Market Crash - Which stocks should you be looking at?

When markets tumble, fear takes over—but that’s when long-term investors get to work. While others panic, we hunt for quality businesses that can thrive through the storm and come out stronger.

Here are three standout companies that offer resilience, innovation, and upside, even in a downturn:

MercadoLibre

Wise

Nvidia

MercadoLibre (MELI): Latin America’s Digital Titan

How It Makes Money

Think of MELI as the Amazon + PayPal + FedEx of Latin America.

Marketplace (MercadoLibre) connects millions of buyers and sellers.

FinTech (MercadoPago) handles payments and transfers.

Logistics (MercadoEnvios) powers same-day deliveries.

Credit, ads, and shops round out a powerful digital ecosystem.

Management & Capital Allocation

Founder Marcos Galperin still runs the show and owns 7.5%. He’s long-term focused, growth-minded, and investor-aligned. Capital is invested wisely to scale the business and fuel free cash flow.

Balance Sheet & Valuation

$7.1B cash vs. $1.4B net debt

PE: 51x – expensive, but 14x P/FCF which is cheap but quality rarely comes cheap

Strong FCF margin, outperforming Amazon and eBay

Market Potential

148M users, 3.2M sellers

LATAM e-commerce to hit $923B by 2026

MELI is growing revenue at 40–50% a year

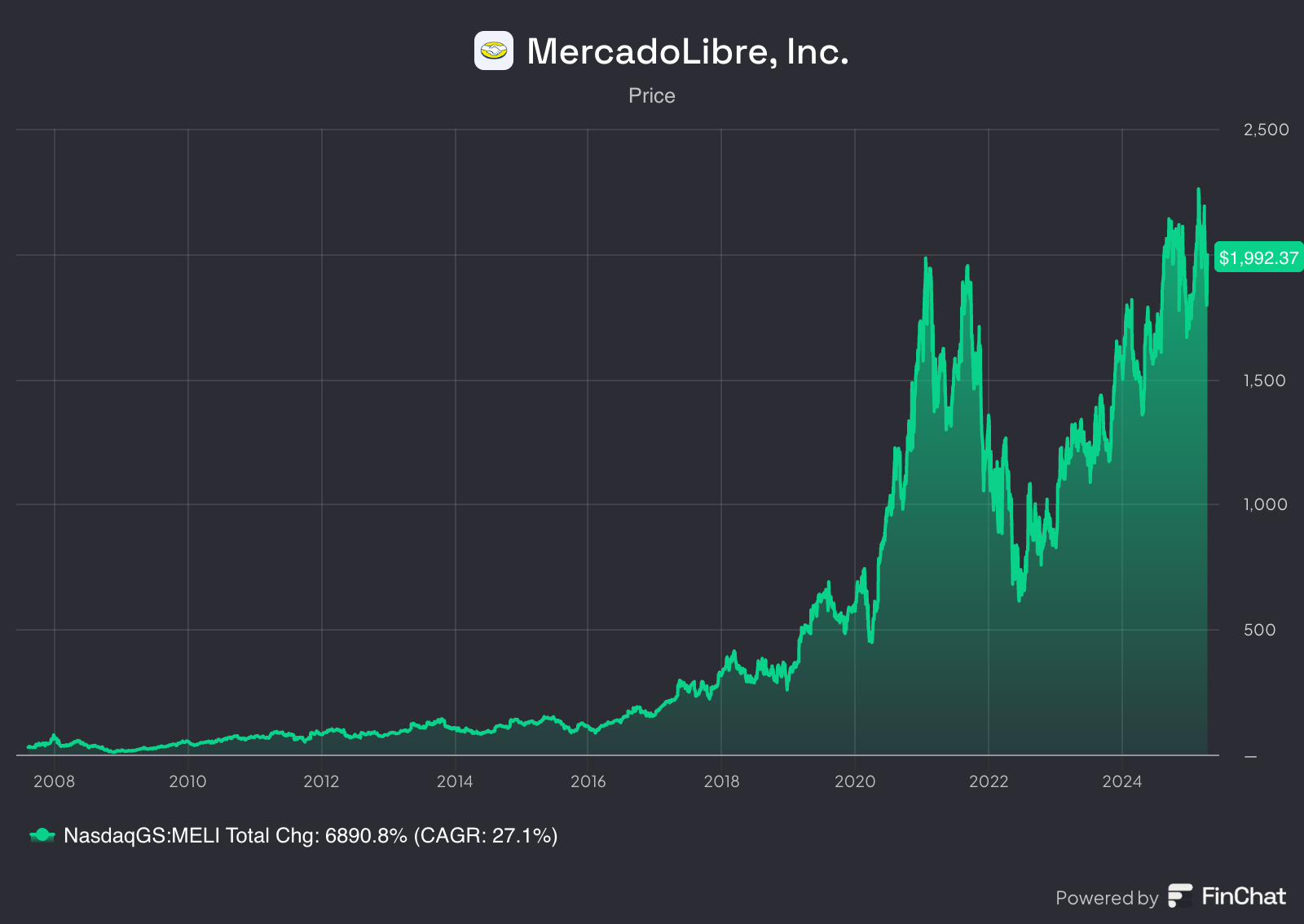

Performance

+6891% since IPO, +27.1% CAGR

Outperformed Amazon on compounding over time.

Risks

Currency devaluation (Argentina in particular)

Political & economic volatility

Credit risk in lending business

SCC View

💥 Buy – decent valuation for a premium business leading the digital economy of an entire continent.

🌐 Wise PLC (WISE): Making Money Borderless

How It Makes Money

Wise started as a hack by two frustrated Estonians sick of overpriced bank transfers. Today, it's a £12.3B fintech giant making global money movement fast, cheap, and transparent.

Business Model: Low cost, high tech, and capital-light. With 66% of new users from word-of-mouth, the product speaks for itself.Wise fixes broken international money transfers.

77.5% from transfers

22.5% from accounts, cards, and APIs

Charges 0.87–1.14% per transaction vs. 3–10% at banks

Management & Capital Allocation

Co-founder Kristo Käärmann still leads and owns 18.3%. Hasn’t sold a single share since IPO—rare conviction.

ROCE: 30.1%

ROE: 23.5%

Rock-solid capital discipline

Balance Sheet

Extremely low debt

Interest coverage: 24x

CapEx-to-revenue: just 0.92

This is a lean, scalable, software-like business.

Market Potential

Addressable market: £27 trillion

Handles <5% of retail and <1% of SMB cross-border transfers

Strategic B2B growth via Wise Platform (e.g. Morgan Stanley)

Performance

+111.3% since 2022, CAGR: 28.3%

Outperformed the FTSE 100 by a wide margin

Valuation

Historically cheap

DCF suggests 40% margin of safety

High margins: 80.8% gross, 36.6% operating, 27.6% net

Risks

Regulatory hurdles

FX volatility

Cybersecurity threats

SCC View

🧠 Buy – A mission-driven disruptor with strong financials and vast runway in a £27T market.

🤖 Nvidia (NVDA): The AI Superpower

How It Makes Money

Nvidia designs world-class chips—mainly GPUs—for data centers, gaming, AI, and autonomous driving.

80% share of the AI chip market

Dominates hyperscaler data center build-outs

CUDA software ecosystem creates developer lock-in

Capital Allocation & R&D

$7.3B R&D in 2023 alone

High FCF conversion

Strategic bets on AI and compute infrastructure

Management

CEO Jensen Huang = Visionary

Owns 3.9% ($137B stake)

Flat org structure, direct involvement, and relentless innovation.

Balance Sheet

Healthy ratios

Low capital intensity relative to returns

Strong cash flow machine

Valuation

P/FCF: 44.5x – richly priced but when we look at the forward valuation is expected to be 28x in 2026 which is cheap.

Market expects 30% annual growth

Big reward… but also high expectations

Market Potential

GPU market: $274B by 2029 (CAGR: 33.2%)

Data center revenue already 80% of NVDA’s top line

The “arms dealer” of the AI revolution and the next wave that is coming

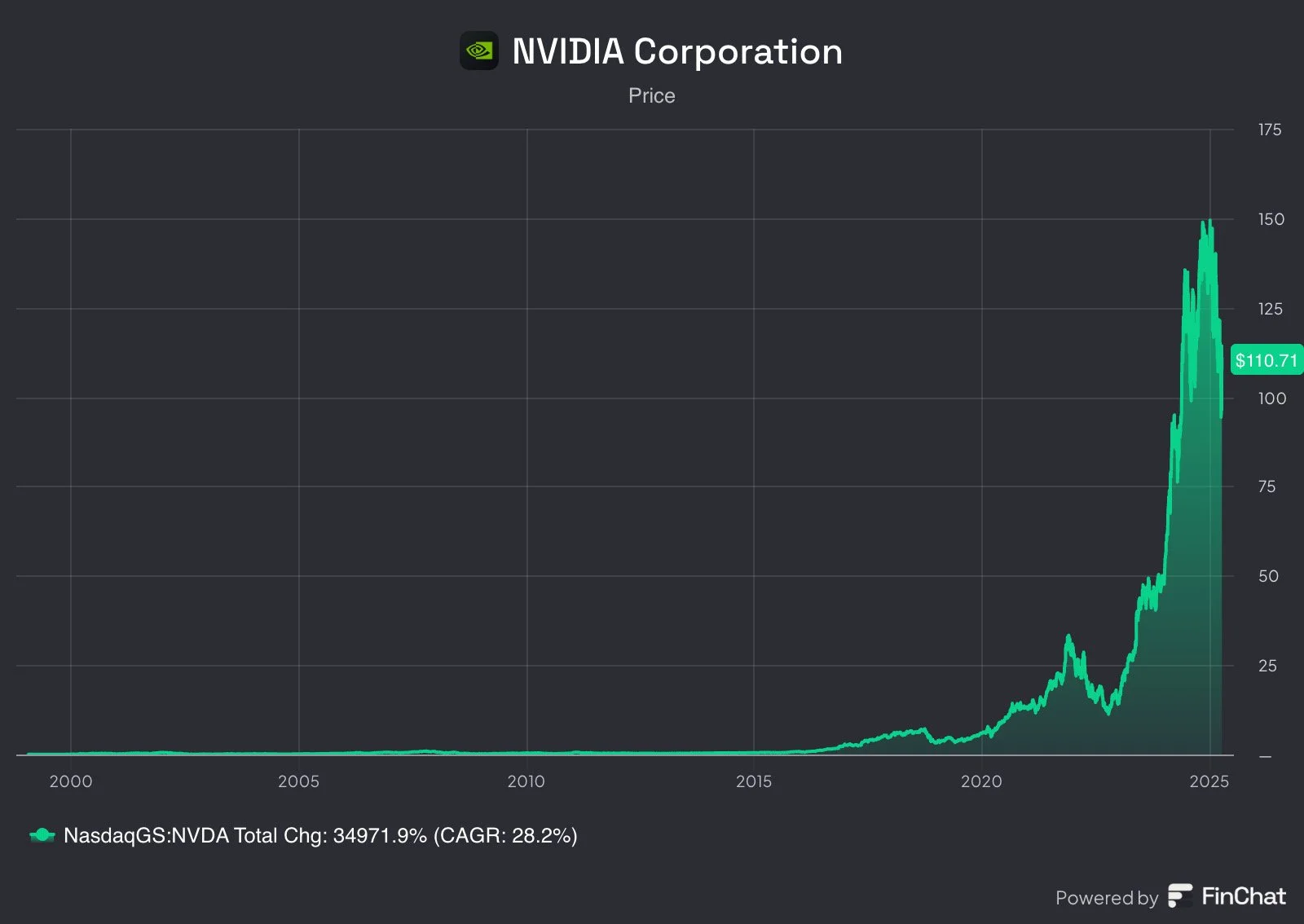

Performance

+34,971% since IPO

28.2% CAGR since IPO

Crushed AMD and Intel in returns

Risks

Valuation bubble?

Customer concentration (Amazon, Meta, etc.)

Geopolitical risks (Taiwan supply chain)

SCC View

⚖️ Underweight – Nvidia is extraordinary, but current prices bake in perfection. Wait for a better entry point.

Final Thoughts

These three companies represent the best of their categories:

MercadoLibre: Dominates Latin American commerce and fintech

Wise: Disrupts a giant market with a simple, scalable model

Nvidia: Powers the AI revolution with unmatched tech

In a market crash, the real winners emerge. These businesses combine visionary leadership, efficient capital use, and massive market opportunities. If you’re investing through chaos, look for companies like these—durable, innovative, and built for the long haul.

📩 Subscribe to Silver Cross Capital for more research-driven insights into world-changing businesses.