Before You Invest in Rigetti: The Quantum Computing Reality Check

The first rule of compounding: never interrupt it unnecessarily. The first rule of bubbles: never believe the story entirely.

Every generation finds its own version of “the future.” In 1999, it was the internet. In 2021, it was crypto. In 2025, it’s quantum computing.

Rigetti Computing (NASDAQ: RGTI) sits right at that intersection — a brilliant scientific pursuit wrapped in a spectacular market narrative. And right now, that narrative looks dangerously ahead of reality.

Quantum computing promises to change everything — eventually. Rigetti believes superconducting qubits are the path to that future, capable of processing information faster than anything else on earth.

The company’s newest system, Cepheus-1-36Q, hit a technical milestone of 99.5% fidelity — and investors went wild.

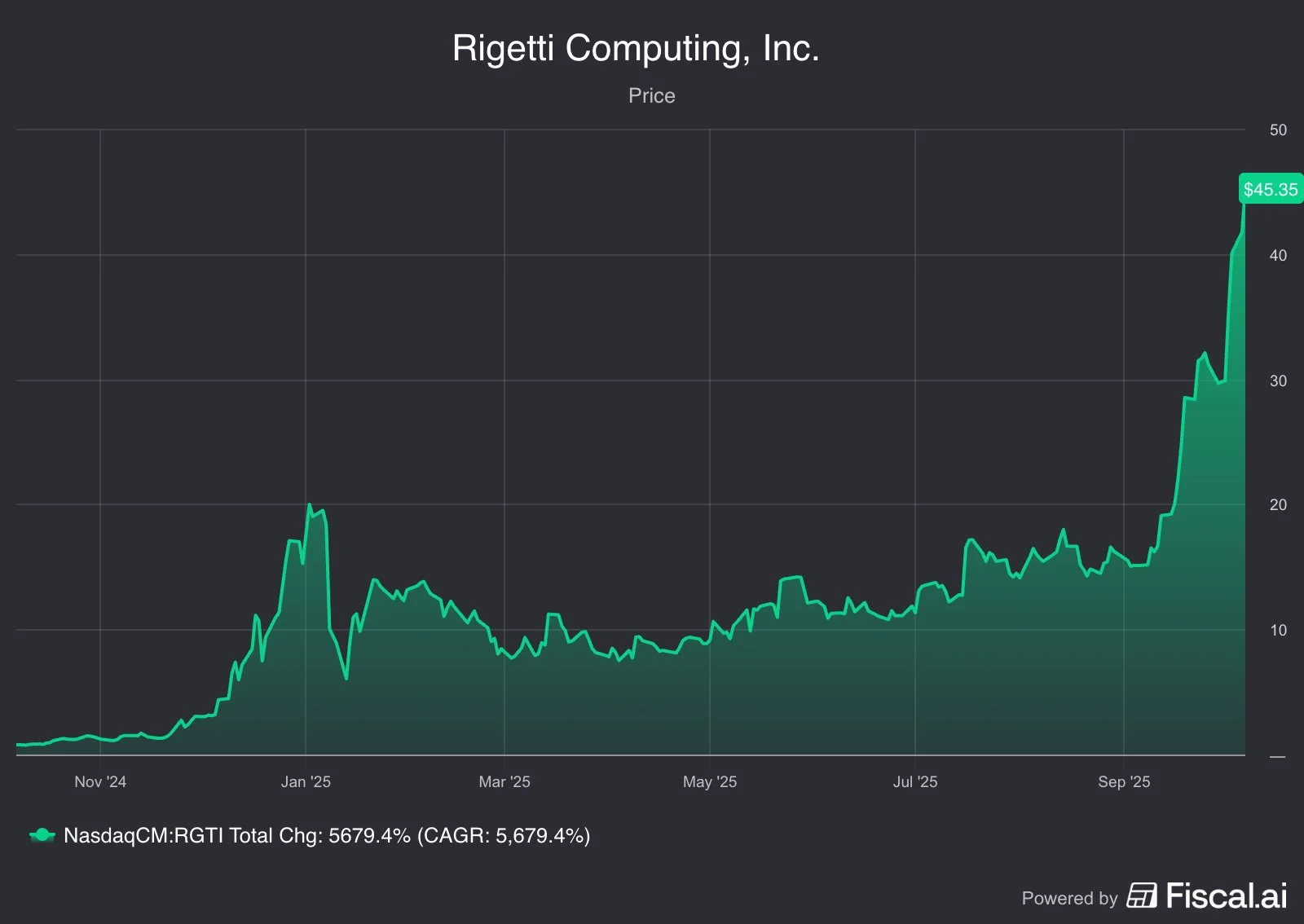

The stock soared 5,679% year-over-year, ballooning to a $13.5 billion valuation on about $8 million in annual sales.

Why It Feels Like a Bubble

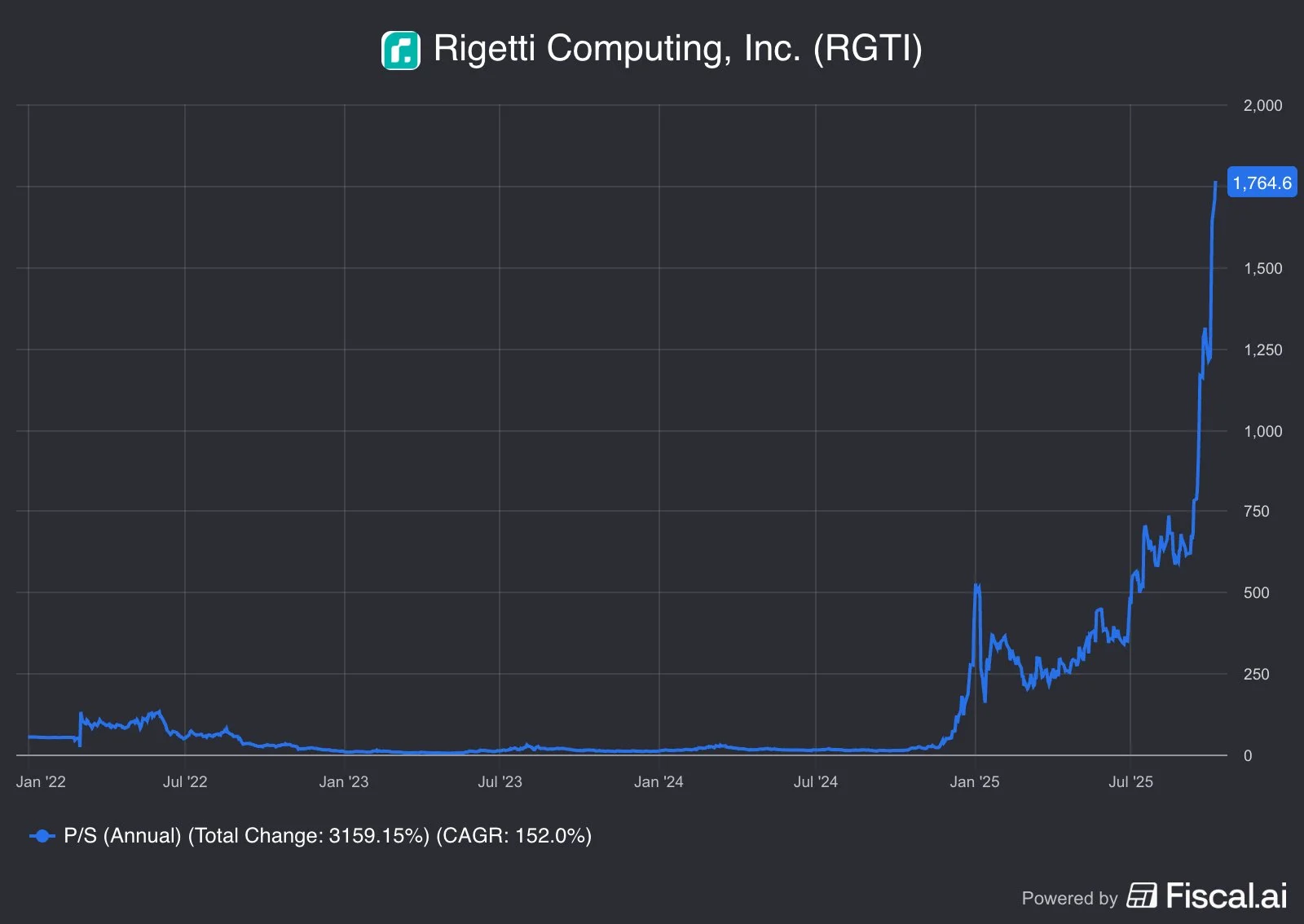

Valuation detachment: Rigetti trades at a $13.5B market cap on $8M in annual sales — roughly 1,700× 2025 revenue. Price has completely divorced from fundamentals.

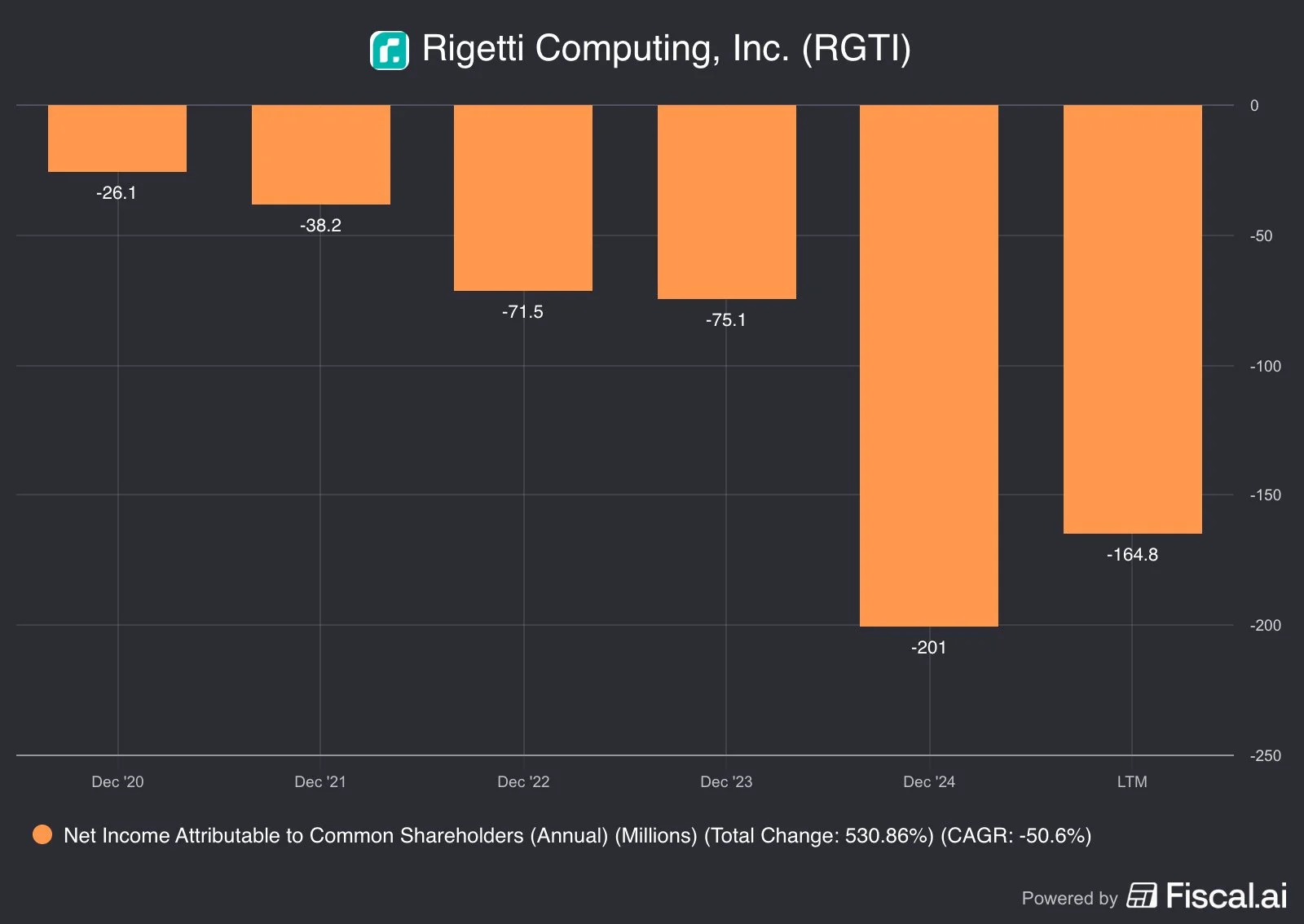

Rising losses: 2024 net loss hit $201M, up from $75M in 2023 — that’s $25 lost for every $1 earned.

Speculative surge: The stock is up 5,679% year-over-year, driven by hype, not growth. Revenue remains flat.

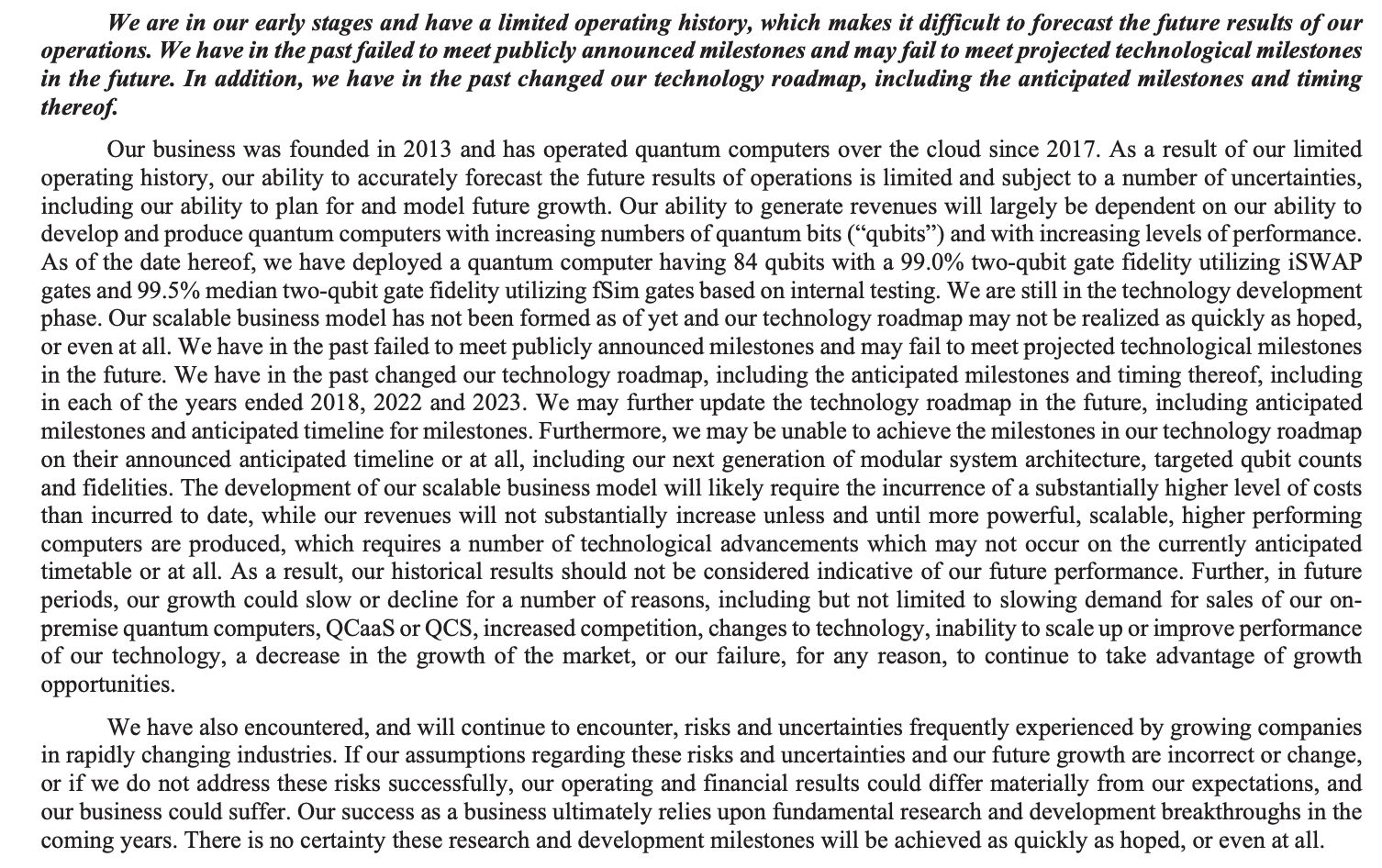

Execution risk: Rigetti has missed key milestones and reset its technology roadmap in 2018, 2022, and 2023, pushing commercialization further out.

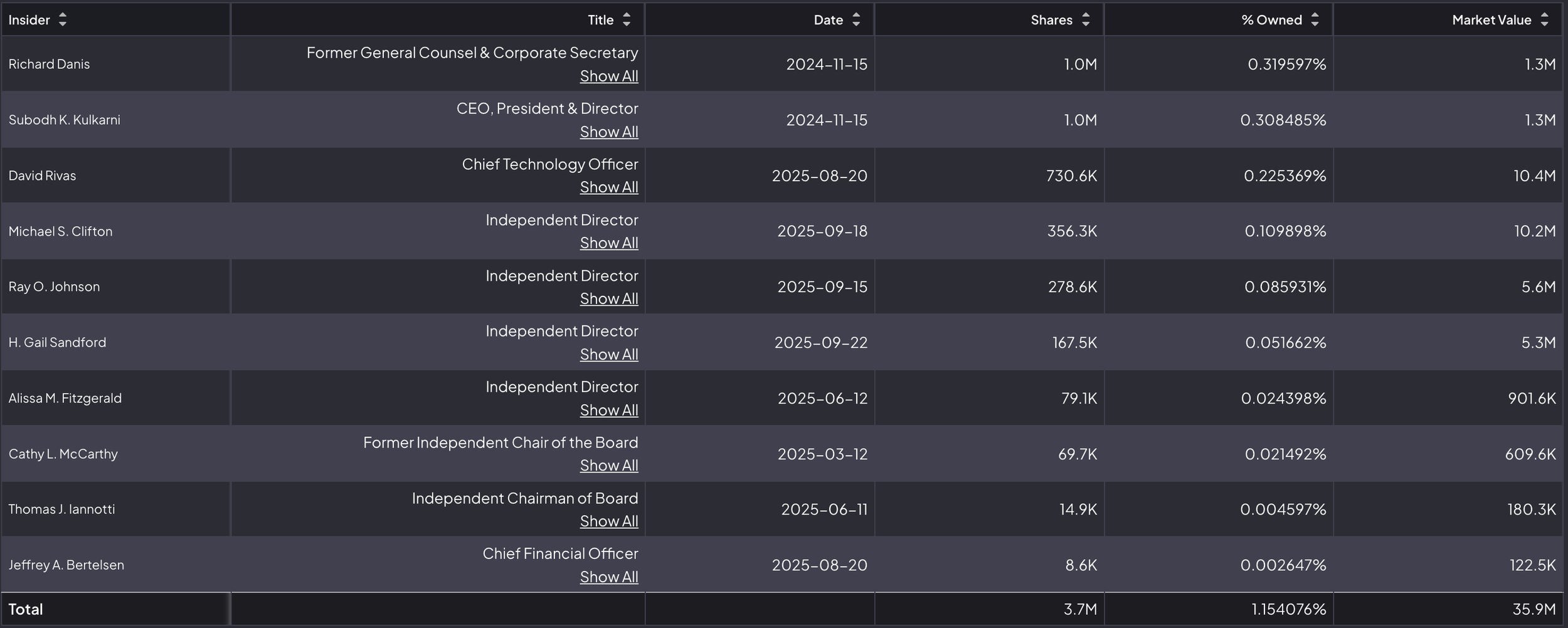

Insider alignment: Management owns just 1.15% of shares. That’s not conviction — that’s a call option. Continued insider selling reinforces the lack of long-term commitment.

Customer concentration: 89% of 2024 revenue came from government contracts. Lose one agency deal, and a full year’s sales evaporate.

Industry skepticism: Nvidia’s Jensen Huang called quantum technology “decades away” and questioned “how a quantum company could even be public.” His new R&D center partnered with Quantinuum, QuEra, and Quantum Machines — not Rigetti.

Technological disadvantage: Harvard/MIT just demonstrated a 3,000-qubit neutral-atom system running continuously for hours; Caltech hit 6,100 qubits (for 13 seconds). Both used neutral atoms, not superconducting qubits like Rigetti’s. The research frontier is shifting away from their core approach.

Competitive pressure: Rigetti faces IBM, Alphabet which is Google, and Microsoft, each with billion-dollar R&D budgets and profitable businesses. Competing against trillion-dollar balance sheets is a losing equation.

Technological bottleneck: Scaling quantum systems isn’t linear — it’s exponential pain.

Entanglement: One qubit’s error can ripple across the system.

Decoherence: Qubits are hypersensitive to thermal and electromagnetic noise.

Crosstalk: Unwanted qubit interactions degrade system accuracy.

Rigetti’s current systems struggle to maintain fidelity while scaling qubits — the core challenge that separates lab experiments from real computing power.

The pattern is familiar — dot-coms, EVs, crypto, now quantum. Valuation has detached before validation.

Rigetti’s success now hinges on hitting 100+ qubits with sustained fidelity. Miss that, and the valuation narrative collapses.

However, Rigetti’s valuation assumes it has solved problems the physics community is still publishing papers about. It hasn’t — and the market is finally starting to notice.

The Business Reality

Rigetti isn’t selling commercial quantum services — it’s selling hope to governments and researchers.

Revenue sources:

Government contracts: DARPA, DOE, U.K. Quantum Mission (≈89% of 2024 revenue)

Cloud access fees for research users

Small hardware sales to labs

CEO Subodh Kulkarni was blunt: “We’re still in R&D. Commercial sales are four to five years away.”

That’s not a growth business — it’s a grant-dependent experiment.

Management and Culture

When Chad Rigetti was ousted in 2022, it marked a shift from idealistic founder energy to industrial pragmatism. Kulkarni, an operations veteran from CyberOptics, runs a tighter ship. But this is still a lab culture trying to become a company — heavy on engineers, light on commercial DNA.

There’s talent here. But not enough skin in the game.

Capital Allocation and Cash

Rigetti played its cards right when it mattered — raising $350 million at the height of quantum hype. As of mid-2025, it holds $426 million in cash and no debt. That gives it about few years of runway assuming ~$80 million in annual cash burn.

Cash buys time, not inevitability.

Profitability and Competition

Rigetti posted $1.8 million in Q2 revenue against $19.9 million in operating losses. Even if it triples revenue, the economics won’t move.

Meanwhile, IBM, Google, and Quantinuum dominate superconducting qubits. Microsoft may leap ahead entirely with its Majorana qubit research. Rigetti’s “modular chiplet” design is clever, but it’s no moat. It’s a survival tactic.

The Bigger Picture

The market potential is enormous — trillions across chemistry, AI, and finance. But commercialization is a decade away. Even Nvidia’s Jensen Huang calls the field “decades out,” and his company’s new quantum lab pointedly excluded public players like Rigetti.

When the smartest guy in semiconductors says you’re early, you’re early.

Risks in Plain English

Tech risk: Scaling fidelity from 99.5% to 99.99% is exponentially harder than it sounds.

Customer risk: 89% of revenue is from the government — miss one milestone, and the lights flicker.

Competition risk: The quantum field will likely be dominated by IBM, Google, and Microsoft, especially if Microsoft’s Majorana-based architecture proves viable. These giants can fund R&D indefinitely from profitable core businesses. Rigetti cannot.

Sentiment risk: When hype fades, liquidity follows.

Valuation is overly stretched: This won't leave any margin of safety for investors.

A Lesson from History

During the Gold Rush, most prospectors didn’t strike gold — they went broke buying shovels. The real money was made by those selling the picks, not digging the holes.

In quantum, the picks are semiconductors, cryogenics, and photonics — not speculative R&D-stage startups.

Alternatively, the safest way to invest will be via Alphabet, IBM and Microsoft which already have a great ecosystem and they are also advancing very well.

Conclsion

Rigetti is a great science story, not a great investment. IBM’s latest benchmarking report shows a massive gap between Rigetti, IonQ, and the leaders (IBM, Google, QuEra).

The company has cash, no debt, and no profit — a bet on survival, not scale. The stock’s 5,679% surge reflects hype, not growth.

Nvidia’s Jensen Huang called quantum “decades away” and partnered with Quantinuum, QuEra, and Quantum Machines — not Rigetti.

And with IBM, Google, and Microsoft funding quantum research from billions-dollar profits, Rigetti simply can’t compete. In addition, the giant tech have a greater ecosystem which will make it easy for them to integrate. Until there’s real commercial traction, it belongs near cash value — on the watchlist, not in the portfolio as its valued $13.5 billion today which is insane.

SCC Rating: 50% | Sell

At Silvercrosscapital we built the Outlier Portfolio on one truth: a handful of stocks create nearly all long-term wealth. Apple already did it. Our mission? Find the next Apple before Wall St. does.