Should UiPath Be on Your Buy List in 2025?

UiPath, founded in Romania and now based in New York, runs a global automation platform that blends AI, machine learning, and software robots to streamline workflows. The pitch is simple: enterprises don’t need to rip out their IT stacks—they just need the glue to connect them.

Source: Uipath.com

The company revenue is generated as follows: 59% from the Americas, 33% from EMEA, and 8% from the rest of the world.

UiPath’s top line tells a story of evolution—away from one-off licenses toward sticky, recurring revenue.

Subscriptions: $878M, now the main growth engine.

Licenses: $575M, slowing but still meaningful.

Services: $44M, supporting adoption and stickiness.

Geography: 59% Americas, 33% EMEA, 8% Rest of World

Why Now This Is an Opportunity

Agentic automation: UiPath is moving beyond bots into AI-powered agents working alongside humans.

Enterprise stickiness: 320+ customers spend $1M+ annually, up from 293 last year. Once it’s in, it’s hard to rip out.

Recurring model: $1.7B in largely subscription-based revenue.

Partnerships that matter: Now working with Snowflake, Google, and NVIDIA—putting UiPath at the center of the agentic AI ecosystem.

Source: Uipath.com

Management & Alignment

Daniel Dines back as CEO. Founder-led, with ~87% voting power and 6% of the company stocks.

Nervous for some, but clear skin in the game. His wealth is tied to execution.

Incentives: Performance stock units only vest if revenue grows

Capital Allocation

$1.5B cash on hand.

Buybacks: $700M+ already deployed.

Targeted M&A: Peak AI ($65M) to boost pricing/forecasting automation.

R&D: Up 15% YoY.

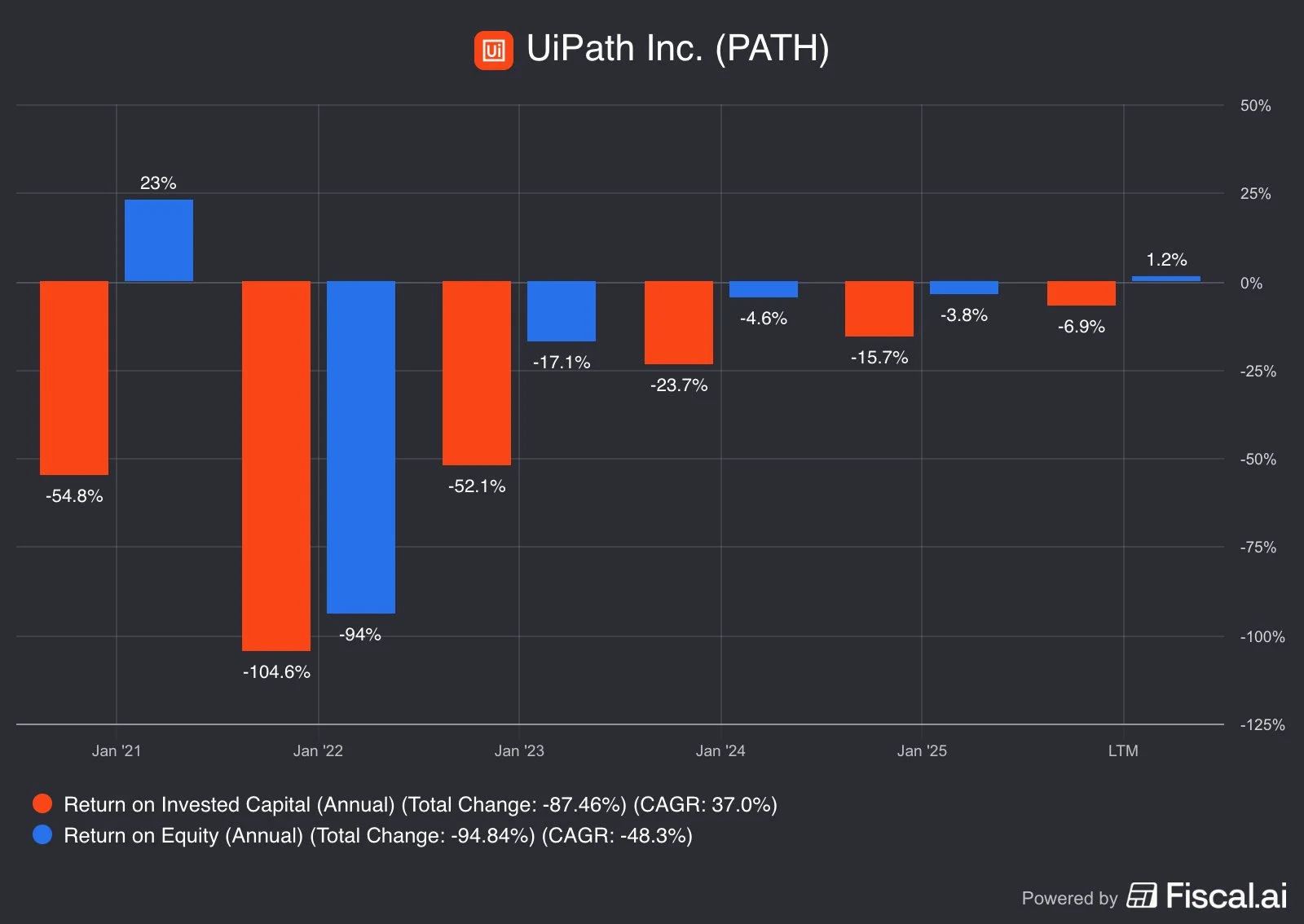

Returns: ROE now positive (1.2% LTM). ROIC improved to –24%, ROE to –5%.

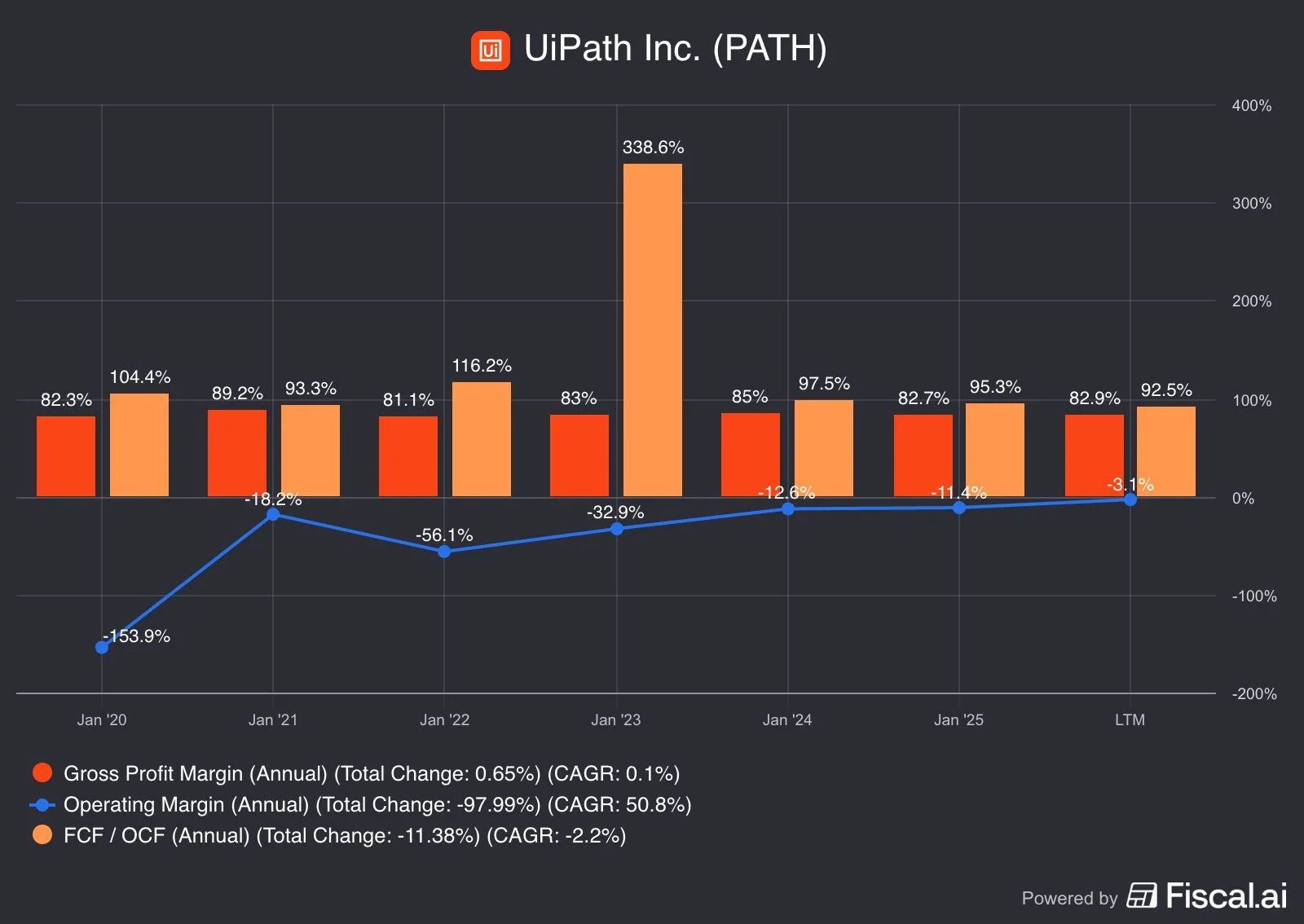

Profitability

Gross margins: Rock-solid, 80%+.

Operating margins: From –154% (2020) → –3% LTM.

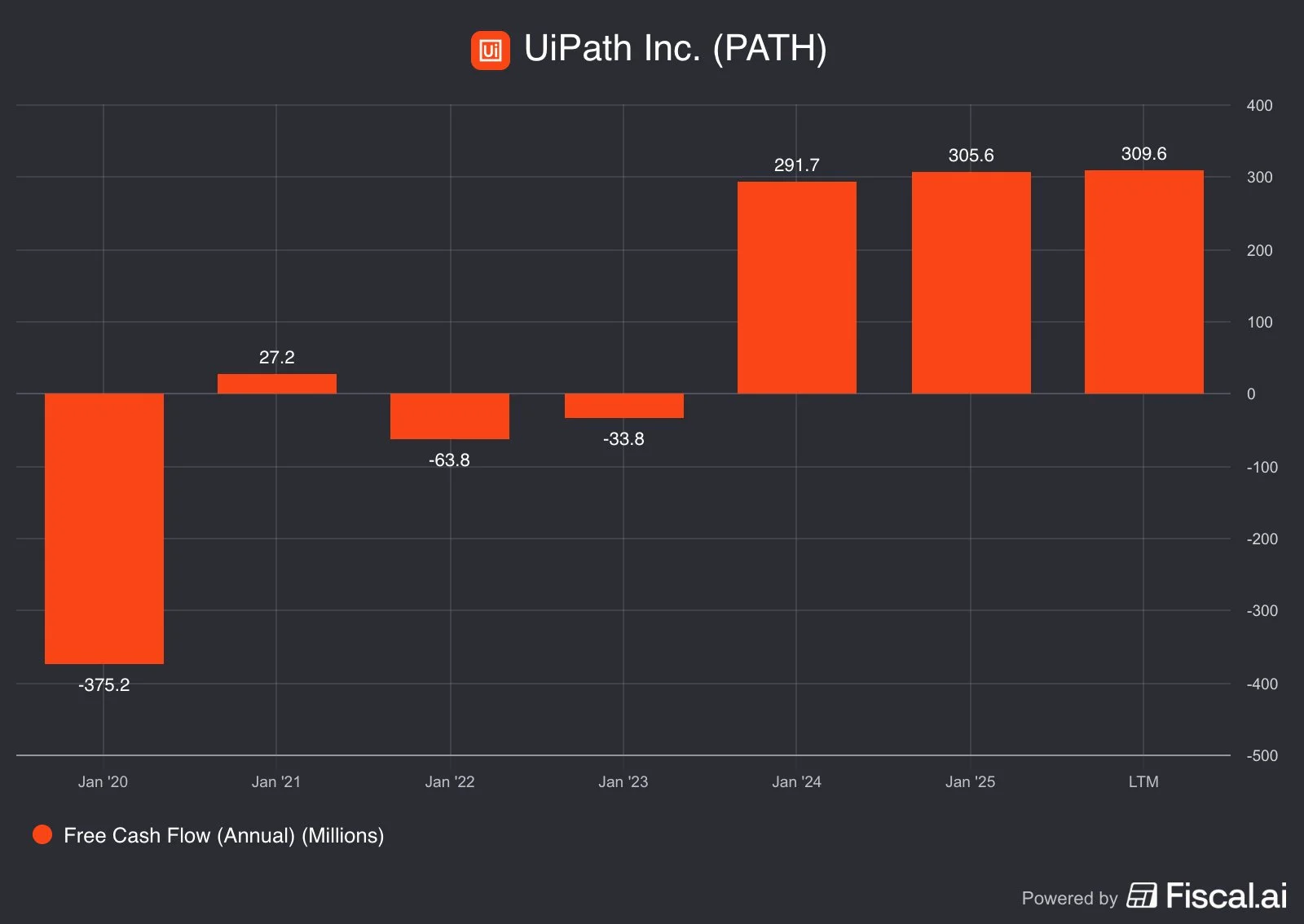

Cash flow: Improving steadily.

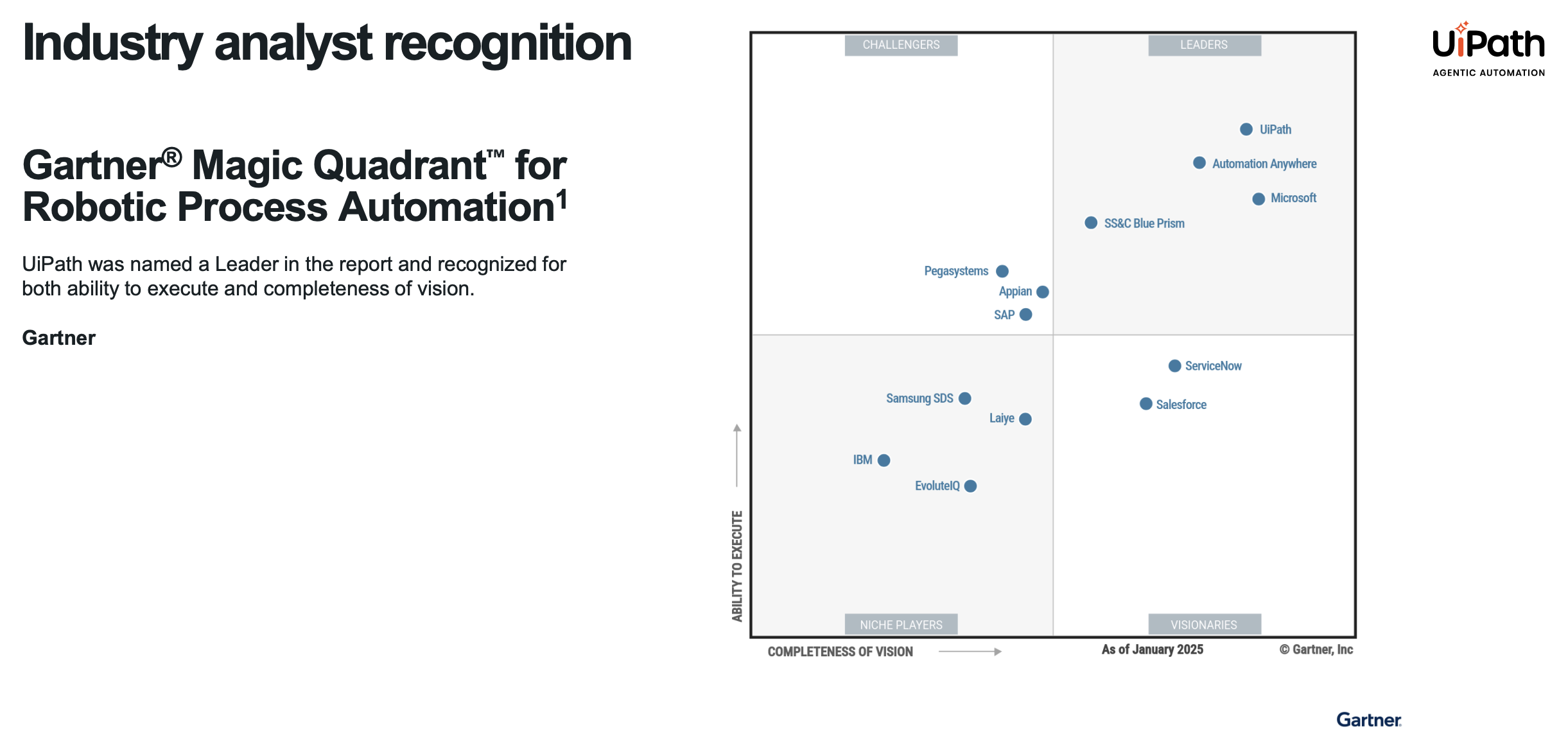

Competitive Edge

Owns the stack: End-to-end automation platform.

Agentic lead: Orchestrates AI + bots + humans together.

Enterprise moat: Deep Global 2000 penetration.

Governance baked in: Critical for banks, governments, healthcare.

Source: Uipath.com

UiPath isn’t trying to beat OpenAI. It’s making OpenAI and Microsoft usable inside Fortune 500 workflows.

Balance Sheet

$1.4B in net cash

Positive operating cash flow and free cash flow improving.

Market Potential

Automation isn’t a trend—it’s a necessity. COOs are under pressure to do more with less, and the global automation market is only just entering its AI-driven phase. UiPath’s focus on enterprise workflows positions it where the dollars will flow.

The total addressable market is massive, with Fortune 2000 companies struggling to stitch together cloud tools, legacy systems, and AI pilots into something coherent.

Automation TAM: Massive. Companies are under pressure to do more with less.

Growth runway: Enterprise automation market growing ~11% CAGR through 2033.

UiPath doesn’t need thousands of new customers. A few hundred more whales is enough.

Performance vs. Peers

Since 2021:

UiPath (PATH): –81.5% (CAGR –28.6%)

Microsoft (MSFT): +160.8% (CAGR +21.1%)

SAP: +85.9% (CAGR +13.2%)

SS&C (SSNC): +50.1% (CAGR +8.5%)

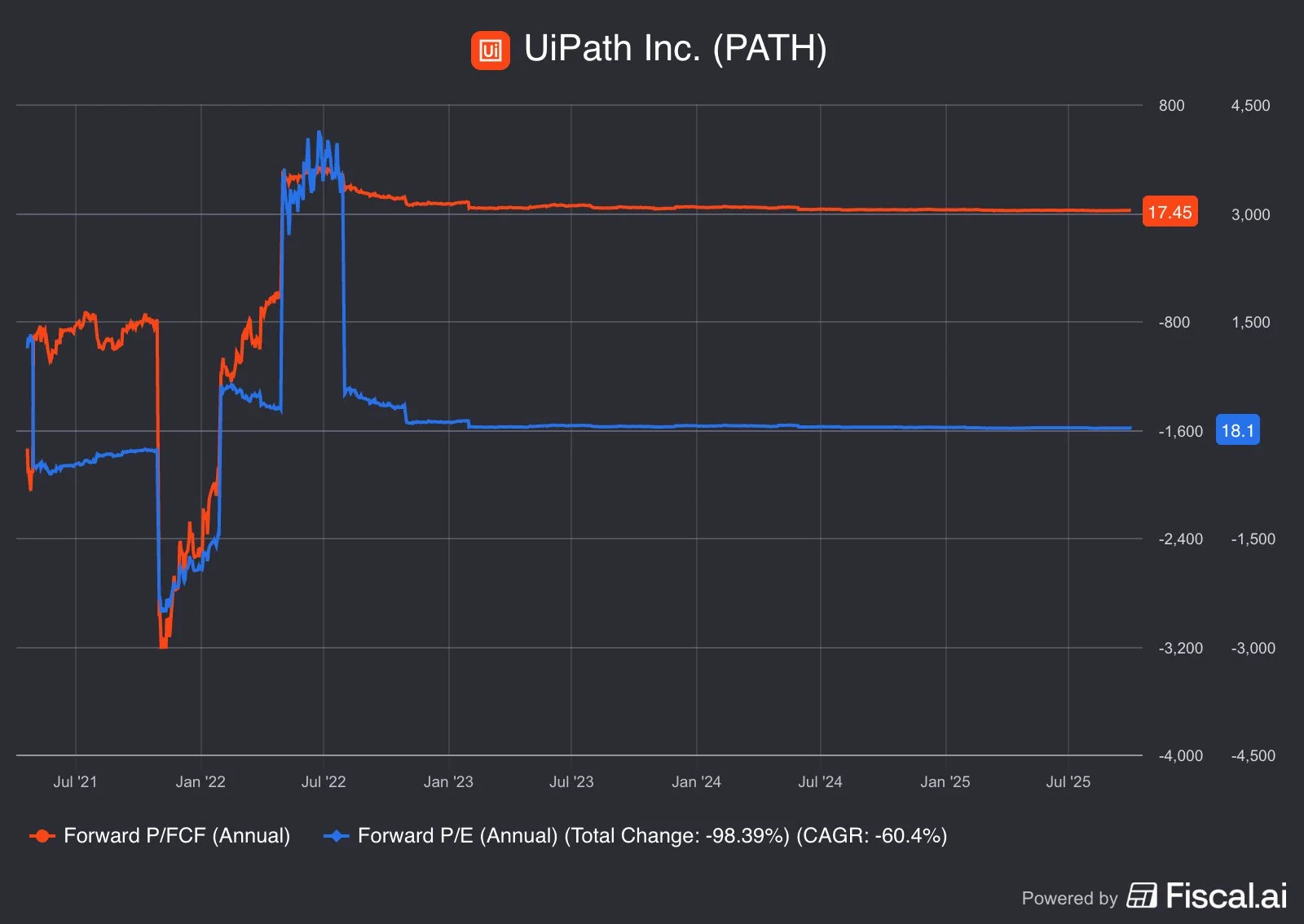

Valuation

From hype to “show-me.” IPO priced perfection. Now it trades at ~4.5x sales.

Forward P/E: Collapsed 98% since 2021.

Forward P/FCF: Same story.

At ~$13/share: Market is pricing in doubt, not growth.

Downside cushioned by cash and buybacks. Upside could be asymmetric if execution improves.

Risks

Brutal competition (Microsoft, ServiceNow, startups).

ARR growth slowing to 11%; retention slipping.

Dines’ 87% control limits shareholder influence.

Macro IT spending could stall.

Conclusion

UiPath won’t win through flashy AI, but by becoming the backbone of enterprise automation—the rails and glue holding systems together.

The risks from big tech are increasing specifically Microsoft, yet the market is large enough for multiple winners. With a beaten-down stock, strong balance sheet, and a sound strategy, the setup is attractive—but it requires patience.

The real test of value creation is only if management executes for this coming AI agentic wave.

SCC Rating: 65% | Neutral