Should You Buy Arista Networks?

In a world obsessed with AI models, few are paying enough attention to the pipes that make it all possible.

Arista Network is the cloud's backbone—powering AI, hyperscalers, and the future of networking.

Investment Thesis

Arista dominates high-speed Ethernet switching, enabling the data flow required by AI workloads, cloud computing, and modern enterprises.

#1 in 100G, 200G, and 400G Ethernet ports.

Trusted by Microsoft, Meta, and NVIDIA.

Founder-led, capital-light, high-margin, zero debt, and net cash of $8.3B.

Arista’s best-of-breed capabilities in Ethernet switching are firing on all cylinders as it continues to take market share. 2025 guidance beat our already-bullish estimates.

Artificial intelligence and cloud spending are driving immense growth in 2025, which we expect to continue into the long term. AI workloads, cloud expansion, and enterprise networking demand are all pushing growth forward, with management forecasting 20–25% revenue growth ahead.

How Do Arista Networks Make Money

Arista Networks? A company that slings high-speed cloud networking gear to the world’s largest data centers. (Think Amazon, Microsoft, AI labs—you name it.)

With the rise of AI workloads, data movement is the new bottleneck—and Arista is solving it.

Core Networking (65% of revenue): Data center, cloud, and AI networking hardware.

Cognitive Adjacencies (18%): Routing, campus networking.

Software & Services (17%): EOS® operating system, CloudVision automation, security, and support.

Recurring service/software revenue is rising—boosting margins and stability.

Management & Skin in the Game

CEO Jayshree Ullal (ex-Cisco) owns 2.6%.

Co-founder Andy Bechtolsheim owns 14.6%.

Total insider ownership: 17.5% worth $17.6 billion—rare for a tech giant.

These aren’t hired guns—they’ve built and run the business with discipline for over a decade.

Capital Allocation

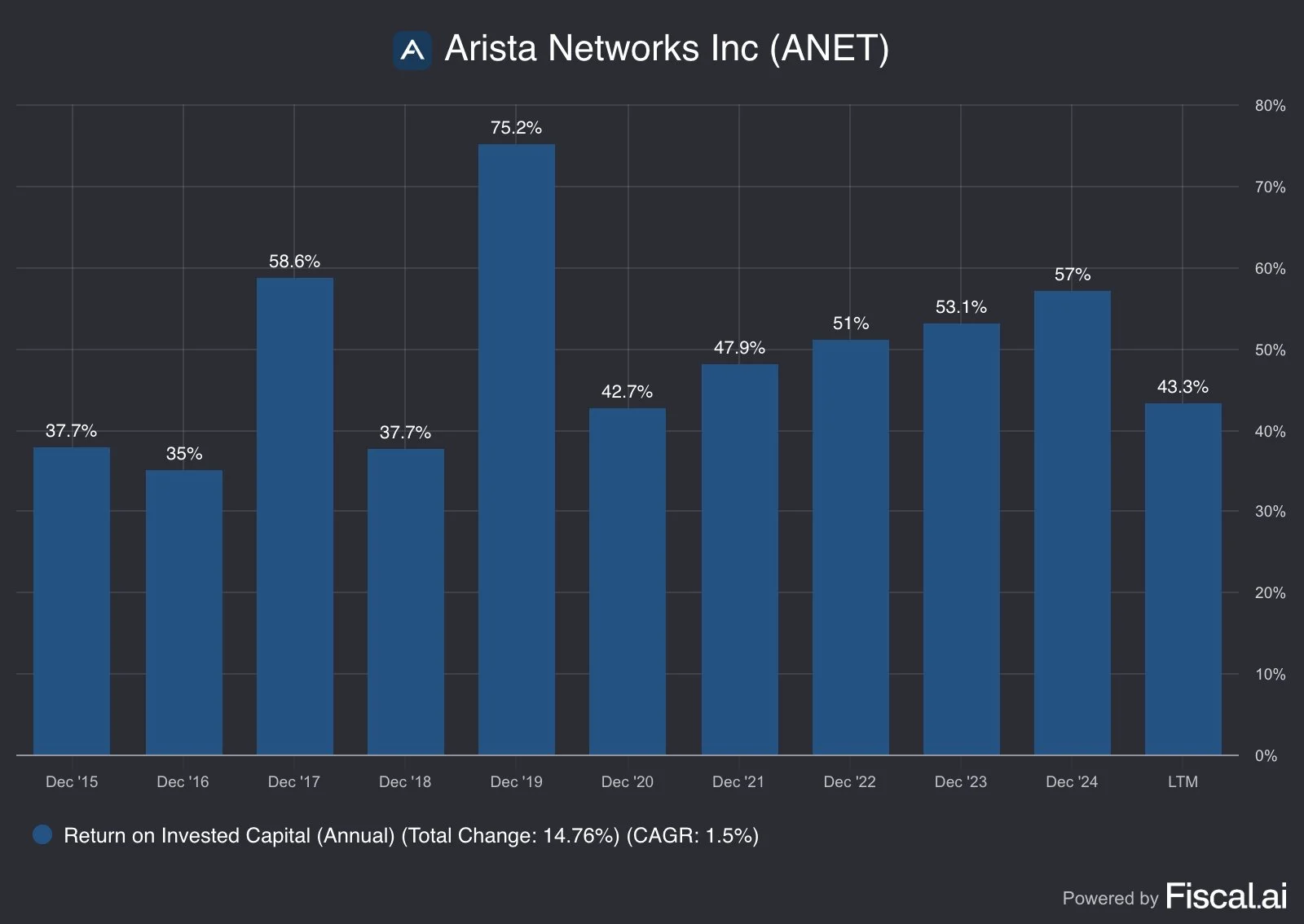

ROIC: 51% averaged in the last five years.

Minimal capex, heavy reinvestment into R&D and strategic acquisitions.

$1.2B share buyback program (through 2027).

This is how you turn cash into compounding returns.

Profitability

Gross margin: 64.2%

Operating margin: 43%

Net margin: 40.9%

Free cash flow margin: 50%, with 122% FCF conversion.

High-quality earnings with very little capital needed to grow.

Competitive Advantage

Technology Leadership: EOS + CloudVision unify software/hardware for easy upgrades and automation.

Customer Loyalty: NPS of 87, 93% satisfaction.

Cloud Titan Partnerships: Deep integration with Microsoft & Meta.

AI-Ready: Purpose-built networking for GPU clusters and AI workloads.

Cisco may be bigger, but Arista is faster, more flexible, and more innovative.

Valuation

54× earnings, 43× free cash flow.

Market pricing in 20% growth; history shows 34% CAGR.

Not cheap on paper—but cheap if history repeats.

Balance Sheet Strength

Net cash: $8.3B, zero debt.

Interest coverage: 261×.

Low goodwill (1.9%)—no overpaying for acquisitions.

Fortress finances = resilience + firepower for opportunistic moves.

Market Potential

Targeting a $70B TAM in networking.

Cloud market growing at 21% CAGR through 2030.

AI workloads exploding—data movement is now the bottleneck.

If AI is the brain, Arista builds the nervous system.

Performance vs. Peers

Arista Networks (ANET) – Clear Outperformer

Total Change: +2,563.67%

CAGR: 38.9%

Price has surged from the low single digits to around $136.48.

Strong, accelerating growth since late 2022—coinciding with AI infrastructure demand boom.

Significantly outpaced both peers, turning early investors into multi-baggers.

Risks

Customer Concentration: Microsoft & Meta = 35%+ of revenue.

Supply Chain: Heavy reliance on Broadcom chips, some manufacturing in China.

Competition: Cisco, Juniper, Huawei, and InfiniBand in AI networking.

Valuation Sensitivity: High multiple could compress if growth slows.

Conclusion

Arista isn’t riding just the AI hype—it’s powering it. With dominant tech, excellent margins, aligned leadership, and a fortress balance sheet, it’s a rare blend of growth and quality.

Yes, there’s customer concentration risk. Yes, the multiple is high. But if Arista continues its track record of 20–25% growth, today’s price may look like a bargain in hindsight.

For long-term investors, this is a “buy the business, hold the compounder, let the market catch up” story.

SCC Rating: 83% | Undervalued

Take Your Investments to the Next Level! We at silvercrosscapital.com provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.