S&P 500 Hits Records as Tariff Tensions Rise – Is the Market Rally on Thin Ice?

Wall street back at it again!

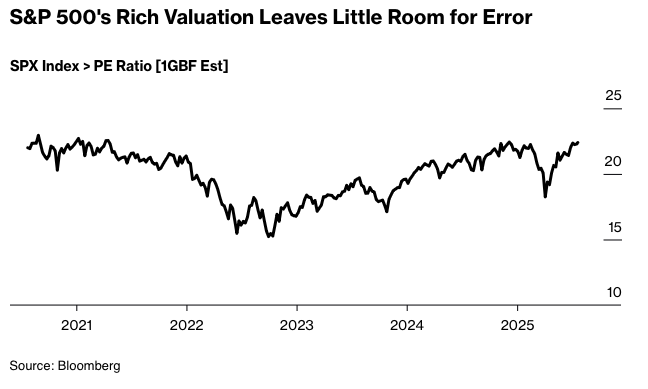

So, S&P 500’s flying high again—breaking records, flashing rich valuations, and yes, bringing back a little of that meme-stock froth energy. But according to JPMorgan’s trading desk? No stress.

They’re saying even the bears are finally caving—bullish sentiment is creeping in fast. Andrew Tyler from JPM put it like this: “Even the skeptics are throwing in the towel.”

Meanwhile, bond yields ticked higher, Fed cut bets are cooling off, and jobless claims? Still falling—for the sixth straight week. Translation: labor market's too healthy for Powell to start slashing rates anytime soon.

Add to that: Trump’s back at it. Not only is he touring the Fed's construction site he just trashed for being too expensive, he’s also hinting that 15% tariffs are the floor, not the ceiling. Mark that—Aug 1 is looking spicy.

But here’s where it gets interesting:

Goldman and Citadel are quietly telling clients to start hedging—cheap. Volatility is sitting near yearly lows, and that smells a lot like complacency in disguise.

Oh, and margin debt? Climbing again. Deutsche Bank says it's running a little too hot, which could be a red flag for credit markets.

Still, Piper Sandler's Craig Johnson says this rally isn't just about the tech giants—breadth is back, and the advance-decline line proves it. That’s bullish, technically speaking.

Markets are running hot, the Fed’s still tight, Trump’s tariff talk is heating up, and Wall Street’s quietly buying protection.

So ask yourself: Is this rally still real—or are we riding on fumes and FOMO?