Is BitMine Immersion The Ethereum of MicroStrategy?

Could BitMine be the MicroStrategy of Ethereum—but smarter, sooner, and yield-generating?

Key BitMine Investment Thesis:

Strategic Ethereum Play: BMNR isn’t just buying ETH it’s building the world’s largest Ethereum-native treasury with a bold target to own 5% of the network.

Ethereum’s ChatGPT Moment: ETH is becoming the rails for global finance and BMNR is positioning itself as the infrastructure layer riding that wave.

Capital Discipline: Every move from issuing stock to making acquisitions—is designed to increase ETH per share without diluting existing shareholders.

Asymmetric Upside: BMNR is a high-conviction, actively managed ETH engine—think MicroStrategy for Ethereum, but smarter and earlier. Legendary investor Peter Thiel (via his Founders Fund) has disclosed a 9.1% stake in the company.

Competitive Advantage: BMNR blends crypto-native strategy with TradFi execution, giving it a unique edge in ETH staking, treasury management, and advisory.

What Makes BitMine a Buy?

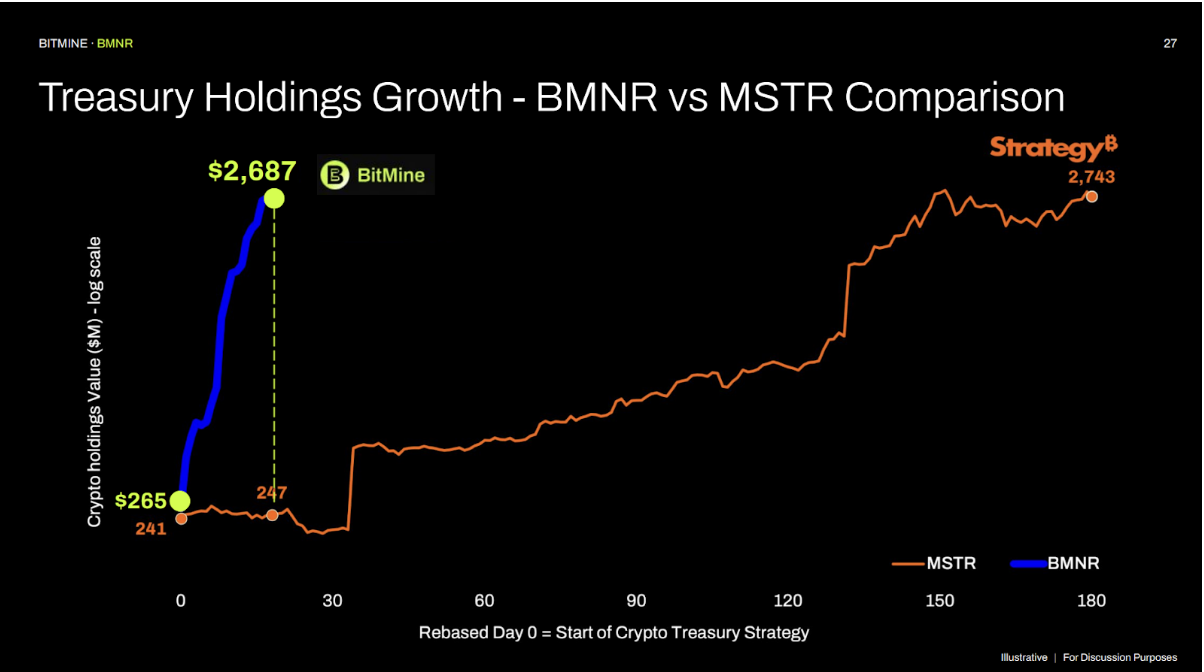

In the last six months, BitMine Immersion Technologies (NYSE: BMNR) building the world’s premier Ethereum-native treasury platform, with over $2.7 billion in crypto assets and a razor-sharp focus: increase ETH per share and become a 5% owner of the Ethereum network.

Think MicroStrategy, but for Ethereum—with an actual infrastructure business to back it up.

Since February 2025, BitMine has grown its digital asset holdings from zero to $2.7 billion, outperforming ETH itself by over 6x in the process. This is a play on the Ethereum economy, with asymmetric upside baked into both treasury appreciation and a capital-light, recurring-revenue business model.

How BitMine Makes Money

BitMine operates a fully managed Mining-as-a-Service (MaaS) fully outsourced crypto mining for institutions.. It’s targeted at public and private enterprises who want exposure to Bitcoin without the complexity of setting up mining infrastructure.

Key revenue levers:

Equipment leasing & hosting fees

Direct BTC payouts to clients

Strategic advisory for corporate Bitcoin treasuries

Synthetic mining strategies (non-dilutive BTC exposure)

This recurring, B2B SaaS-style mining model creates operating income that is reinvested into ETH—fueling per-share growth.

Management, Culture, and Skin in the Game

Led by CEO Jonathan Bates, a former Managing Director at JP Morgan, and advised by Tom Lee, Fundstrat’s Head of Research and one of Wall Street’s top-ranked strategists, BitMine’s leadership blends deep TradFi experience with crypto-native insight.

They’re not just talking their book. The company holds 600,000 ETH, 192 BTC, and $369M in cash on its balance sheet. Their mission is clear and aligned: maximize ETH per share.

Capital Allocation: Laser-Focused on ETH Per Share

BitMine has created a playbook for increasing ETH/share:

Issue equity at premium to ETH NAV

Use proceeds to buy more ETH

Reinvest operating income and staking rewards

Acquire other digital asset treasury (DAT) firms near NAV

Approved a $1 billion stock buyback program

Capital allocation is active, accretive, and non-dilutive by design.

Profitability: Building While Staking

The company doesn’t just hold ETH—it puts it to work.

By staking ETH and running validator nodes, BitMine earns yield and secures the Ethereum network. This is revenue-generating digital infrastructure, not a passive holding company.

The strategy mirrors productive oil reserves vs inert gold. ETH is the oil. BitMine is Exxon, not a vault.

Competitive Advantage

BitMine’s moat lies in a rare combination:

ETH-native staking and treasury mechanics

Provide mining-as-a-service

Regulatory-compliant advisory for corporate BTC strategy

Strategic partners: Kraken, Galaxy, FalconX

It’s building a next-gen digital asset platform—part infrastructure, part asset manager, part strategic advisor.

Valuation: Premium to NAV, Leverage to ETH

As of July 29, 2025:

NAV per share: $22.84

Stock price (6/27/25): $33

Implied NAV premium: ~44%

With 117.6 million fully diluted shares, BitMine is trading well below its NAV—a deep-value play on the world’s second most valuable crypto asset.

Balance Sheet Strength

BitMine’s treasury as of July 2025:

ETH: $2.295B

BTC: $23M

Cash: $369M

Total Treasury NAV: $2.687B

Zero long-term debt disclosed. It’s rare to find this much digital firepower, unlevered, and this early in the cycle.

Market Potential: Ethereum’s ChatGPT Moment

ETH is entering its “ChatGPT” moment, as tokenized real-world assets, stablecoins, and payment rails all consolidate on the Ethereum network.

ETH supply is shrinking. Use cases are exploding. Treasury-driven companies like BitMine could be the next frontier much like MSTR pioneered Bitcoin.

Risks

No crypto play is risk-free. BitMine faces:

ETH price volatility

Regulatory shifts (especially stablecoin/tax rules)

Treasury strategy execution

Dilution risk if equity issued without accretive ETH buys

Its trading 44% premium to net asset value

Conclusion

BitMine isn’t just MicroStrategy for Ethereum—it’s the smarter, earlier version. With $2.7B in crypto assets, real staking yield, and an active treasury strategy, it offers leveraged ETH exposure backed by infrastructure and execution.

It’s not just betting on ETH. It’s compounding.

For investors seeking asymmetric upside in Ethereum’s next chapter, BMNR is the share to watch.

Take Your Investments to the Next Level! We provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.