Palantir Technologies Inc: Palantir Is Winning the AI War—But Should You Still Buy the Stock?

Alright. Let’s talk about Palantir—but not the way Wall Street usually does. This isn’t another “growth tech stock with strong tailwinds and margin expansion.” Nope. This is a rebel software firm with a philosopher-CEO and a cult-like culture, selling AI and data operating systems to militaries and multinationals.

It’s a profitable, high-growth platform company at the center of the AI-industrial revolution. With accelerating revenue, expanding margins, and an unmatched product stack, the case for Palantir as a generational software company is building fast. But at what cost, right?

Palantir Is Building the AI Backbone of Industry

This isn't some glammed-up SaaS startup chasing flashy TAM slides. Palantir is building the AI infrastructure layer of Western civilization or at least, that’s how Alex Karp sees it (and sells it).

Its platforms (Foundry, Gotham, and the newer AIP) are fast becoming mission-critical across defense, healthcare, manufacturing, finance, and fast food. Yes, Wendy’s is in the mix.

And the numbers? They’re starting to match their ambition. In Q2 2025, revenue grew 48% year-over-year to over $1B, while U.S. commercial revenue nearly doubled.

This is software that runs everything from AI-powered NATO operations to supply chains in burger joints. Think chips + ontology + Foundry = power. Palantir might just be the operating system for AI in the real world.

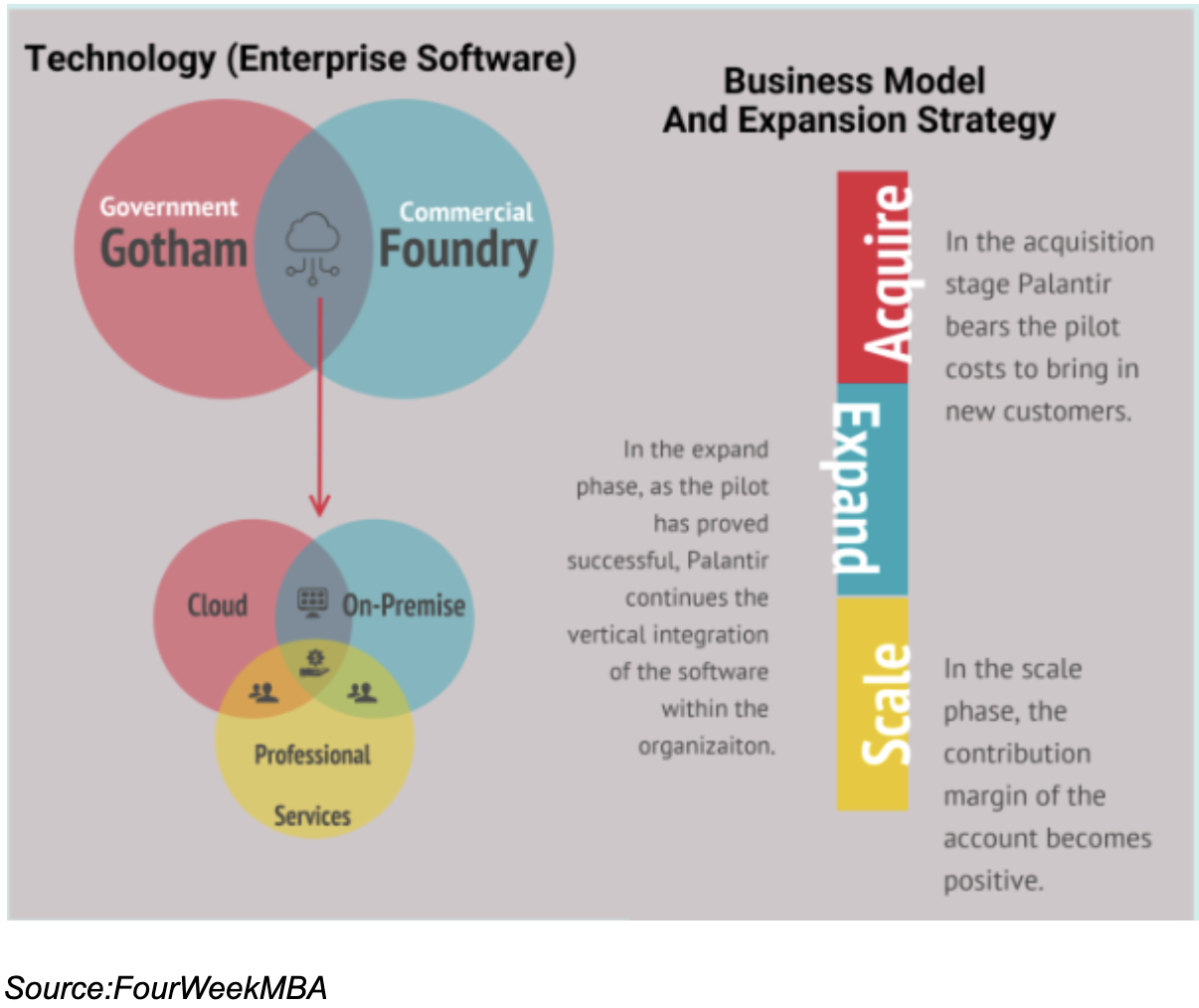

How They Make Money:

It’s all about mission-driven enterprise software—high-stakes, high-retention, often bespoke deployments.

Gotham: Defense and intelligence agencies.

Foundry: Commercial customers—logistics, pharma, energy, finance.

AIP (Artificial Intelligence Platform): The future. Built for AI agents, automated decision-making, and real-time execution. Now scaling rapidly.

Revenue is increasingly subscription-based, layered with professional services. Their remaining deal value in U.S. commercials grew 93% YoY, +14% QoQ. That’s not a fluke, it's stickiness.

Management & Culture:

Alex Karp is not your average Valley bro. He’s part Habermas, part Sun Tzu, part CEO. He meditates, skis, rants about Western values, and has a penchant for quoting C.S. Lewis in earnings calls.

CEO Alex Karp, co-founder alongside Peter Thiel, leads with intellectual intensity and absolute strategic conviction. With a PhD in social theory, Karp mixes philosophical depth with battlefield pragmatism. He’s not just selling AI; he’s shaping how institutions use it.

But here’s the kicker: he’s not bluffing. Karp owns a 2.4% of stock worth around five billion dollars and Peter Thiel also owns 4.3% worth around 9 billion dollars, leads with conviction, and cultivates a company culture that’s more artist colony than corporate suite.

Palantir hires Forward Deployed Engineers, not sales reps. They bet on grit, friction, loyalty—and they’re not shy about their love for Western military-industrial cooperation.

Karp credits the rise to Palantir’s unapologetic, high-friction, high-conviction culture—what he dubs “an artist colony for engineers.”

He positions Palantir not as just a software firm, but the AI operating system for the real world.

Palantir Technologies (PLTR) has entered a new phase—and the numbers speak louder than any hype. From its earlier sluggish period, the stock has exploded +1712.1% from its lows, compounding at a staggering 81.7% CAGR. That’s not just impressive—it’s rare.

Capital Allocation:

$18M share repurchase in Q1 2025, with $917M still authorized.

Heavy internal investment in AIP and R&D (over $134M last quarter).

Minimal M&A activity—this is not a roll-up story.

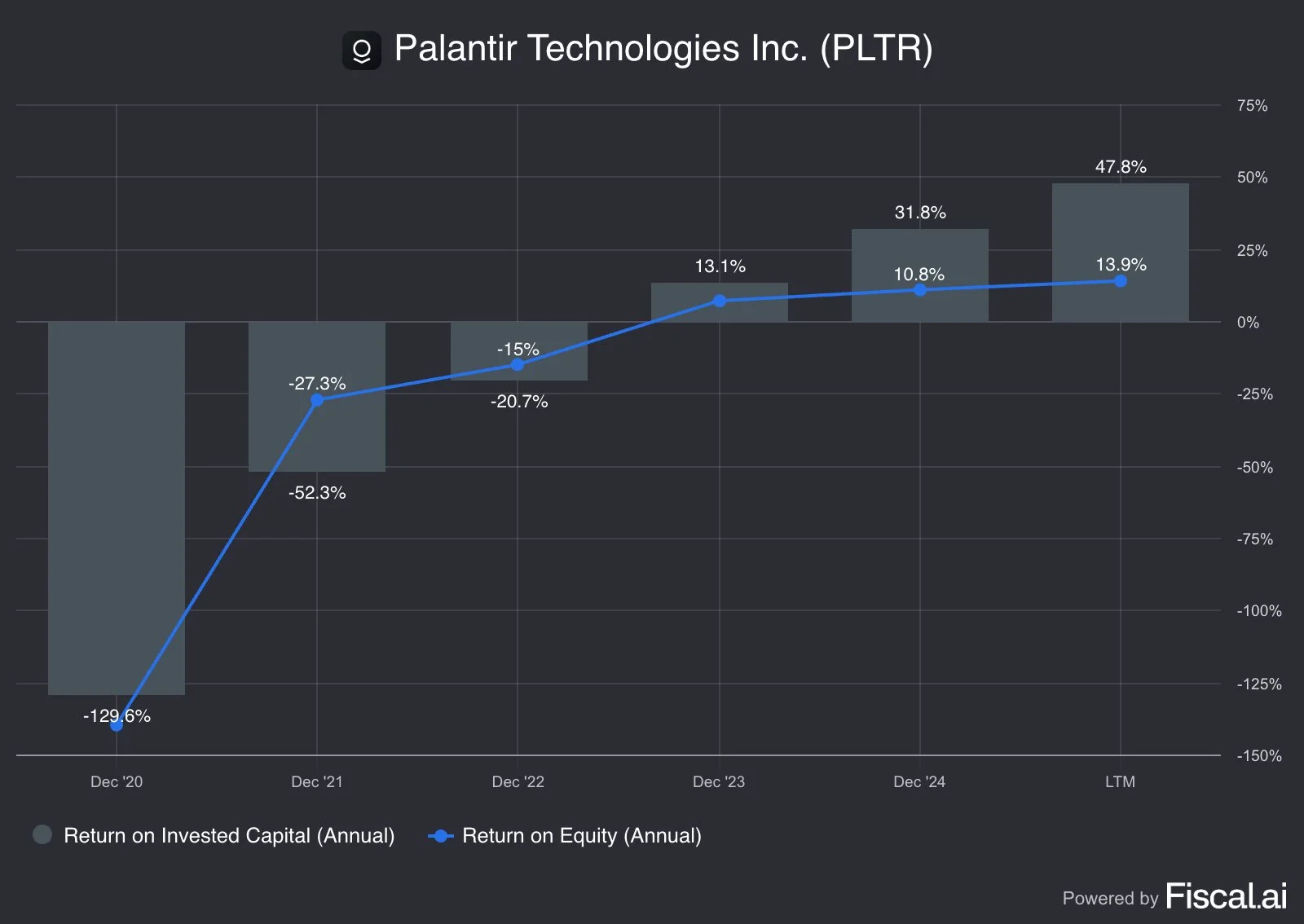

The Turnaround on Capital Allocation Is Real

Just look at the numbers:

ROIC flipped from -129.6% in 2020 to 47.8% LTM

ROE rose steadily, now at 13.9%

This isn’t window dressing. It’s sustained operational leverage kicking in.

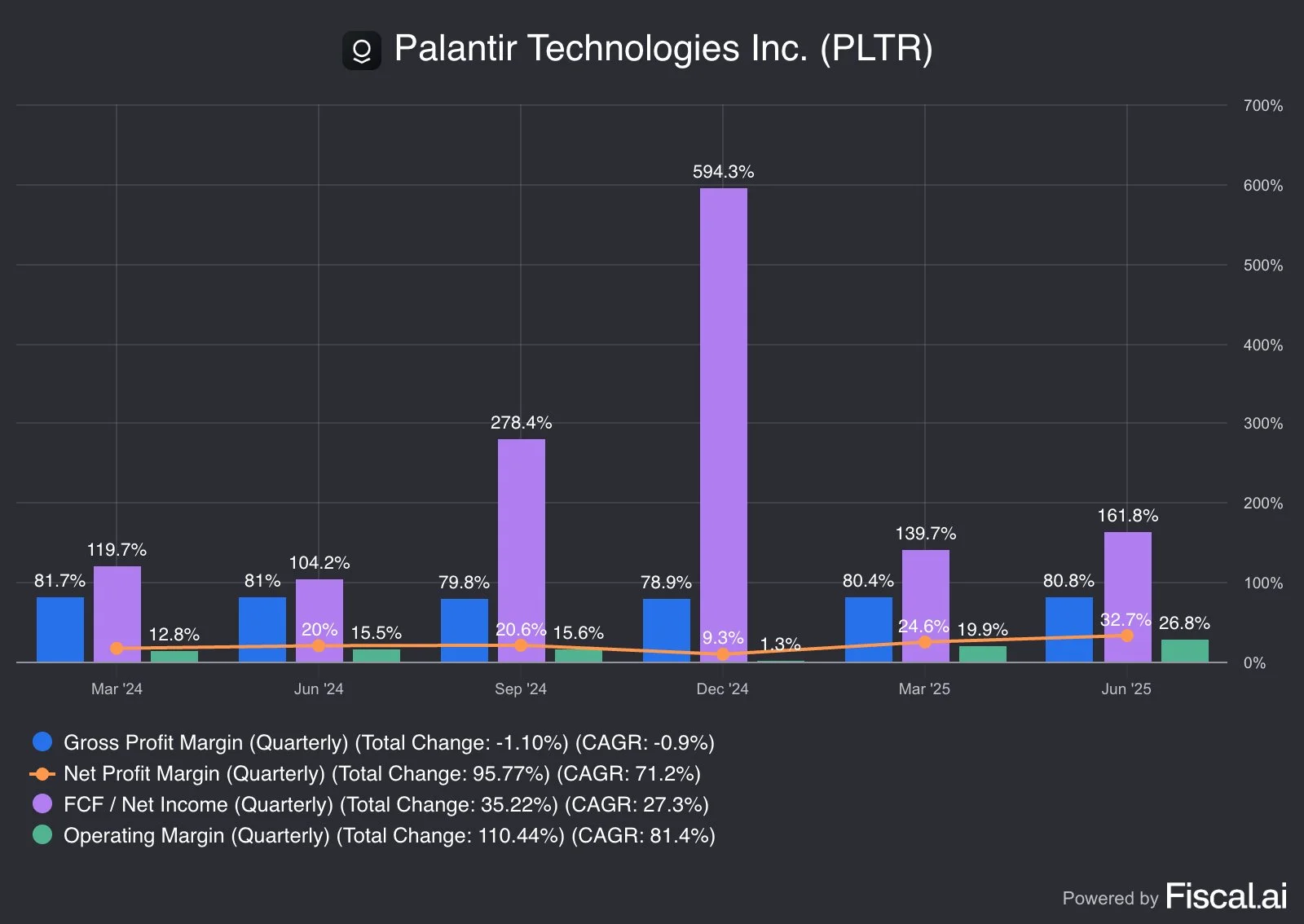

Profitability:

It’s happening. Slowly, then all at once:

Gross Margins: Steady, Strong

Consistently around 80%, quarter after quarter.

🟧 Net Margins: Quiet Revolution

Nearly tripled in a year—from 12.8% (Mar '24) to 32.7%

Operating Margin: Breaking Out

Doubled over the past year to 26.8%.

🟪 FCF/Net Income Ratio: Surge Mode

Rocketed from 119.7% to 161.8%.

Competitive Advantage:

Palantir’s moat is built on depth, not breadth.

Decade-long contracts.

Forward-deployed engineers embedded at customer sites.

High switching costs.

Government trust (DoD, NATO, CIA).

Ontology-based architecture, meaning their AI doesn’t just guess—it understands your data and your reality.

Source: Silvercrosscapital.com

Valuation Has Exploded

P/E: Up 561% YoY

P/S: Up 1,203% YoY (!)

P/FCF: Up 357%

Forward multiples (P/E, P/S, P/FCF): Also surged 400–950%

Markets aren’t just optimistic—they’re betting big.

DCF Reality Check

Based on our discounted cash flow model:

Stock trades ~60% above intrinsic value

Market is pricing in a 48% growth rate

That’s aggressive—even for a company growing 40–50% YoY.

Analysts are cautious (or confused), with 16 holds, 6 buys, 3 sells. But Palantir’s narrative may be outrunning their models. If you're playing based on 2025 earnings, the valuation is steep. If you’re betting this becomes the next Microsoft for AI, it might still be expensive.

💼 Balance Sheet:

$993M in cash

$4.4B in marketable securities

No debt.

This company is self-funded, cash-rich, and clean. And yes, still growing like it’s 2013.

Market Potential:

AI spend is set to exceed $1T globally by 2030. Palantir’s AIP is targeting everything from hospitals to hypersonics, from supply chains to satellites.

AI tailwinds, commercial growth, deep government ties, and expanding margins are converging.

Notably:

Heineken: cut 3 years of dev time into 3 months.

Wendy’s: fixed week-long issues in 5 minutes.

U.S. Army’s TITAN: one of its top AI programs.

AIG, Citi, R1 RCM, Archer Aviation—all onboarded recently.

Palantir Q2 2025 Earnings Summary:

Total Revenue: $1.004B

↳ +48% YoY, +14% QoQU.S. Revenue: $733M

↳ +68% YoY, +17% QoQU.S. Commercial Revenue: $306M

↳ +93% YoY, +20% QoQU.S. Government Revenue: $426M

↳ +53% YoY, +14% QoQ

They’re not just part of the AI wave. They’re designing the surfboard

Risks:

Valuation risk: It’s priced for perfection—or at least domination.

Geopolitical risk: Heavy reliance on U.S. government contracts.

Cultural alienation: Not everyone loves Karp’s rhetoric or Palantir’s defense ties.

Execution risk: AIP is still relatively new. Can it scale globally?

Regulatory heat: AI + data = more scrutiny.

This isn’t a “safe” bet. But safe doesn’t change the world.

Conclusion:

Palantir isn't for everyone. It’s bold, weird, mission-obsessed. You won’t find polished earnings call banter here—just Karp, talking about men without chests and the fate of the West. But the results? They’re hard to ignore.

The stock has run. But the mission may be just beginning.

So the question isn’t: is Palantir overpriced?

The question is: what if they’re right?

I often use this rule near market bottoms: high risk-reward = be aggressive and near market peaks: high risk, low reward = be cautious.

I think it's time for the latter to be cautious or take some profit.

At the end of the day no one goes broke by taking profit.

SCC Rating: 78% | The market appears to be driven by a fear of missing out on future gains. We recommend caution, as investors may be disappointed if future results do not materialize.

Take Your Investments to the Next Level! We provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

To find more research and expert commentary, visit www.silvercrosscapital.com — your source for sharp, data-driven insights into transformative public companies.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.