Is GigaCloud Technology Stock a Buy?

When I first stumbled across GigaCloud Technology (NASDAQ: GCT) I almost skipped it—another Chinese tech stock? But the numbers wouldn’t let me.

This isn’t a speculative flash in the pan. It’s a founder-led, capital-light, high-ROIC platform scaling a global B2B logistics network that nobody else is touching. And it’s trading at less than 7x free cash flow.

What Makes GCT a Buy

5-year revenue and free cash flow CAGR of 40-41%%

Fully integrated cross-border logistics moat

P/FCF of just 7x

Expansion into Europe accelerating

Huge margin of safety—base case upside of +140% if we assume a conservative 5% growth.

Founder Laddy Lei Wu's 21.5% stake ($95 million) aligns his interests with shareholders.

This is a rare opportunity where the market is mispricing quality due to bias, not fundamentals.

GigaCloud operates a vertically integrated B2B marketplace connecting Asian manufacturers with global resellers—specializing in large, bulky goods like furniture and home equipment.

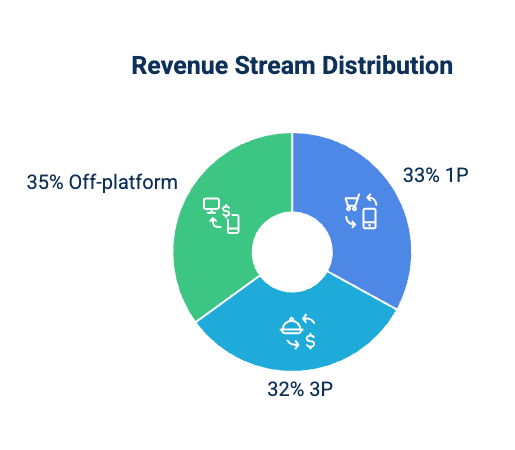

Three revenue streams:

1P (33%): Sells its own inventory on the platform

3P (32%): Charges sellers platform and logistics fees

Off-platform (35%): Sells inventory through Amazon, Wayfair, etc.

Source: Silvercrosscapital.com

Its proprietary “Supplier Fulfilled Retailing” model handles the entire process—from warehouse to doorstep—at one flat rate. That’s where the moat is.

Management

CEO Larry Wu

CEO Larry Wu still owns 21.5% of shares worth ($95M), even after modest selling for personal diversification. The C-suite is U.S.-based and committed to transitioning the company to full U.S. regulatory compliance something frauds simply don’t do.

Compensation is mostly salary-based, tied to operational metrics like GMV growth and margin expansion. Think Buffett-style alignment over flashy stock awards.

Capital Allocation: Disciplined and Opportunistic

Zero debt, $287M+ in cash

$78M repurchase program—buying back shares well above IPO price

M&A at <5x EBITDA: Noble House and Wondersign were strategic, accretive, and synergistic

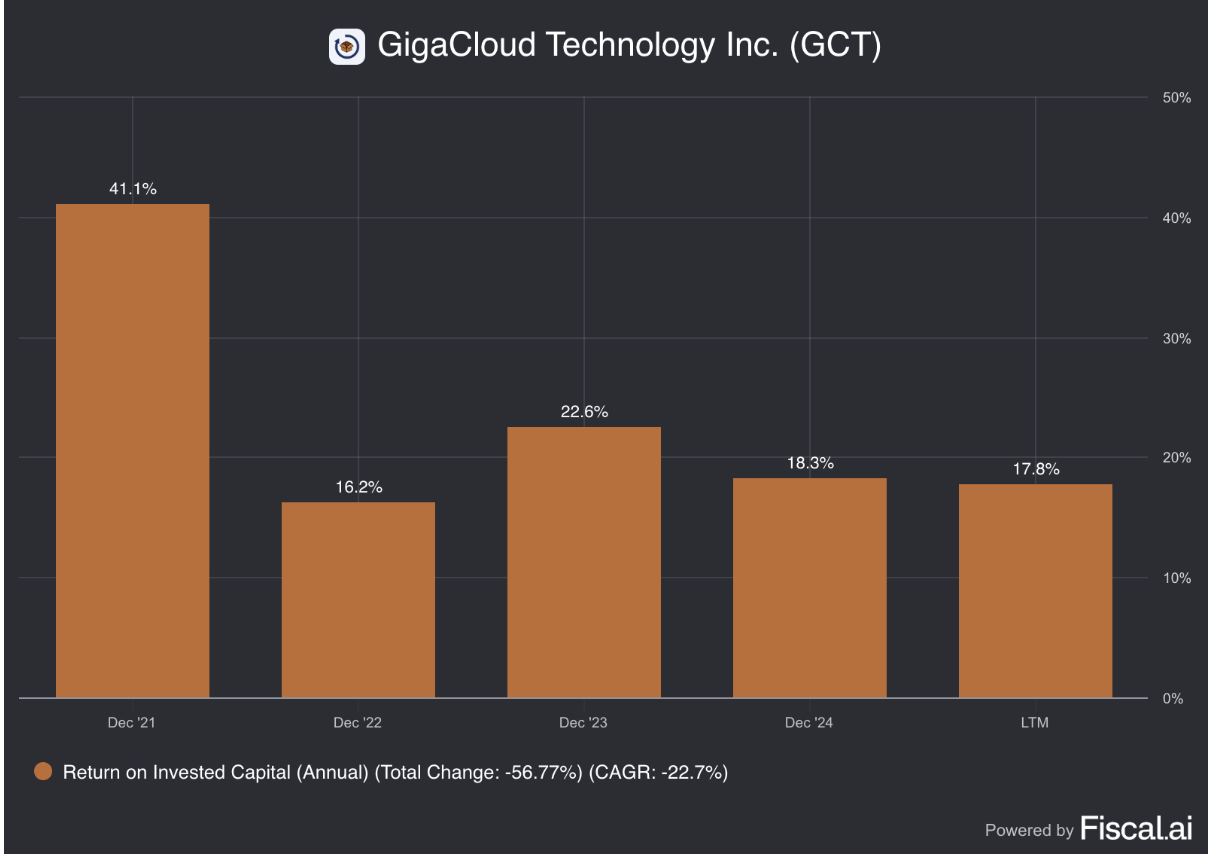

Return on invested capital has dropped from 41% in 2021 to 18% currently.While finding highly profitable investments is challenging, 18% is still a good return.

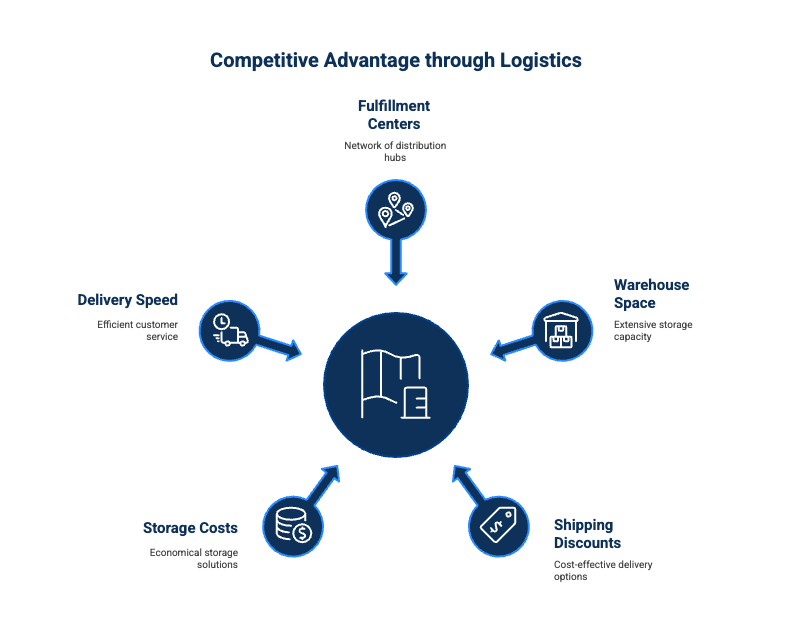

Competitive Advantage

35 fulfillment centers

10.3M sq. ft. across five countries

90% discount vs peers on bulky shipping

Warehouse storage cost: ¢5 vs $1.50 industry average

Serves 90% of U.S. customers within 3 days

Source: Silvercrosscapital.com

This scale is unreplicable without $100M+ in capex and years of execution. The flywheel—volume → lower cost → more customers → better margins—is excellent and accelerating.

This Stock Is Hiding in Plain Sight: Why We See 140% Upside

At $24 a share, the market is sleeping on this business.

Here’s what it’s missing:

EPS Growth: The company has grown earnings per share at a 21% CAGR.

Free Cash Flow Engine: FCF has compounded at 40% annually, hitting $138.3 million recently.

Valuation Disconnect: Despite that growth, the stock trades as if it will crawl forward—just 5% growth priced in.

But our analysis shows a different picture.

Even under conservative assumptions, the intrinsic value points to a 140% upside from current levels.

Market Potential: Still Early Days

$130B TAM in U.S. and Europe

GCT has just 2–2.5% share

Total revenue CAGR 54% since 2020

9,966 active buyers, each spending $142K+ annually

1,000+ active suppliers

As homebuilding and real income recover, GCT’s logistics-first model will gain even more traction.

Risks: What the Market Is Worried About

Tariffs? Minimal impact—bulk of sourcing has shifted to Vietnam and Southeast Asia

China discount? GCT is U.S.-listed, U.S.-compliant, U.S.-run

Fraud concerns? Short-sellers misread the story—real web traffic, real imports, real warehouses

Insider selling? Small scale and largely for diversification; major holders remain committed

GigaCloud looks like in its early logistics expansion phase—capital-light, misunderstood, and skating to where the puck is going.

“You don’t get many chances to buy a capital-light, founder-led, cash-generating logistics disruptor at a distressed multiple. This is one.

GCT has the hallmarks of a compounder in the making:

Founder-led

Cash-rich

Capital-light

Structurally advantaged

Deep moat in a growing niche

Yet it trades like a broken story. I’m buying the disconnect.

SCC Rating: 85% | We recommend buying the shares

Take Your Investments to the Next Level! We provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions