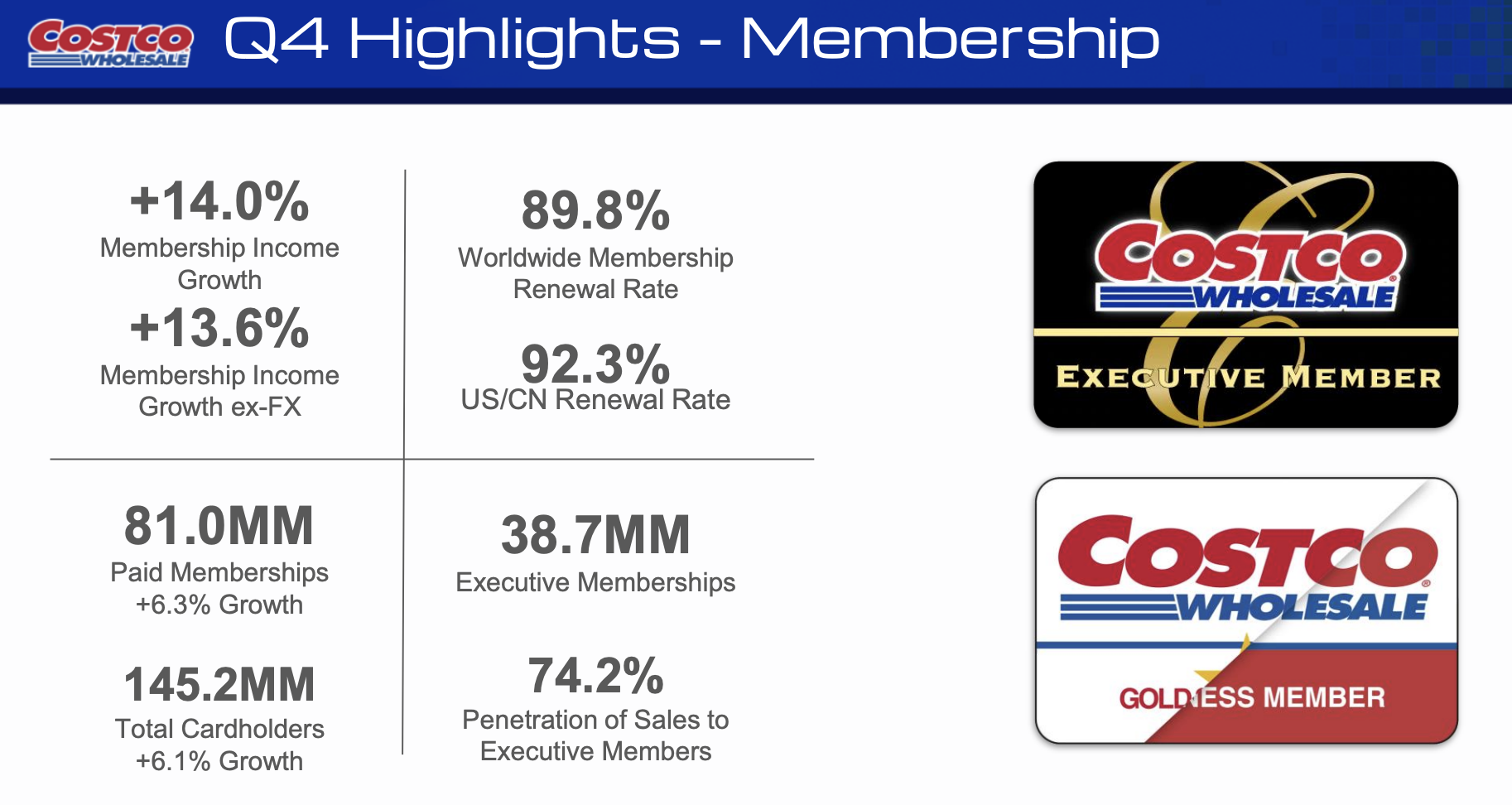

Membership remains the engine: now 81M paid members, renewal rates near 92% in the U.S.

Expansion continues: 914 warehouses, headed toward 944 next year.

Why Now Matters

Costco just raised membership fees for the first time in seven years. That’s a direct $370M revenue kicker over two years.

Expansion continues — 30 new warehouses planned for fiscal 2025.

But the market is already pricing Costco as if it’s invincible: 55x earnings. That’s a dangerous place for a mature retailer.

E-commerce growing at 16% in 2024, giving Costco optionality beyond warehouses.

Management & Culture

The new CEO (Ron Vachris) and CFO (Gary Millerchip) are seasoned insiders. Stability matters here.

All insiders owns 0.16% of the company valued $670 million

Costco treats employees unusually well for retail. Average U.S. hourly wage: $31. Retention: 93%. That loyalty flows directly into customer service.

Execs have real skin in the game. Stock ownership requirements are 3–7x base salary, and they comply.

Profitability

Costco net income: $7.4B in 2024, +17%. The E-commerce: +16%, an important growth lever.

Gross margin: Essentially unchanged for a decade, hovering ~12–13%.

Operating margin: Edged higher, from 3.1% in 2015 to 3.8% today (+20%).

FCF vs. net income: All over the place, swinging from 27% to 155%, now ~93%.

Competitive Advantages

Pricing power: consumers trust Costco as the low-price leader.

Limited SKUs: under 4,000 per warehouse, keeping focus sharp.

Kirkland Costco’s brand where I get my maple syrup: $86B brand that undercuts consumer packaged goods at scale.

Membership model: 90% renewal rate worldwide. That’s stickier than Netflix.

Capital Allocation

Capex: $4.7B, mostly new warehouses.

Generous to shareholders: $6.65B special dividend in 2024, plus regular hikes.

Stock buybacks remain modest relative to cash flow.

Costco’s return on equity has surged from ~20% to over 30% in the past decade, while ROIC has inched up from ~12% to ~15%.

Balance Sheet

Costco sits on $6.7B more cash than debt, making the balance sheet bulletproof. Debt/Equity of 0.3 looks conservative, but the real story is they don’t actually need debt.

With 81x interest coverage and cash flow 1.5x total debt, Costco could pay down obligations overnight. That kind of flexibility is rare in retail and gives them dry powder if growth slows or opportunities pop up.

Market Potential

Still under 900 warehouses globally, with a long runway internationally.

Membership base: nearly 137M and growing.

E-commerce scaling quickly — though Amazon looms large.

Valuation: Where Things Get Uncomfortable

Costco now trades near 55x earnings and ~59x free cash flow. That’s almost double where it sat a decade ago, with P/E expanding nearly 97% since 2016.

Our model suggests the stock is priced at a 55% premium to intrinsic value. In other words, you’re paying for perfection in a low-margin retail business.

Risks I See

Affluent consumer weakness: Costco’s core shopper ($100–150k income) faces fading tailwinds. Stock market wealth effects and stimulus checks aren’t coming back.

Discretionary exposure: TVs, appliances, seasonal goods — not recession-proof.

Business sales: 20–25% of revenue tied to commercial customers, which are under pressure.

Canada: 10%+ of sales, but signs of pushback against U.S. brands could sting.

Gold bar sales: a quirky, cyclical boost in 2024 that’s unlikely to repeat.

Competition: Walmart and Amazon are sharpening their knives.

Cybersecurity and IT: Increased security threats, including sophisticated computer crimes and ransomware, pose a risk to systems and sensitive data.

Performance vs. Perception

Yes, Costco is one of the best businesses in retail. Maybe in the world.

But at 55x earnings, the stock leaves no room for error. A small stumble — slower comps, softer membership growth, margin pressure — and suddenly, the “safe” stock doesn’t look so safe.

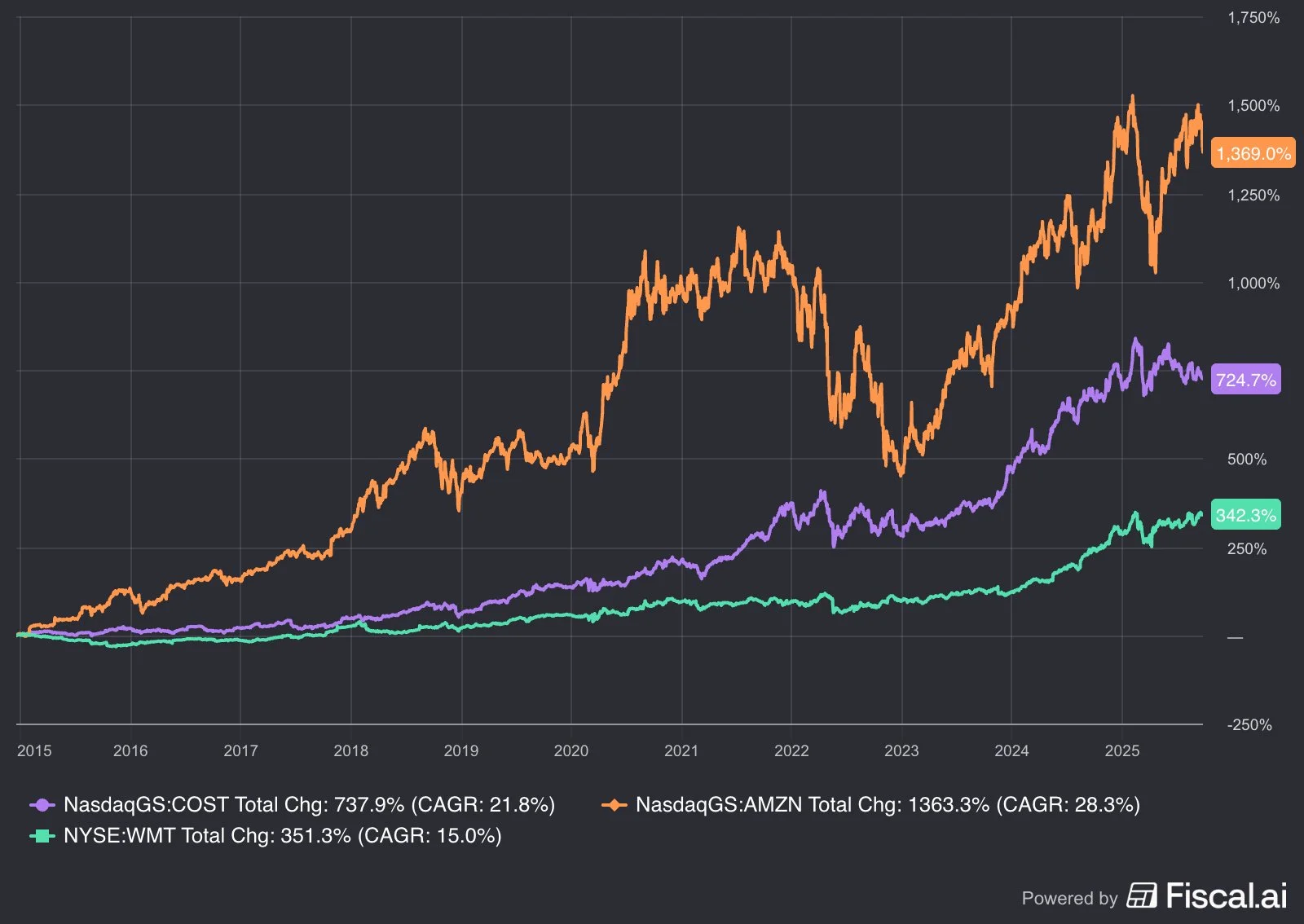

Over the last decade, Costco delivered a 738% total return (CAGR ~22%), far ahead of Walmart’s 351% (~15%). But compared to Amazon’s 1,363% (~28%), Costco looks more like steady compounding than explosive growth.

Closing Thought

Costco embodies Warren Buffett’s marker of a wonderful company but its not trading at a fair price!

The global expansion and e-commerce growth extend the long-term story.

Yes, the stock is expensive, but Costco has consistently justified its premium.

No debate there. But at today’s valuation, it’s not a fair price. When perfection is priced in, even small cracks can disappoint investors as it does not provide a good margin of safety.

We have to remember that only 2% of stocks created $75 trillion in net wealth.

Will the next 10 years mirror the past 20 years for Costco? Probably not

SCC Rating: 75% | Neutral