Should You Buy MercadoLibre? The Amazon-Plus of Latin America

Michael Burry—yes, that Michael Burry of The Big Short fame—just disclosed a 14% stake in MercadoLibre. That’s not noise. It's a signal.

Why? Because MercadoLibre (MELI) is not just the “Amazon of Latin America.” It’s Amazon + PayPal + UPS + Stripe built for chaos.

Where others see fragmentation, volatility, and regulatory mess, MELI sees moat.

Let’s break down why this matters.

How They Make Money

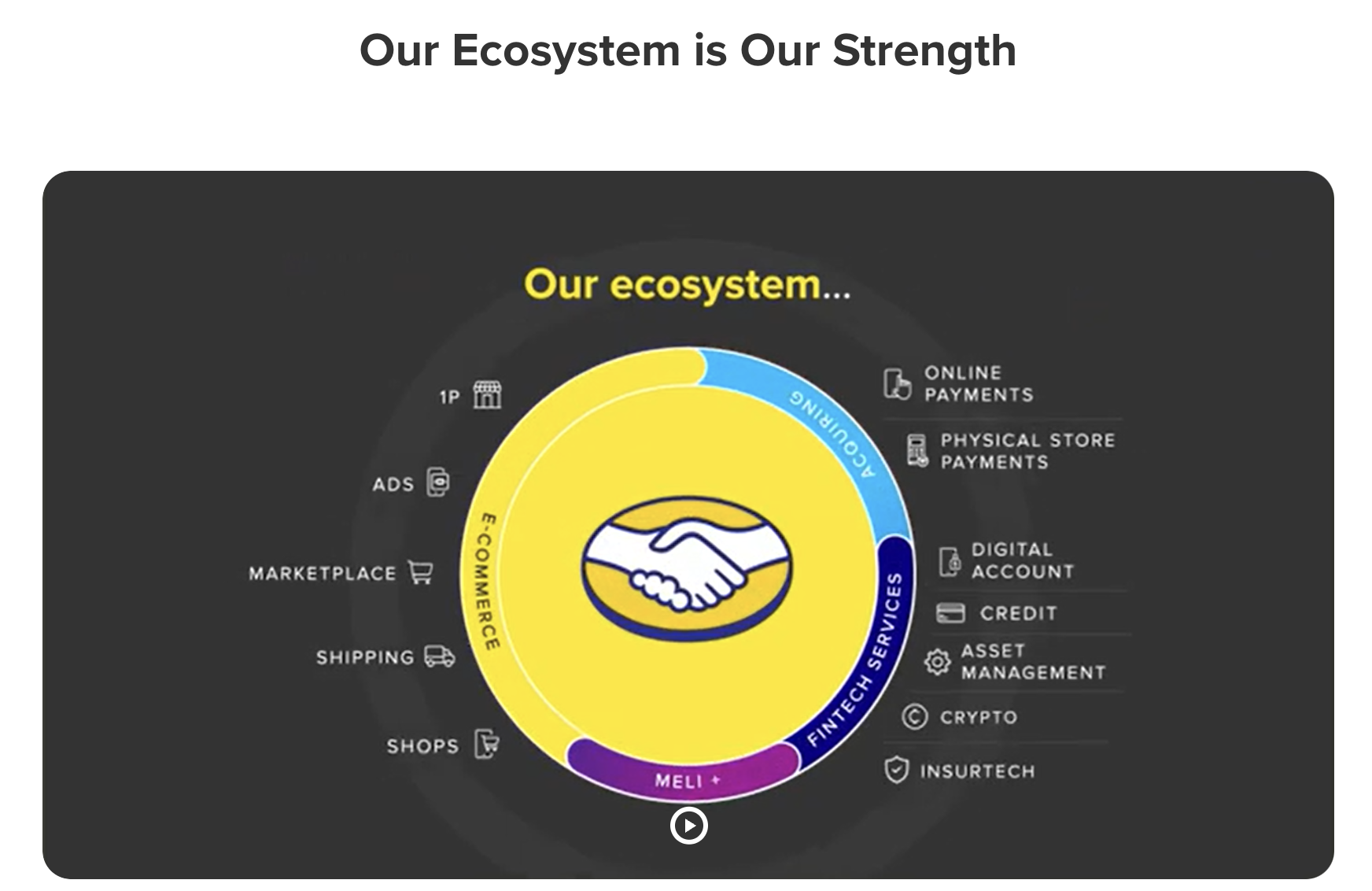

MercadoLibre runs a full-stack commerce and fintech ecosystem across 18 countries:

Marketplace: Amazon-style third-party platform with selective first-party sales.

Payments (MercadoPago): Wallets, credit cards, POS tools, QR-payments.

Logistics (MercadoEnvíos): 95% of deliveries handled in-house, 80% in under 48 hours.

Credit (MercadoCrédito): Micro-loans to buyers and sellers.

Advertising (MercadoAds): Retail media network.

Shops: Shopify-style storefronts.

Each piece reinforces the next. More buyers → more sellers → more payments → more data → more loans → more ads. The flywheel spins.

Management & Skin in the Game

Founder Marcos Galperin still owns 7.5% (~$9B) of MELI. That’s rare conviction in emerging markets.

He’ll shift to Executive Chairman in 2026, keeping strategy and culture intact while Ariel Szarfsztejn (a long-time insider) takes over as CEO. Continuity is baked in.

Culture? Long-term, meritocratic, obsessed with execution.

CEO Transition: Marcos Galperin and Ariel Szarfsztejn

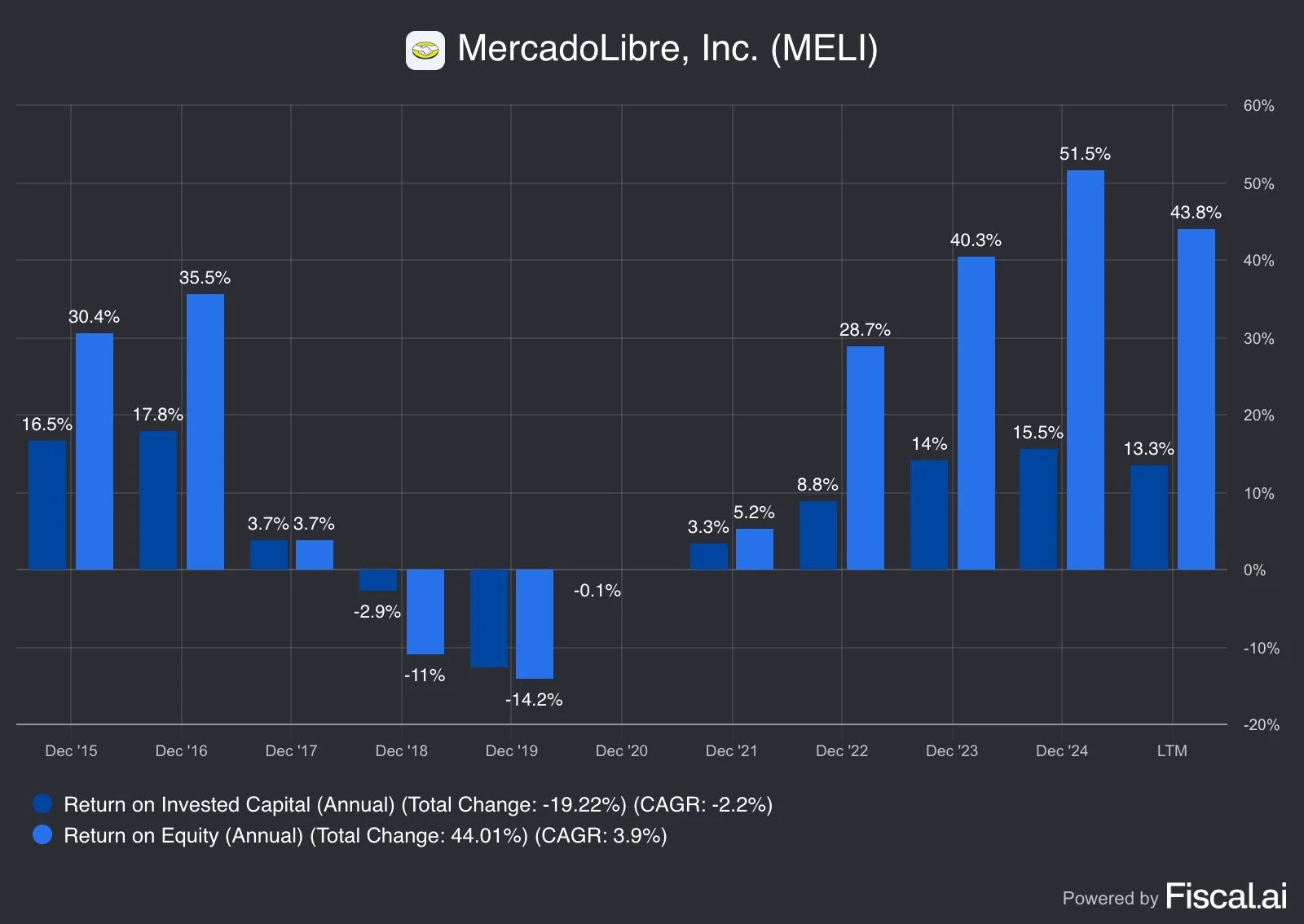

Capital Allocation

MELI is a rare tech giant with ruthless efficiency:

Return on Invested Capital: 13.3%.

Return on Equity: 44%.

R&D doubled in five years, now >$1B, fueling logistics and fintech dominance.

This isn’t a capital hog. It’s a cash engine reinvesting where it matters.

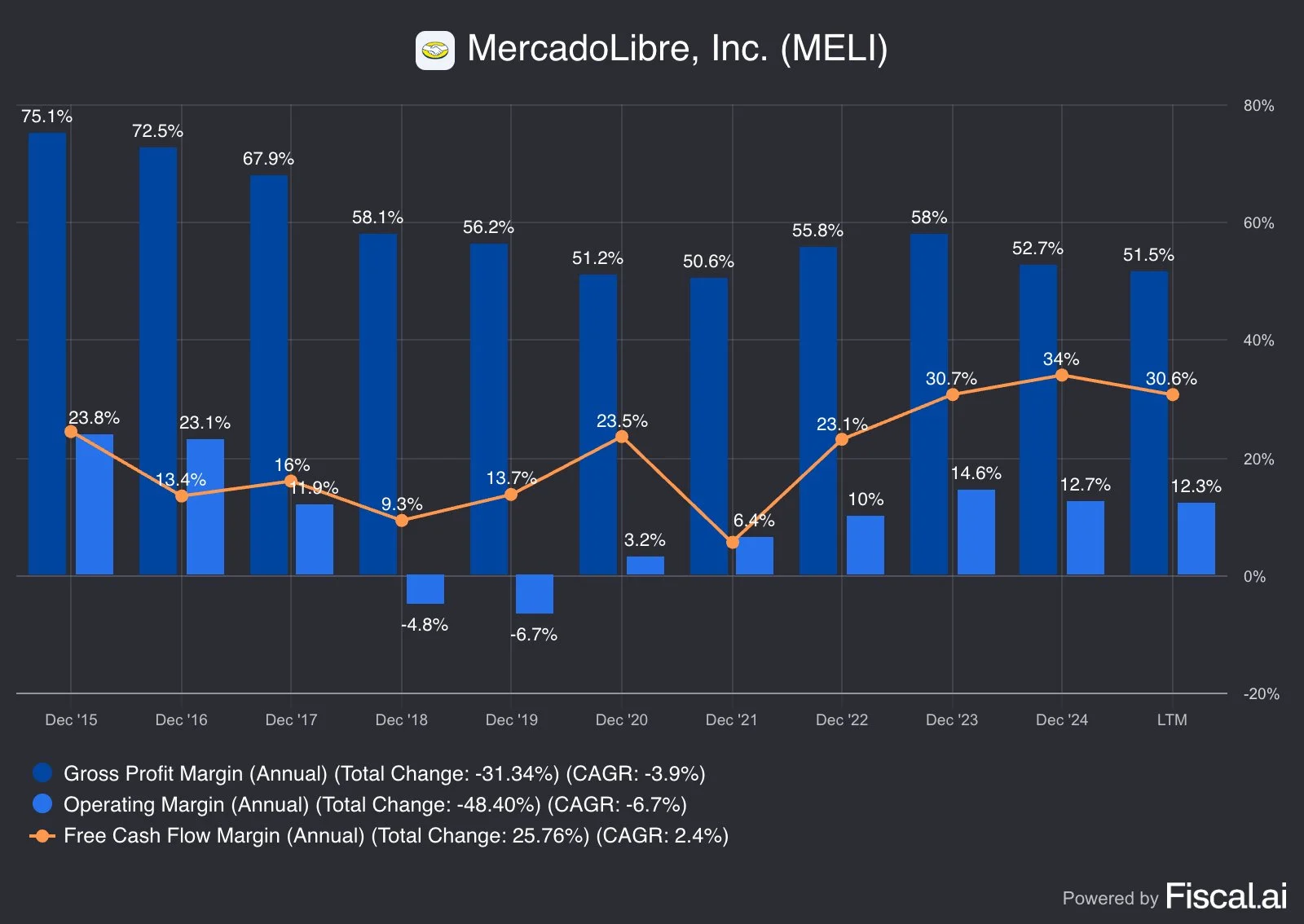

Profitability

Margins show why investors care:

Gross margin: 52%

Operating margin: 13%

Free cash flow margin: 29%

For every $1 of profit, MELI generates $3 of cash. That’s great.

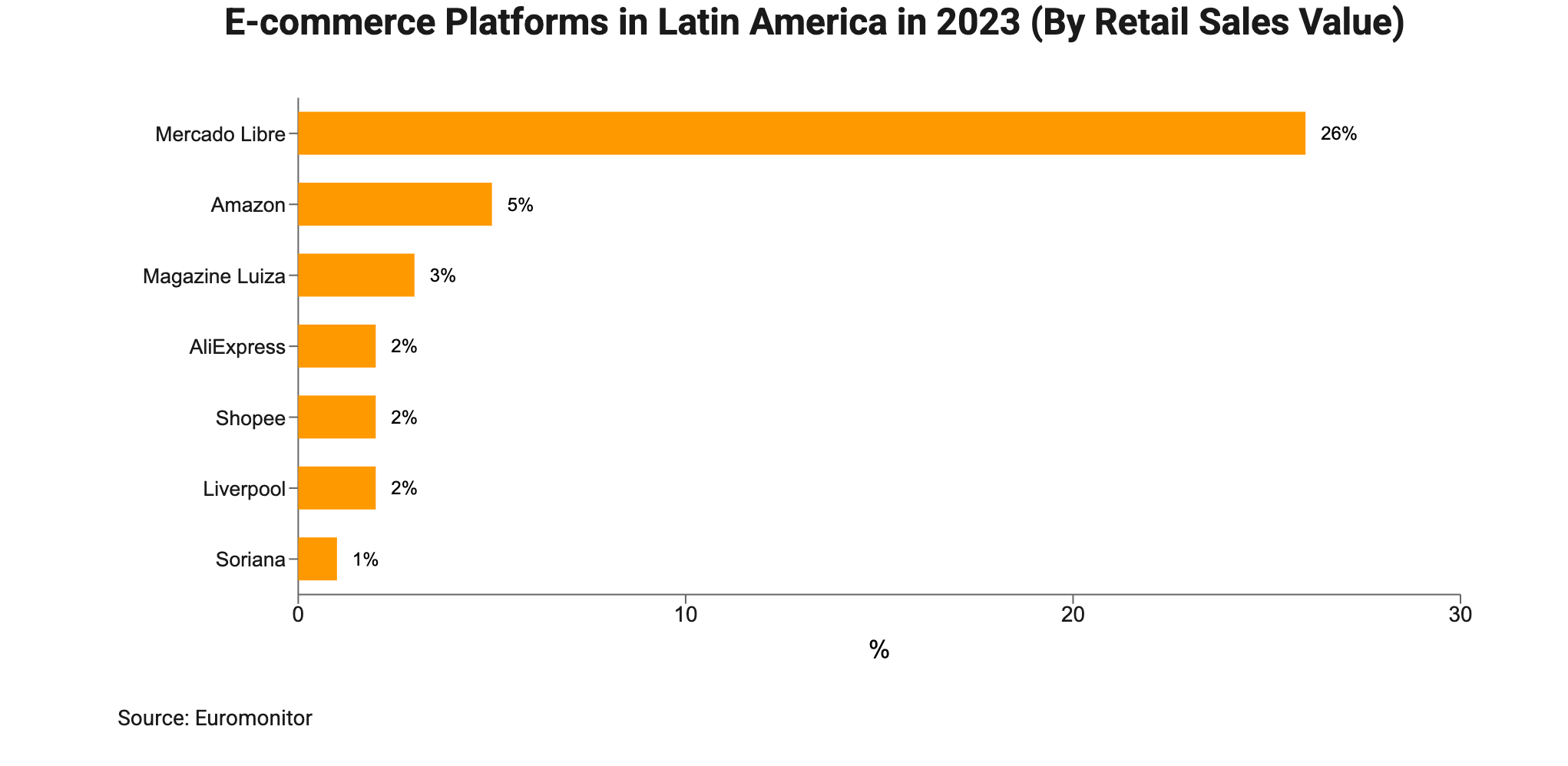

Competitive Advantage

MELI was built for Latin America’s mess:

Logistics moat: 80% of shipments within 48 hours in a region notorious for broken infrastructure.

Payments moat: $200B+ processed in 2024, #1 in Mexico, Chile, Argentina.

Network effects: more users → more data → more loyalty.

Switching costs: embedded payments, loyalty points, integrated delivery.

Foreign rivals? Amazon, Shopee, AliExpress. Local challengers? Magalu, Nubank. But none stitch it all together like MELI.

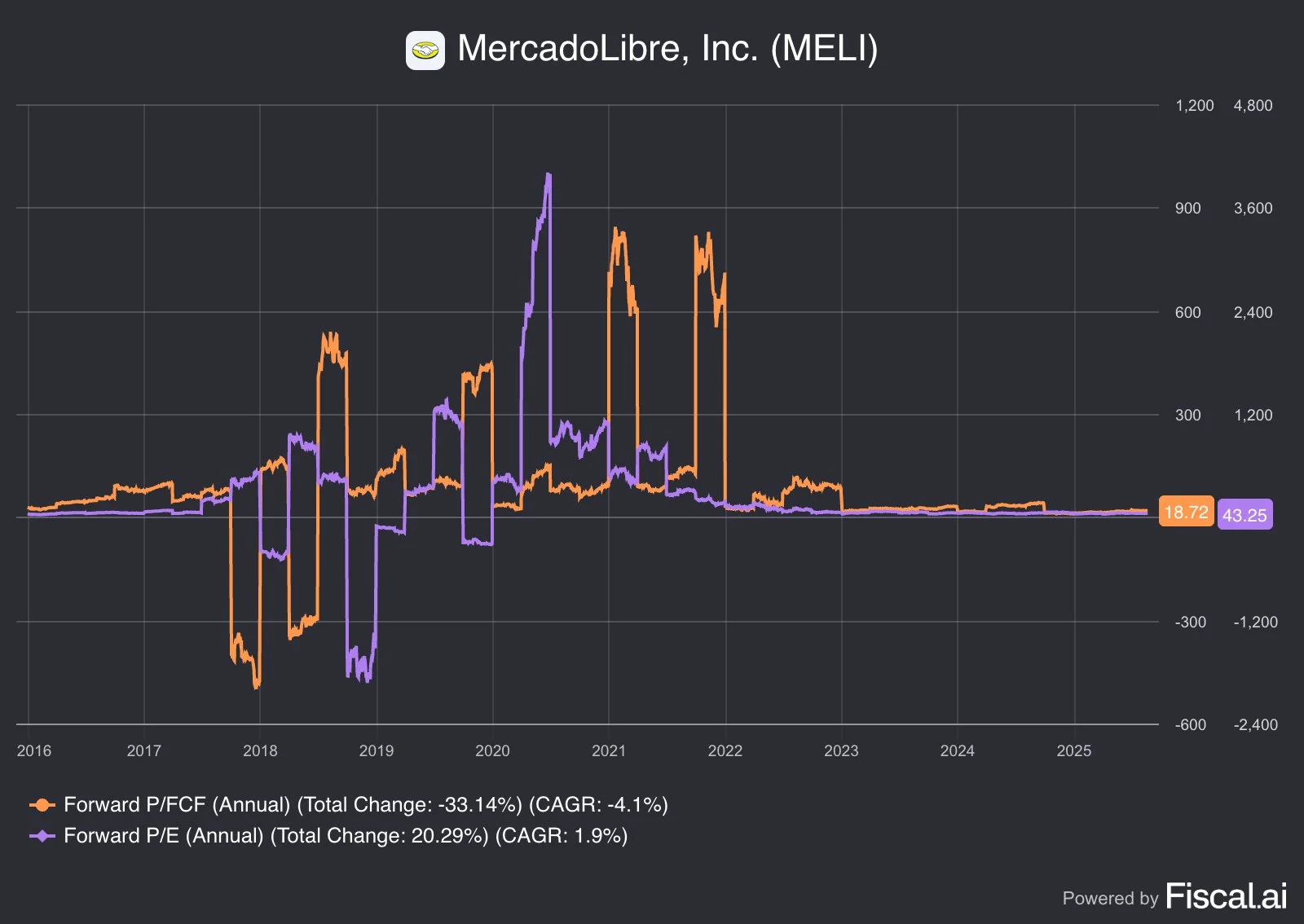

Valuation

After euphoric highs, MELI’s multiple has cooled:

19x FCF

43x forward earnings

DCF implies 45% upside

With a six-year revenue CAGR of 47%, this is growth at a reasonable price.

Balance Sheet

Cash: $8.07B

Debt: $7.76B (net debt: minimal)

Debt-to-equity: 1.6x (higher than Buffett likes, but manageable)

Interest coverage: 21x

Not pristine, but solid enough for a fast grower.

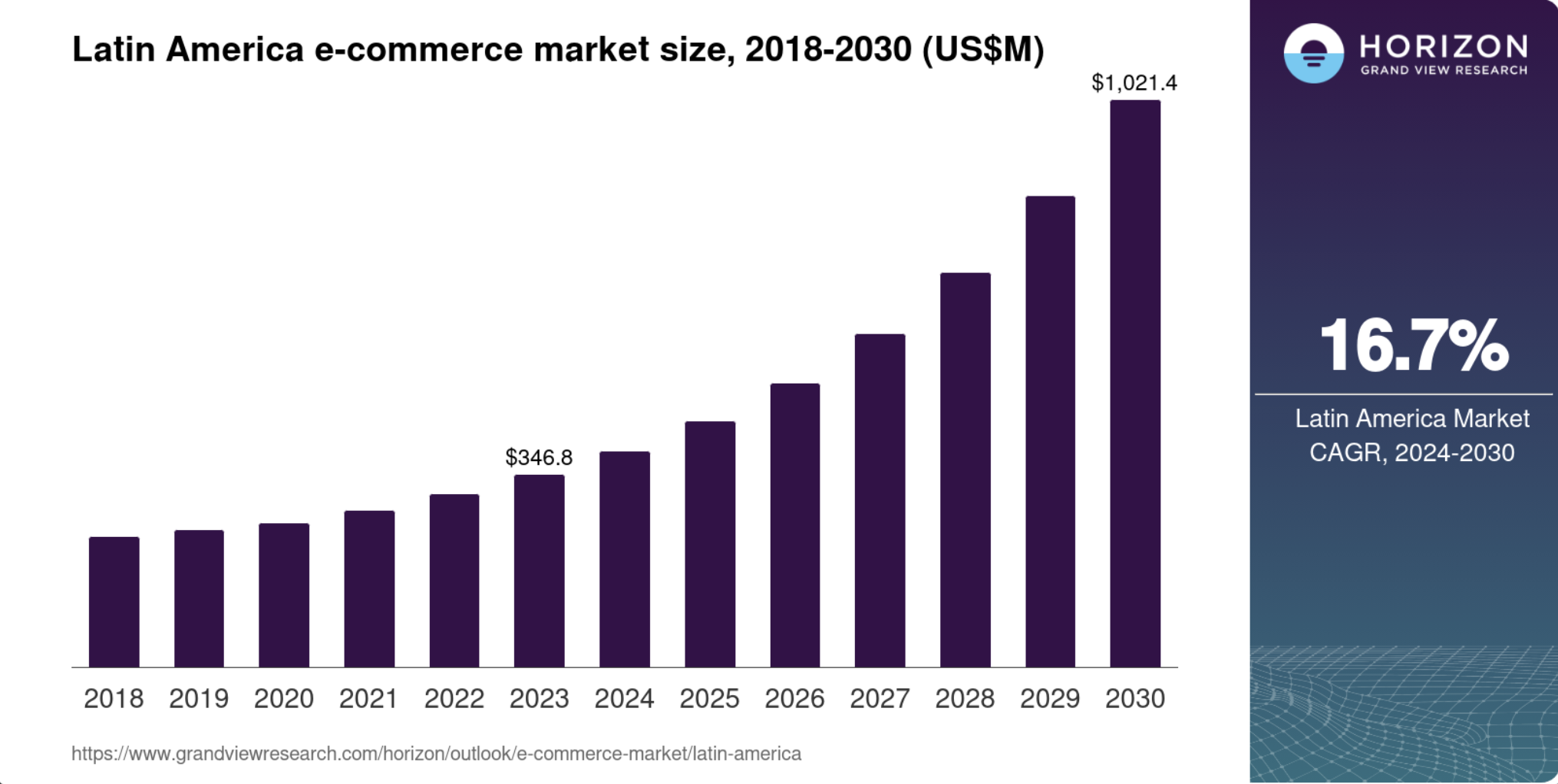

Market Potential

LATAM e-commerce penetration: ~11% vs. 20–30% in U.S./China

E-commerce in LATAM: $509B (2023) → $923B (2026)

Digital payments: expected to triple to ~$300B by 2027

Smartphone penetration + nearshoring tailwinds

The runway is enormous. MELI is the vehicle.

Stock Performance

IPO: $18 (2007) → $2,335+ today.

Total return: 3,158%.

Since IPO: CAGR of 31%.

$10,000 at IPO = ~$334,601 today.

Risks

High leverage relative to peers.

Credit risk as lending expands.

Constant currency volatility.

Regulatory unpredictability across 18 countries.

Global competition.

MELI thrives in volatility, but it’s not immune.

Conclusion

MercadoLibre is not simply a Latin copy of Amazon. It’s a regional monopoly in e-commerce + fintech + logistics, founder-led, cash generative, and still compounding.

Valuation has reset. Market potential is massive. Execution is proven.

The question isn’t whether MELI can grow. It’s whether investors can stomach the volatility long enough to ride it.

Michael Burry clearly thinks so. Do you?

SCC Rating: 82% | Undervalued

Take Your Investments to the Next Level! We at silvercrosscapital.com provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Most stocks don’t matter. Ours do. At Silver Cross Capital, we uncover the 2% of companies driving global wealth creation. Join us, and take your portfolio beyond the ordinary

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.