Nike: Is Now the Time to Just Buy It?

NIKE is resetting after a deliberate clean-up year: near-term dents, long-term engine. The bet is that brand, scale, and athlete-led demand creation re-accelerate product heat and earnings as wholesale is re-balanced and innovation recenters on sport.

Short Brief About the Company

NIKE, Inc. is the world’s largest seller and leading designer of athletic footwear and apparel, led by the Nike, Jordan, and Converse brands.

Sell shoes/apparel/equipment via NIKE Direct and wholesale.

In FY2025, NIKE Direct was ~42% of NIKE Brand revenue; wholesale remains critical for reach and trial.

Here are the key Nike’s Q1 FY2026 Financial Results

Revenue: $11.7B, up 1% (reported), but down 1% currency-neutral.

Nike Direct: $4.5B, down 4% (digital -12%, stores -1%).

Wholesale: $6.8B, up 7% (5% currency-neutral), showing wholesale recovery.

Converse: $366M, down 27%.

Gross Margin: 42.2%, down 320 bps (pricing pressure, higher discounts, tariffs).

Net Income: $727M, down 31%.

EPS: $0.49, down 30%.

🌍 Geographic Performance

North America: +4% (led by apparel +11%, equipment +16%).

EMEA: +6% (apparel strong).

Greater China: -9% (footwear -11%, equipment -32%).

APLA: +2%.

Why Now

Deliberate reset: “Win Now” actions reduced supply, raised markdowns/returns, and hurt FY25—but cleared the deck.

Next phase: “Sport offense” realignment: tighter focus on key sports, fuller product pipelines, cleaner marketplace, and renewed wholesale muscle.

Set-up: Depressed earnings, stable inventory, and a high-ROI marketing engine ready to lean back into sport.

Management, Culture & Alignment

CEO Elliott Hill said, “Win Now” actions are delivering early progress in North America, wholesale, and running; but uneven performance across regions and channels.

However, recovery has been non-linear, external headwinds persist, but focus remains on controllable execution.

CEO: Elliott Hill (Oct ’24), a 30+ year Nike veteran—execution-focused, sport-first.

Culture: Inspiration and innovation for every athlete”—and now translating that through sport-led product and distribution discipline.

Skin in the game: Management owns 0.5% of the company worth $536 million.

Capital Allocation

FY25 returns: $5.3B to shareholders (dividends + buybacks).

Dividends: 23 straight years of increases.

Buybacks: $3.0B in FY25; management moderating but consistent repurchase cadence remains a core lever.

Share repurchases totalled $123 million, retiring 1.8 million shares under the current $18 billion program.

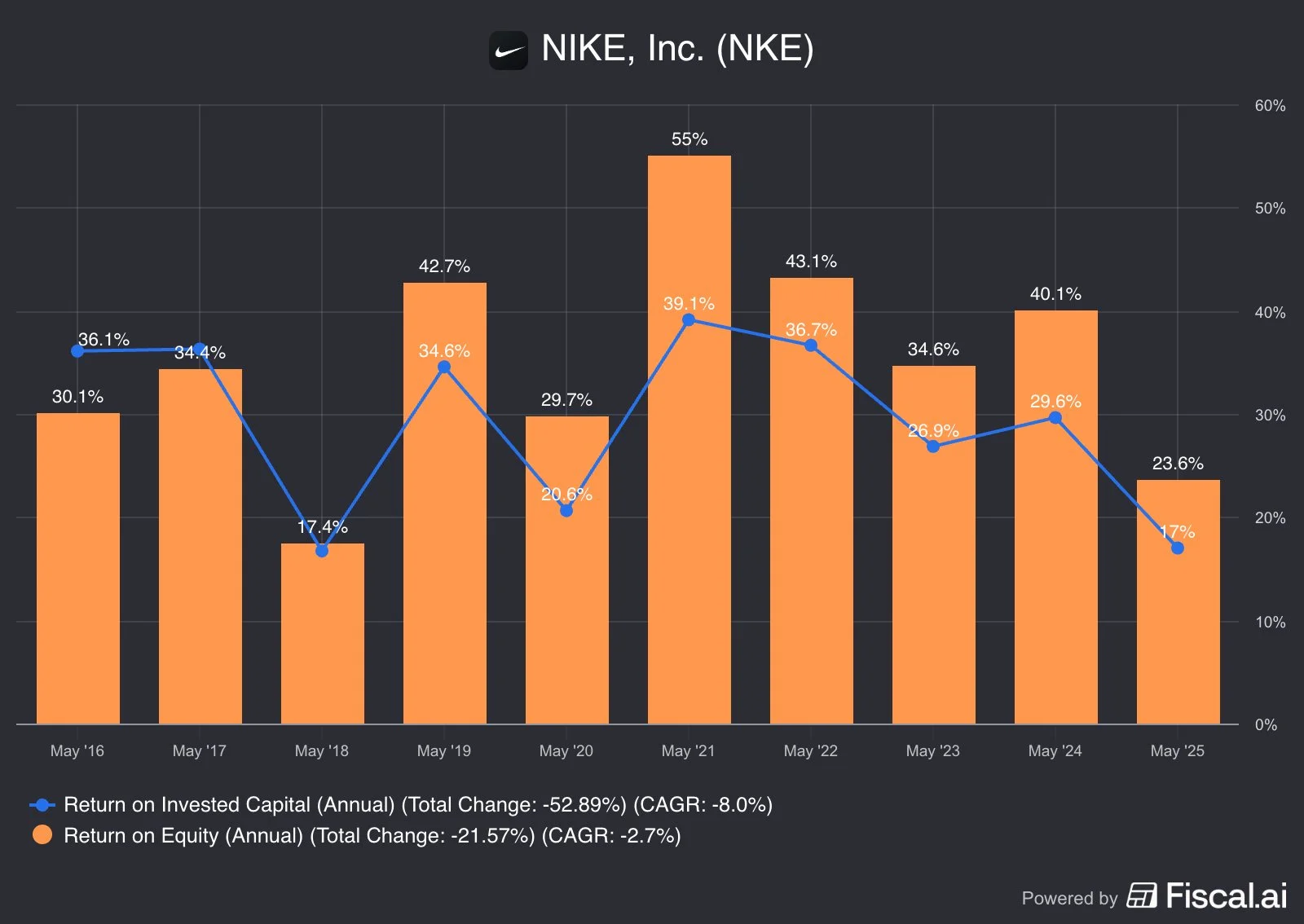

Nike’s capital efficiency has deteriorated, with ROIC dropping from ~36% in 2016 to 17% in FY2025 and ROE falling from ~30–40% to 23.6% over the same period.

Profitability

Margins: Operating margin declined from ~14% in 2016 to 8% in FY2025, while gross margin slipped from 46% to 42.7%.

Cash Flow: Free cash flow stayed strong, consistently exceeding net income, showing Nike’s ability to generate cash even in weaker earnings years.

Competitive Advantage

Endorsement-scale moat: Nike can outspend peers on the few athletes/teams that move culture and purchase intent. That spend compounds brand equity.

Brand gravity: Decades of elite sport storytelling (Nike/Jordan) keep attention and pricing power and also moat across ~190+ jurisdictions.

IP + product depth: Patented innovation and fast-follow capability—if Nike falls behind on a micro-trend, it can catch up.

Valuation

Premium without growth: Nike is trading well above intrinsic value on our DCF. That might be fine if growth was firing—but revenue and profitability have been flat.

Multiples stretched: P/E is up ~25% since 2016. P/FCF has been wildly volatile, at times blowing past 100x. That’s sentiment, not fundamentals.

Tough market, tougher rivals: Retail is unforgiving. Competitors like Adidas, Lululemon, and On are pressing harder than ever. In my experience, paying a premium in a brutally competitive space is rarely a winning bet.

Balance Sheet

Inventories: $8.1B (-2% YoY; lower units, higher product costs from tariffs)

Debt profile: Nike now carries net debt (~$1.9B in FY2025) versus a net cash position just a few years ago. Debt-to-equity sits at 0.8, not alarming but a clear shift in leverage.

Coverage remains solid: With an interest coverage ratio of 45.7x, Nike can comfortably service obligations.

Cash engine still works: Free cash flow has grown nearly 45% over the past decade, hitting $3.3B in FY2025.

The company has leaned on its balance sheet to keep rewarding shareholders during a reset. That’s pragmatic in the short term, but it leaves less margin for error if competition intensifies or growth stalls longer than expected.

Market Potential

Global engine: Non-U.S. ~57% of revenue. Segments across North America, EMEA, Greater China, APLA.

FY25 regional pressure (FX-neutral): NA -8%, EMEA -10%, China -12%, APLA -3%; Converse -19% reported.

The reset reopens wholesale doors and clears the lane for new product flow.

Performance Comparison

Nike has lost ground while rivals like Deckers are running laps around it. Deckers Outdoor Brands owns UGG, Hoka, Teva, and Koolaburra by UGG.

Nike (NKE): -40.6% since 2021, lagging badly.

Adidas: -32.3%, still better than Nike.

Lululemon: -46%, stumbling too.

Deckers: +177.5%, clear win

Key Risks

Execution risk: If “Sport Offense” fails to deliver, margins stay stuck.

Competition: Adidas, Lululemon, On, and Hoka are gaining share in different segments.

Macro/FX: Global exposure amplifies volatility.

Channel mix: Direct carries fixed cost risk; traffic swings hurt.

Tariffs/supply chain: Near-term drag.

Governance: Knight family retains board control via dual-class.

Conclusion

Nike is still in a reset phase—revenue growth is modest and earnings under pressure, but inventories are cleaner, wholesale is rebounding, and the “Sport Offense” strategy is setting up for longer-term growth. However, the retail sector is notoriously challenging. It's worth noting that only 2% of stocks have generated a net wealth of $75 trillion.

It's unlikely that Nike's performance in the next decade will replicate its success of the past two decades as competitors are now better and well equipped than ever before.

SCC Rating: 66% | Neutral