Warrior Met Coal: A Low-Cost Cash Machine with Hidden Upside

Warrior Met Coal Inc. - Mohnish Pabrai’s Betting 37% of His Portfolio.

Warrior Met Coal (NYSE: HCC) is more than just a miner—it's a disciplined, cash-rich operator thriving where others stumble. With one premium product, unmatched cost control, and a world-class expansion underway, Warrior is quietly positioning itself for the next global steel supercycle.

How Warrior Met Coal Makes Money

Warrior sells ultra-low sulfur, high-CSR metallurgical coal—a critical input for blast-furnace steel production. In 2023, it shipped 6.8M short tons, generating $1.68B in revenue across Europe, South America, and Asia.

Premium Pricing: Blue Creek coal commands above-index prices.

Lean Operations: Two slick longwalls, owned prep plant, and conveyor-to-rail efficiency.

Methane Monetization: Captures and sells mine gas.

Cash Machine: $701M operating cash flow in 2023 funds growth and shareholder returns.

Management: Veteran Operators, Owner-Minded

CEO Walter Scheller (ex-Walter Energy, Peabody, CONSOL) leads a veteran team with a rare blend of operational and financial rigor.

Insider Ownership: Scheller ($20.2M), Boyles ($8.1M), Richardson ($9.1M).

Execution Record: Survived a historic strike, fixed terminal issues, ramped production.

Comp Aligned: Stock awards tied to safety, production, and cost—not just share price.

Capital Allocation: Disciplined, Shareholder-Focused

Blue Creek Mine: Fully funded from internal cash. No debt. No dilution.

Dividends: Raised 17% in 2023, plus a $0.88 special.

Debt: Cut nearly 50% of secured debt last year.

Capital Productivity

ROIC: 32.8%

ROE: 27.3%

ROA: 18.7%

That beats most industrials—let alone cyclicals.

Does Warrior Have a Moat? Yes—Several.

Lowest-Cost Producer: In-house prep plant, high-quality geology, and conveyor-to-rail efficiency.

Tight Market: Eastern U.S. met coal is a niche few can enter.

Efficient Scale: Few peers in U.S. met coal; $1B capex deters new entrants

Long-Term Contracts: Low switching costs but consistent reorders.

Valuation: Margin of Safety Is Clear

P/E (TTM): 10.3 | Forward P/E: 25.2

EV/EBITDA (TTM): 5.4 | Forward EV/EBITDA: 7.6

DCF Discount: Trading at 34% below intrinsic value.

Investor Backing: Mohnish Pabrai has 37% of his U.S. stock portfolio in HCC.

Balance Sheet: Rock-Solid

Cash: $506M | Net Debt: $333M

Debt/Equity: 0.1 | Interest Coverage: 97.1x

Clean Structure: No goodwill or accounting fluff.

No goodwill. No fluff. Just muscle.

Market Potential: Global Tailwinds, Tight Supply

Steel Demand Rising: Forecast up 11% by 2030.

India Leads: Seaborne coking coal demand up 50% by 2035.

Supply Crunch: Forecast 28M ton deficit in seaborne coking coal by 2035.

Blue Creek: Adds >60% to production with $90-105/ton cost base.

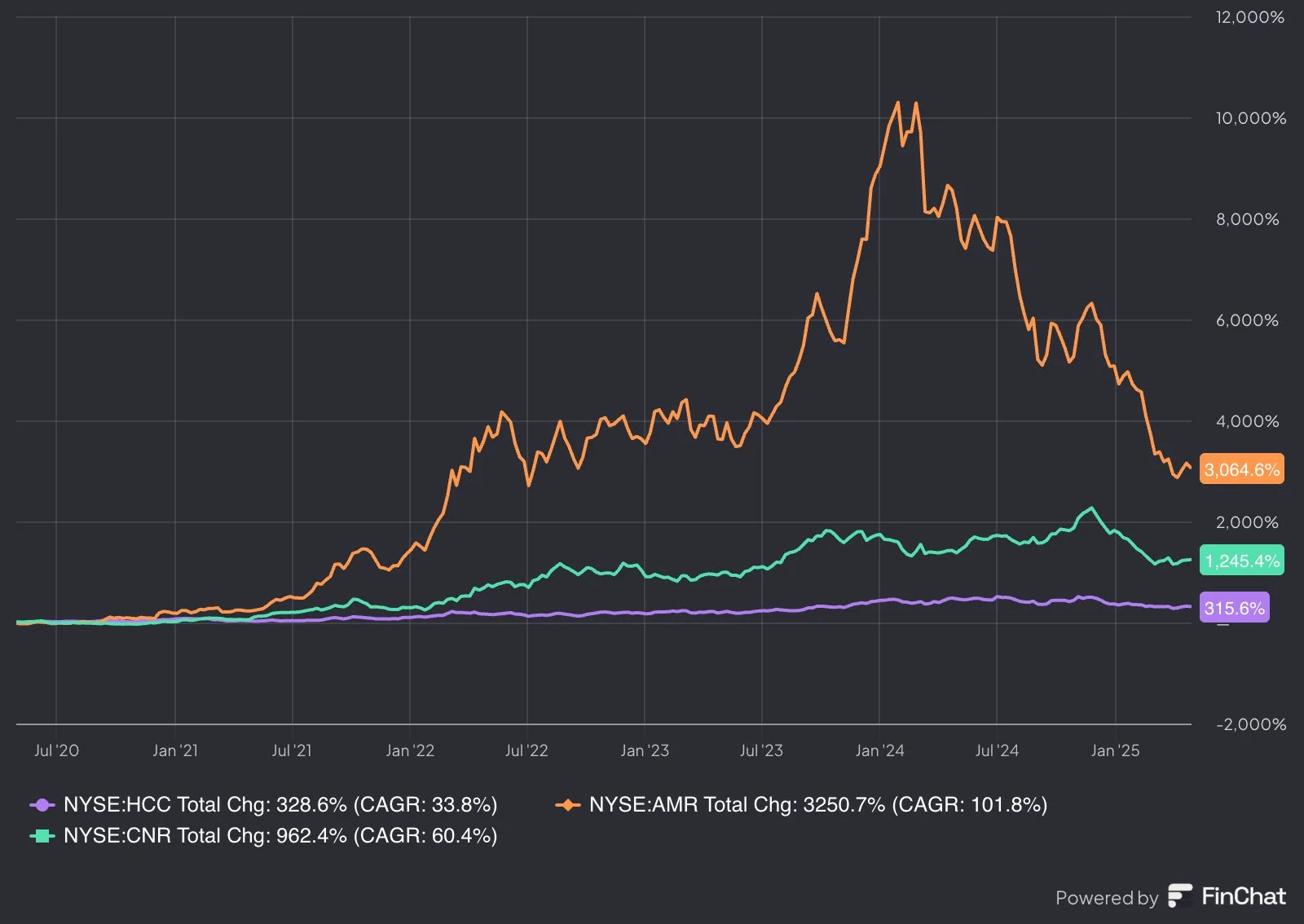

Performance: Steady Outperformer

Total Return Since 2020: +328.6%

CAGR: 33.8%

Peers (AMR, CNR): Outpaced Warrior in momentum, but not in resilience.

Risks to Watch

Commodity Volatility: Pricing pressure in down cycles.

Labor: Unionized workforce poses operational risks.

Regulation: ESG and emissions policy could tighten.

Execution: Blue Creek delays or overruns.

Customer Concentration: Exposure to key global buyers.

Final Take: High-Conviction Compounder in a Mispriced Wrapper

Warrior Met Coal is executing from a position of strength. With Blue Creek ramping, a lean cost base, and aligned leadership, it's one of the few coal miners positioned to grow through the next decade—not just survive it.

For patient investors, the value is hiding in plain sight. Warrior is a rare combination of high margins, low risk, and long-term optionality.

SCC's View: Buy.