Core Natural Resources Inc: Mohnish Pabrai is betting 25% of his US portfolio.

Core Natural Resources Inc. (CNR) is a name that’s quietly making waves in the investing world. With a $4.04 billion market cap and deep roots in coal mining dating back to 1864, this company just underwent a major transformation. After a merger of equals between CONSOL and Arch Resources in early 2025, the new entity has emerged with serious momentum. Legendary investor Mohnish Pabrai has taken notice—allocating a staggering 25% of his U.S. portfolio to this single coal stock. That’s not just a bet. It’s a conviction.

How Core Makes Money

Core operates two core segments:

Metallurgical Coal: Supplying high-quality coking coal to global steelmakers.

Thermal Coal: High-calorific coal for cement, brick, and power plants.

Ownership in two major East Coast export terminals gives CNR a logistics advantage, allowing it to move coal efficiently to high-demand markets.

Management That Thinks Like Owners

CEO Paul Lang has 40+ years in coal, Harvard-trained, and owns $20.5M in stock.

Executive Chair Jimmy Brock started underground and climbed to the top—now leads innovation efforts and owns $34.7M in shares.

Total insider ownership: ~2%, with incentives tied to long-term performance.

These are operators—not financial engineers—with real skin in the game.

Capital Allocation & Returns

CNR has gone from negative returns in 2020 to industry-leading ROIC of 28.8% in 2023.

5-Year Avg ROIC: 14.5%

2024 ROIC: 12.6% (post-merger dip, still strong)

CapEx remains low (10% of revenue), while free cash flow soars. That’s how you create value.

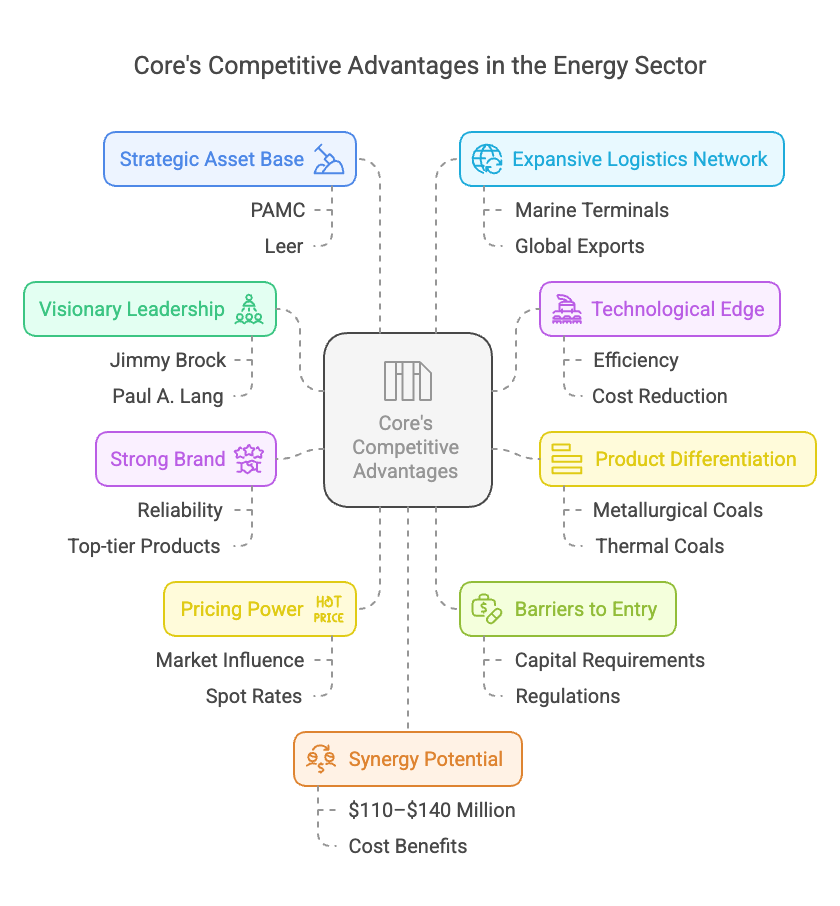

Competitive Advantage

What sets Core apart?

Synergies Realized Fast: $40M saved within 5 weeks post-merger, targeting $110–$140M.

Premium Coal Assets: Leer and Leer South among the best globally.

Export Infrastructure: Owns two key terminals, ensuring access to global markets.

Global Diversification: Expanded product mix reduces price volatility.

Pricing Power: Supplies high-quality coal, not just competing on cost.

Sustainability Edge: Focus on responsible mining and clean coal innovation.

Visionary Leadership: Lang and Brock bring decades of credibility, discipline, and capital efficiency.

Valuation: Margin of Safety Intact

CNR trades cheaply relative to its cash flows:

P/E: 7.6

EV/EBITDA: 6.7

P/FCF: 13.2

DCF Upside: ~137% implied margin of safety

Legendary value investor Mohnish Pabrai has made CNR 25% of his U.S. stock portfolio. That conviction speaks volumes.

Financial Strength

The balance sheet is built to last:

Operating Cash Flow / Debt: 2.28x

Interest Coverage: 25x

No Goodwill: Clean and conservative accounting

Core can pay off all debt in under a year using just free cash flow.

Market Potential

Despite global decarbonization trends, Core’s product—especially metallurgical coal—remains essential:

Steel Demand: Driven by growth in India and Southeast Asia

Tight Supply: Asia lacks local sources; imports will rise

Coal Still Dominates: Especially in developing markets

Prices have normalized since 2022 highs, but demand for Core’s niche remains firm.

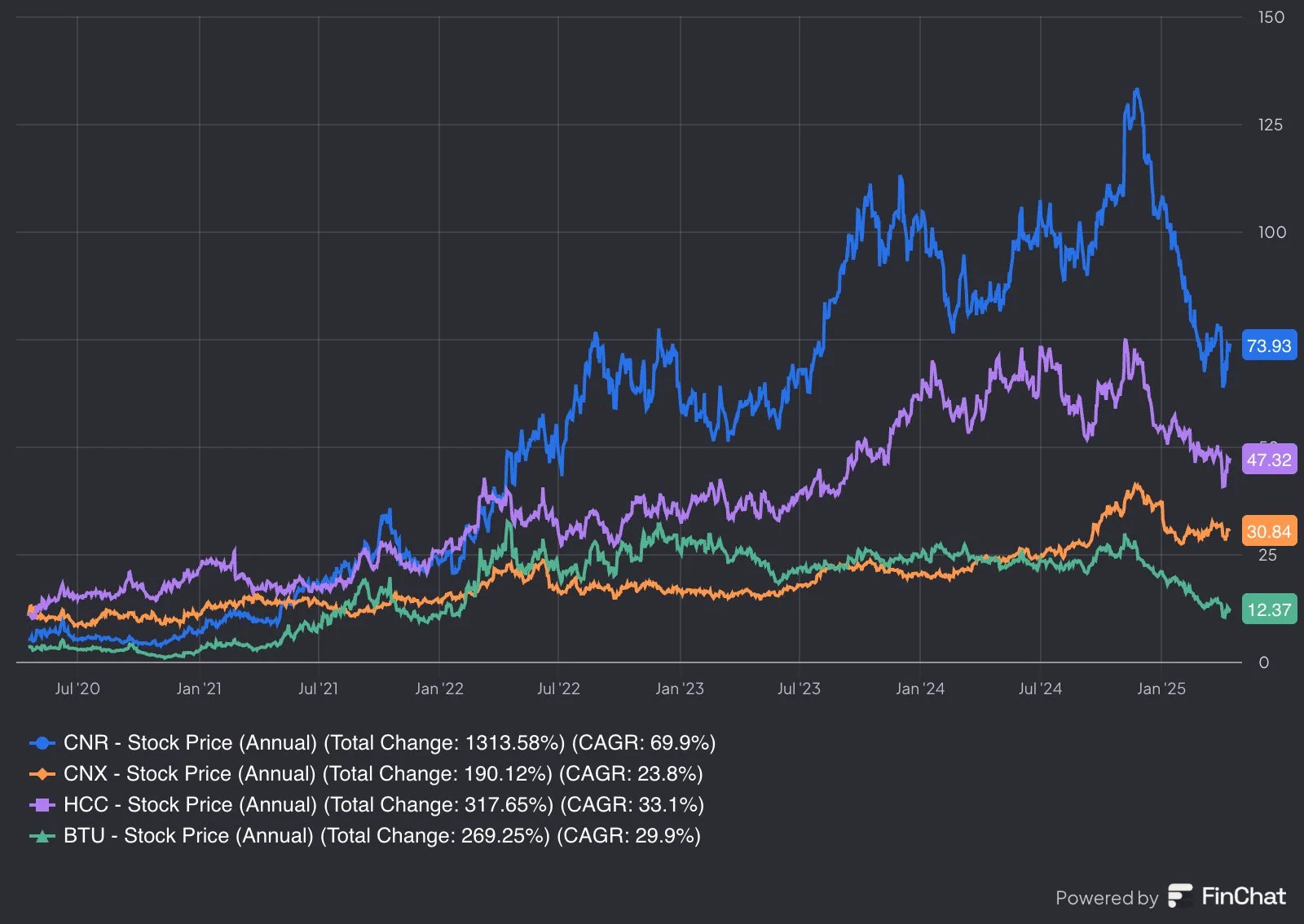

Performance vs Peers

Core is not just beating the market—it’s leaving it behind:

Total Return (5Y): +1313.6%

CAGR: 69.9%

Outperformed CNX, HCC, and BTU by a wide margin

CNR vs Competitors

This isn’t a fluke. It’s the result of disciplined strategy and top-tier execution.

Key Risks

Merger Integration: System and cultural alignment takes time

Regulation: Increasing ESG and environmental scrutiny

Operational Hiccups: Longwall mining has little margin for error

Pricing Volatility: Global coal prices remain unpredictable

Still, with a clean balance sheet and proven leadership, Core is well-equipped to manage these challenges.

Our Take

Core Natural Resources is quietly turning into one of the most compelling stories in U.S. energy. Efficient, disciplined, and seriously undervalued, CNR offers rare exposure to high-quality coal assets with global relevance.

And when someone like Mohnish Pabrai bets big, it’s worth paying attention.

SCC’s View: Buy

Check out our full in-depth analysis on our substack: https://silvercrosscapital.substack.com/p/core-natural-resource-inc-mohnish?r=4fs22e