Axon Enterprise: Taser Empire or Overhyped? The $20B Tale...

Axon Enterprise: Mission-Driven Tech That’s Saving Lives

What started as a mission to reduce gun violence has evolved into a $20B public safety tech powerhouse. Axon Enterprise (NASDAQ: AXON), founded in 1993 by Rick Smith, has gone from making stun guns to becoming the backbone of modern policing through software, AI, and cloud integration. It’s not just a hardware company anymore—it’s public safety, reimagined.

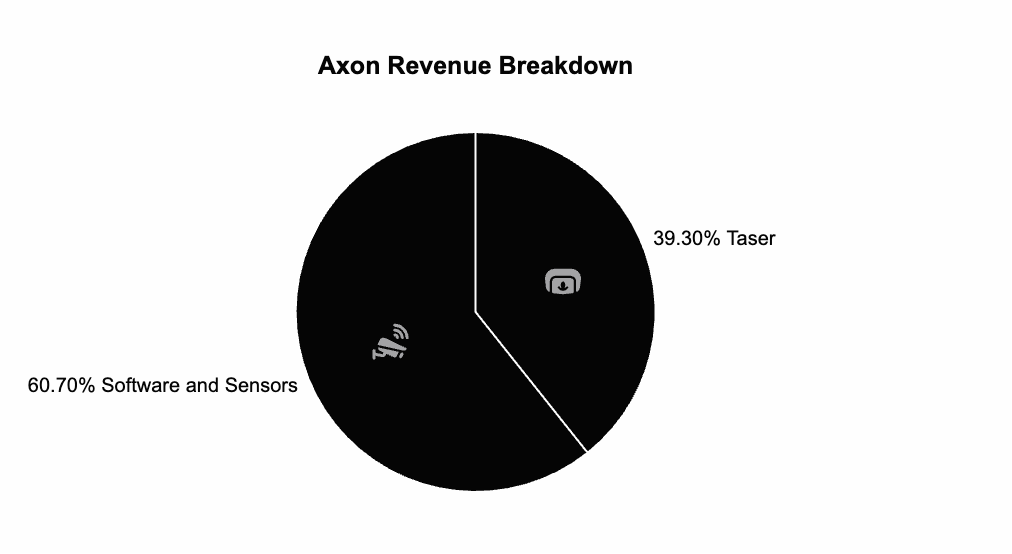

1. How Does Axon Make Money?

Hardware + Cloud = Public Safety Flywheel

Axon operates an integrated ecosystem that combines physical tools with high-margin software:

TASER Energy Weapons: Flagship non-lethal tools used by law enforcement worldwide.

Body Cameras & In-Car Video: Core tools for accountability and safety.

Axon Evidence (SaaS): Cloud platform to manage, analyze, and store digital evidence.

Axon VR & AI: Simulated training and predictive analytics for modern policing.

Recurring Revenue Wins instead (What makes this compelling?

In Q4 2024, 40% of revenue was recurring, with 95% of customers on subscriptions. With 123% revenue retention, customers aren’t just sticking around—they’re spending more.

Our Take: That kind of retention? It’s SaaS gold. In my opinion, Axon is quietly building one of the stickiest B2G (business-to-government) models in the tech world.

2. Management

Founder-Driven Mission: Rick Smith founded Axon after losing two friends to gun violence. Now CEO, he’s still leading the charge with a strong vision to make deadly force obsolete.

Skin in the Game: Smith owns 4.95% of Axon—worth ~$1.8B. That’s serious alignment with shareholders.

Source: Axon Enterprise CEO Rick Smith

Our Take: This isn’t a passion project; it’s a purpose-led juggernaut. I trust companies more when the founder still owns a meaningful slice and is driving innovation.

Rick Smith is no ordinary CEO. After losing two friends to gun violence, he built a company with purpose. He still owns nearly 5% of Axon’s stock (≈$1.8B stake), keeping his incentives aligned with long-term value creation.

Axon’s leadership blends vision with execution—investing in long-term tech while staying grounded in the needs of law enforcement.

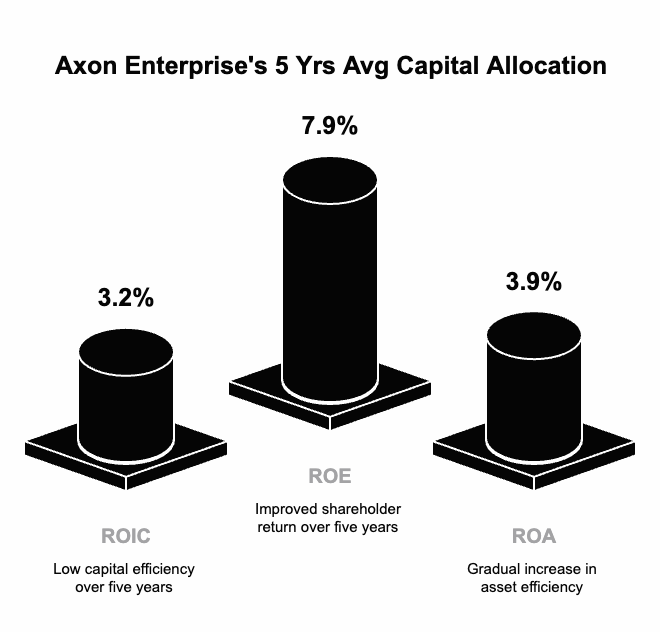

3. Capital Allocation & Efficiency

Mixed History, Clear Progress

While historical ROIC was a modest 3.2%, 2024 saw a leap in ROE to 19.1% and ROA to 9.6%.

CapEx Discipline

With only 0.2% CapEx to operating cash flow, Axon is investing in growth—without burning cash.

Our Take: I love that they’re reinvesting in tech and AI without bloating their balance sheet. It’s growth—but with guardrails.

4. Valuation & Margin of Safety

Sky-High Expectations

Axon trades at 115x FCF and 112x earnings — pricing in serious growth. A DCF suggests a 51% premium unless Axon delivers 36% annual growth.

Our Take: That’s a stretch. But if you believe in their AI play and cloud dominance, you might just be paying up for quality.

5. The Balance Sheet: Lean, Liquid & Focused

Operating Cash Flow to Total Debt: 60%

Interest Coverage Ratio: 17.6x

Free Cash Flow to Total Debt: 45%

Goodwill to Assets: Just 16.9%

Our Take: They’re not over-leveraged, and they’re not cash-rich either. It’s a balanced structure that lets them play offense without taking on risky debt.

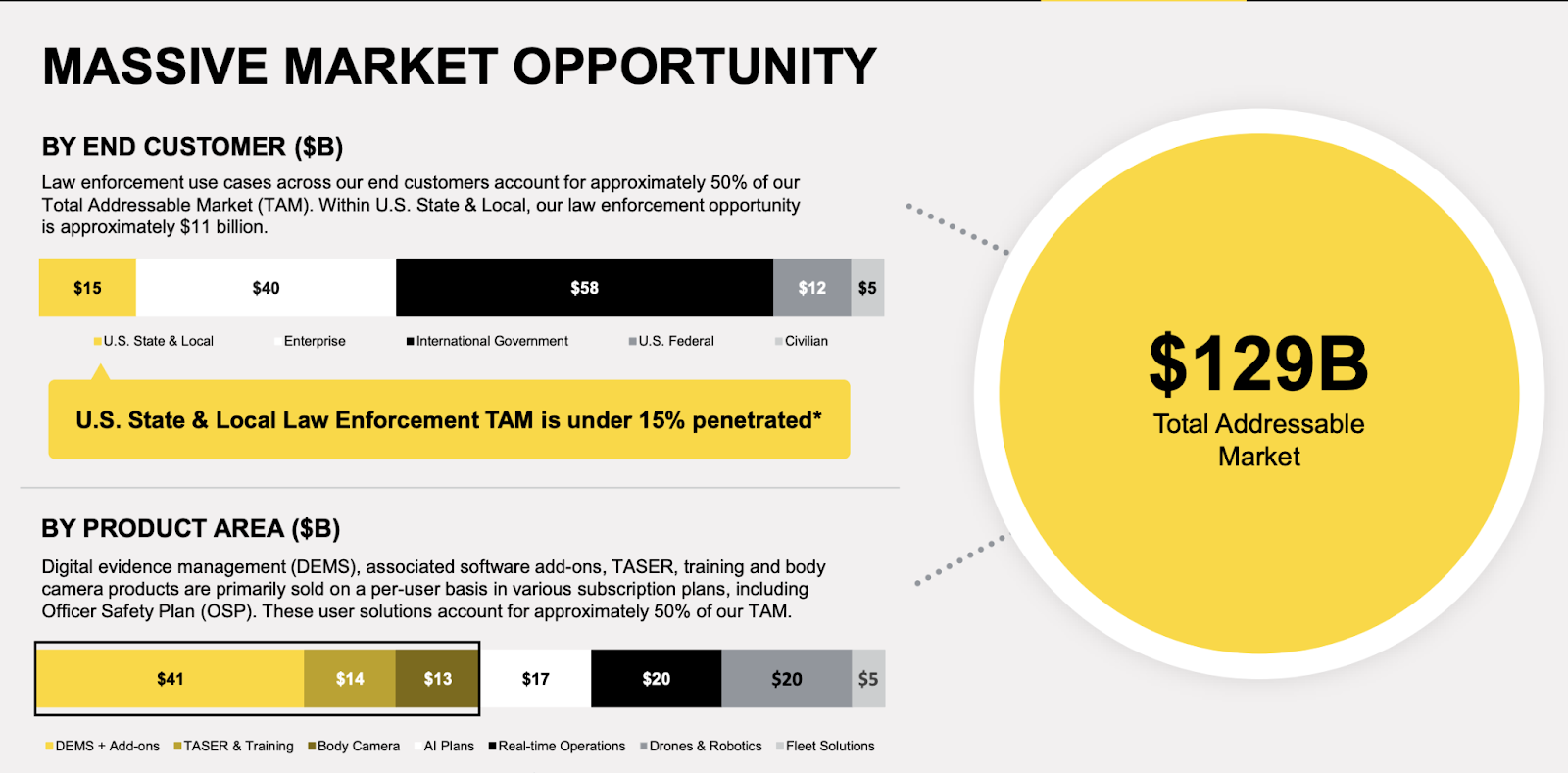

6. Market Potential

$129B Total Addressable Market, with Axon owning just 1.6%. That's untapped territory.

Only 15% U.S. penetration

Expansion into fire, corrections, and global markets

AI, cloud, and SaaS demand in law enforcement is accelerating

Our Take: The TAM is massive, and Axon is the only company with a closed-loop ecosystem. Think of it like the Apple of public safety—once you’re in, you don’t leave.

Source: Axon Enterprise Investor Relations Presentation 2024

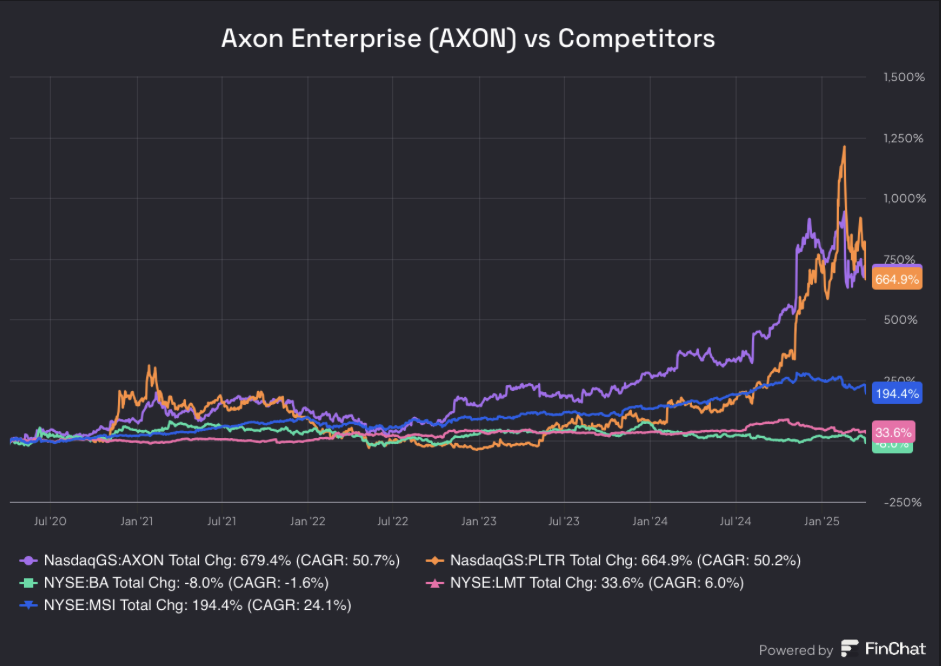

7. Performance vs. Competitors

Crushing Tech Peers

Axon consistently outperforms SaaS and defense-tech firms. With 20–30%+ annual growth and double-digit stock gains in 2024, it’s delivering on innovation and scale.

Our Take: You rarely see a company dominate in both hardware and software. That dual-threat edge is rare—and durable.

8. Risks & Hurdles

Valuation Pressures: At these multiples, any slip could spook the market.

Regulatory Scrutiny: Law enforcement tech is politically charged.

Reputation Risk: A single product misuse incident can erode trust.

Competitive Pressure: Motorola, Palantir, and Big Tech are circling.

Supply Chain Fragility: Physical products still mean logistics risk.

My Take: No company is bulletproof—especially one so intertwined with politics and public perception. But Axon’s customer integration and tech moat offer a buffer.

Final Word: A Quiet Giant in the Making

Axon Enterprise isn’t a flashy name in Silicon Valley—but it should be. With a founder-led team, strong recurring revenues, deep customer integration, and a mission that resonates globally, Axon’s upside is real.

It’s not cheap. But you’re not just buying a hardware firm—you’re backing a full-stack, AI-powered platform with a social mission and institutional support from BlackRock, Vanguard, and Fidelity. If you believe in tech that actually solves problems, Axon deserves a serious look.

For our in-depth analysis check out our substack: https://silvercrosscapital.substack.com/p/axon-enterprise-taser-empire-or-overhyped?r=4fs22e