Why Banks Should Be Nervous About This £12 Billion Disruptor

Wise plc: Your Passport to Borderless Money

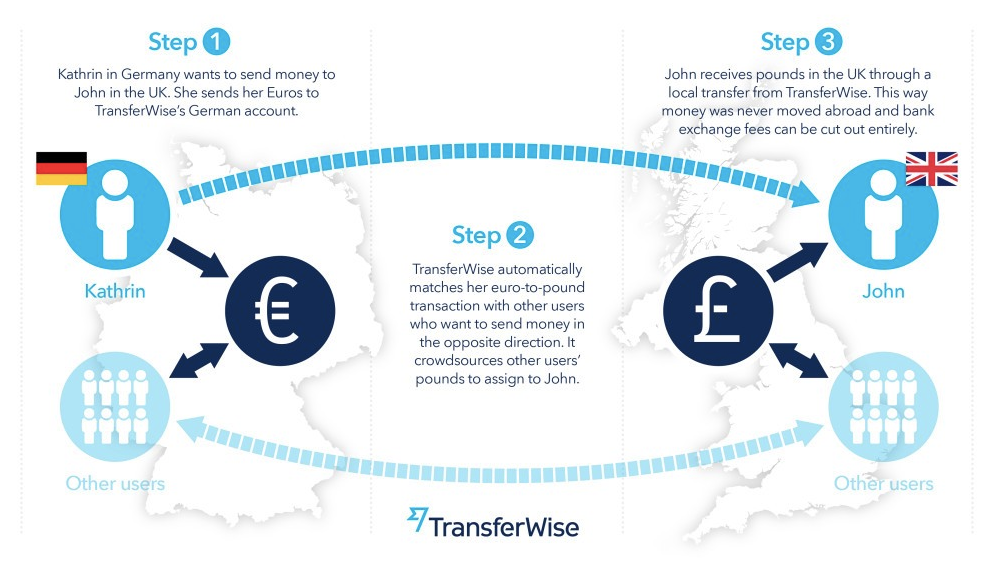

Wise plc (formerly TransferWise) began with a personal frustration: two Estonians in London, Kristo Käärmann and Taavet Hinrikus, couldn’t believe how much it cost—and how long it took—just to move their own money across borders. Their simple hack evolved into Wise, now a publicly listed powerhouse with a £12.3B market cap. It’s on a mission to make money transfers fast, cheap, and transparent.

1. How Does Wise Make Money?

Cross-Border Transfers (77.5% revenue): This is the heart of Wise. With fees around 0.87% to 1.14%, they’re up to 10x cheaper than banks.

Financial Tools (22.5% revenue): Debit cards, multi-currency accounts, and business-focused services. Think everyday banking, but globally.

My Take: I’ve recommended Wise to friends abroad—watching them realize how much they’ve saved in fees is priceless. This underscores why Wise’s user base keeps growing by word-of-mouth.

2. Management

Founder-Leader:

CEO Kristo Käärmann experienced the pain of slow, pricey bank transfers firsthand. This personal mission continues to drive innovation.

High Insider Ownership:

Käärmann holds about 18.3% of Wise (worth ~£1.68B), and hasn’t sold shares since the 2021 IPO—indicating deep belief in the company.

Vision & Alignment

The aim is borderless, low-cost money transfers; management’s stake aligns them closely with shareholder interests.

Source: Wise

My Take: Founder passion isn’t just branding—it’s ingrained in the way Wise operates. Seeing leaders who personally share the frustrations they’re fixing adds conviction to their long-term strategy.

3. Capital Allocation & Efficiency

High Returns on Capital: Averages a 30.1% ROCE and 23.5% ROE.

Capital-Light Model: Wise invests mostly in tech infrastructure rather than heavy physical assets, keeping CapEx modest.

Room to Improve: ROA (1.4%) and ROIC (1.7%) suggest there’s still upside as Wise scales and finds more ways to use its cash efficiently.

My Take: I’m impressed by their focus on growth without chasing fancy acquisitions. They’re strategically reinvesting, yet they’ve avoided debt-heavy expansion.

4. Valuation & Margin of Safety

Undervalued via DCF: Some estimates show a 40% margin of safety, assuming ~15% growth.

Historic Lows: Wise is at its cheapest valuation since listing, which could be a window for investors who like to buy on dips.

My Take: If you’re like me—looking for solid companies at a fair price—Wise’s combination of growth potential and dropping multiples is tempting.

5. The Balance Sheet: A Fortress

Debt is a Non-Issue: Operating Cash Flow to Total Debt stands at 14.5%, and interest coverage is 24x. Essentially, they can pay off debt multiple times over.

Peace of Mind: In a world where higher rates can cripple over-leveraged firms, Wise’s strong balance sheet is a breath of fresh air.

My Take: Nothing kills excitement faster than surprise debt problems. With Wise, I can sleep easily.

6. Market Potential

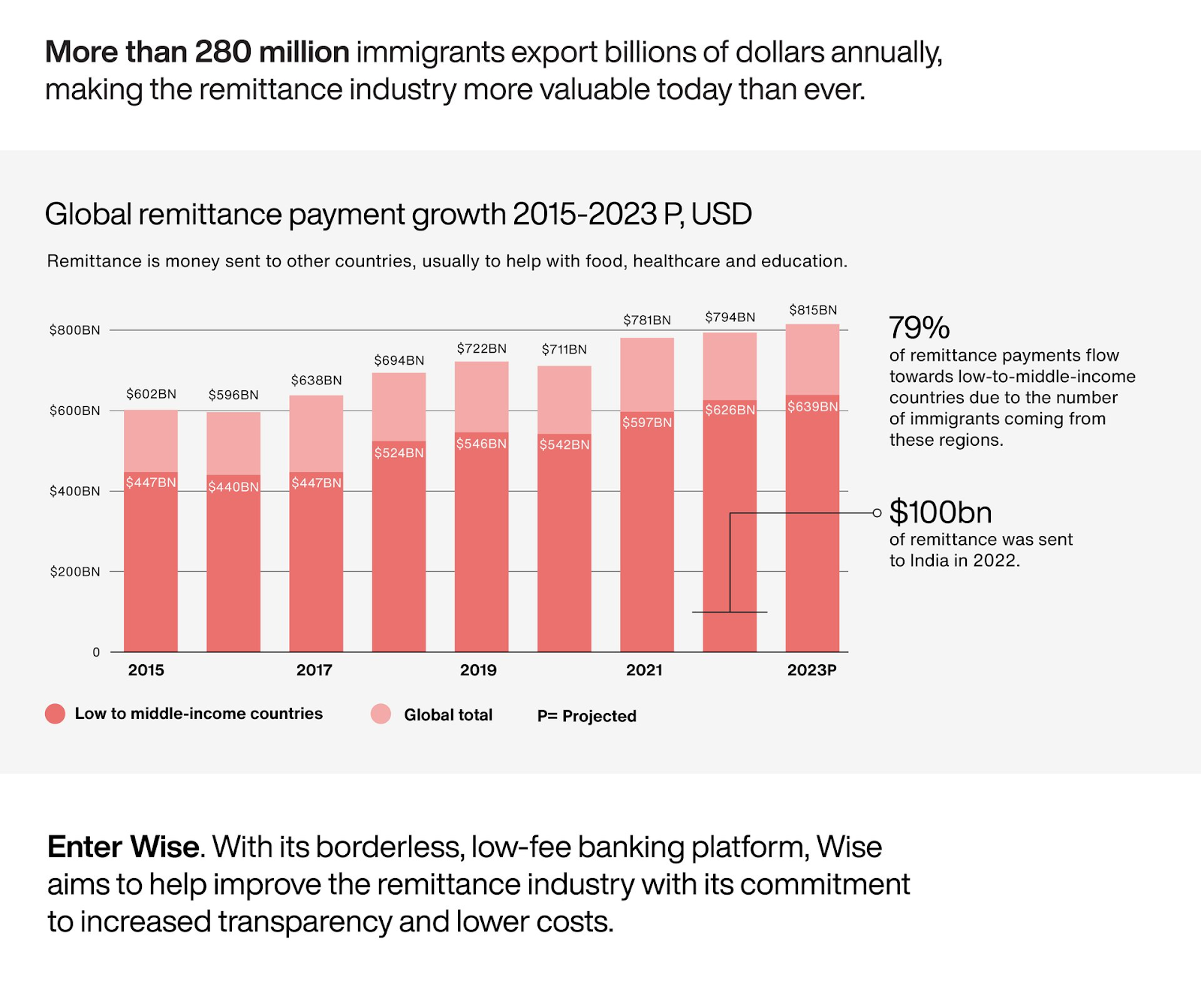

Enormous Market: The cross-border payments sector is worth ~£27 trillion. Wise captures only 5% of the retail market and <1% of SMB.

Global Remittances: Over 280 million immigrants send money home, a $815B market—and growing.

B2B Boom: Partnerships like Morgan Stanley plus expansions in Japan, Brazil, and possibly the US FedNow system could unlock massive volumes.

Source: Knomad, IMF, WEF, Wise, Bailliegifford

My Take: Having relatives abroad, I see firsthand how remittances add up. Wise’s friendly interface wins people over, so they’re well-positioned to tap into these trillions of global flows.

7. Performance vs. Competitors

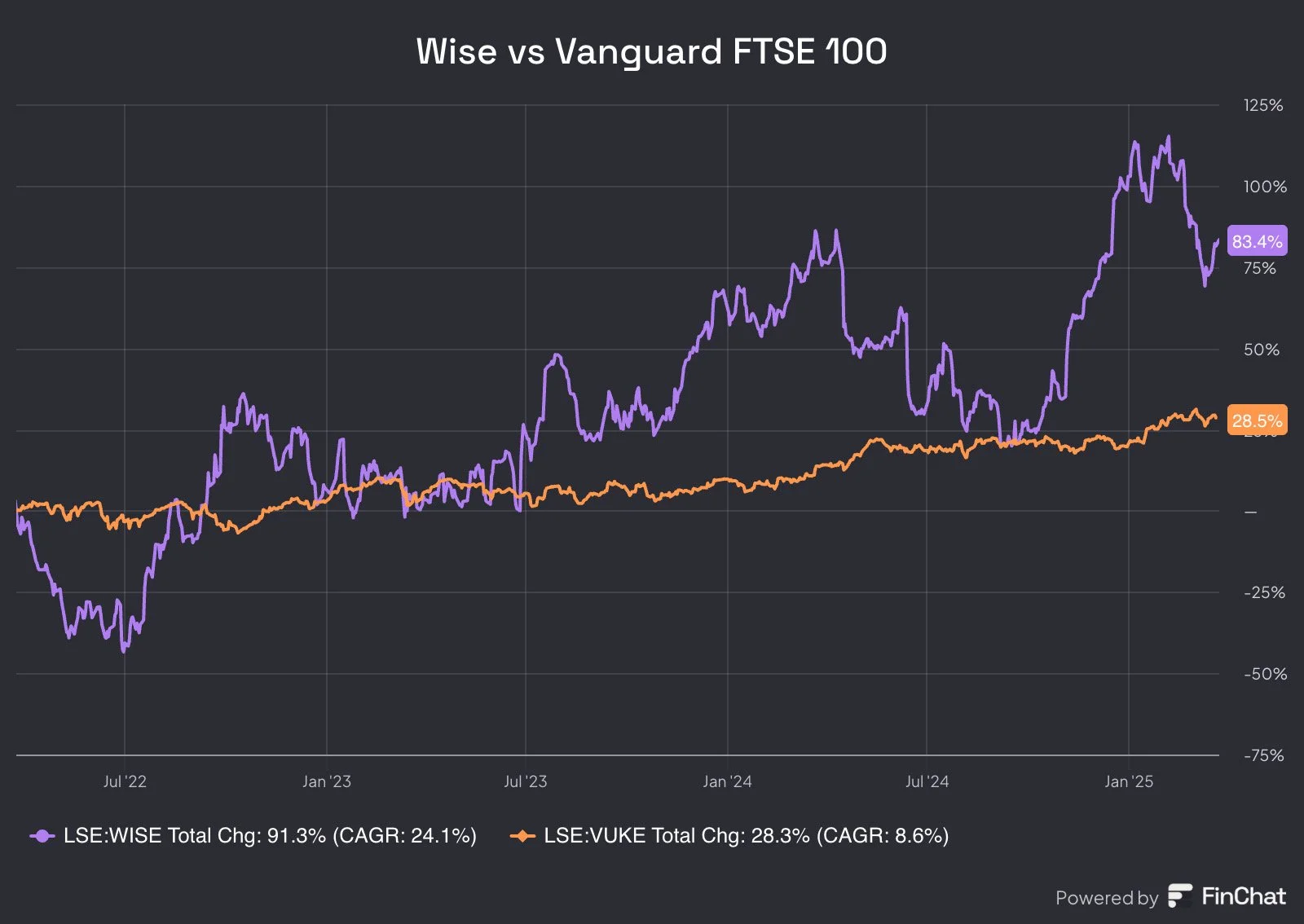

Crushing the FTSE 100: Wise delivered 91.3% total return (24.1% CAGR) in three years, trouncing the FTSE 100’s 28.3%.

Stable vs. Volatile: Compared to some fintechs or remittance players, Wise trades more steadily—an appealing trait in an ever-shifting tech market.

My Take: This steadiness reflects the trust people place in Wise. While not immune to market dips, its resilience suggests a lasting competitive edge.

8. Risks & Hurdles

Regulation & Compliance: Wise manages 65+ global licenses—a monumental task if rules tighten.

Cybersecurity: Handling billions in cross-border flows makes them a prime cyber target.

Competition & Pricing Pressure: Large banks won’t give up high FX fees without a fight. Wise’s goal to drive fees lower could compress margins if not balanced carefully.

Geopolitical & AI Concerns: Sanctions, fraud, or new AI-driven scams could disrupt operations.

My Take: Even the best fintech isn’t bulletproof. I keep an eye on regulatory shifts. However, Wise’s transparency-first reputation might buffer them from some of these challenges.

Final Word: A Mission-Driven Fintech with Room to Run

Wise aims to dismantle the painful barriers of traditional banking—something I’ve personally found compelling. The combination of strong capital allocation, rock-solid financials, and a vast untapped market gives Wise serious momentum. Yes, competition is fierce, and regulatory hurdles are real, but Wise’s track record and high insider ownership (CEO Kristo Käärmann owns ~18.3%) show deep commitment.

If you value lean, growth-oriented companies that solve real-world pains, Wise deserves a spot on your watchlist—or even your portfolio. It’s already exceeded expectations, and the journey has only just begun.

Our in depth-analyis can be found here: https://silvercrosscapital.substack.com/p/why-banks-should-be-nervous-about?r=4fs22e