Is Coinbase Worth Buying?

In investing, the hard part isn’t finding the next big thing — it’s recognizing when a big thing is quietly evolving.

Quick Company Snapshot

Industry: Crypto Exchange / Fintech

Founded: 2012 by Brian Armstrong & Fred Ehrsam

CEO: Brian Armstrong (co-founder)

Founder Ownership: ~14.5%, with dual-class control

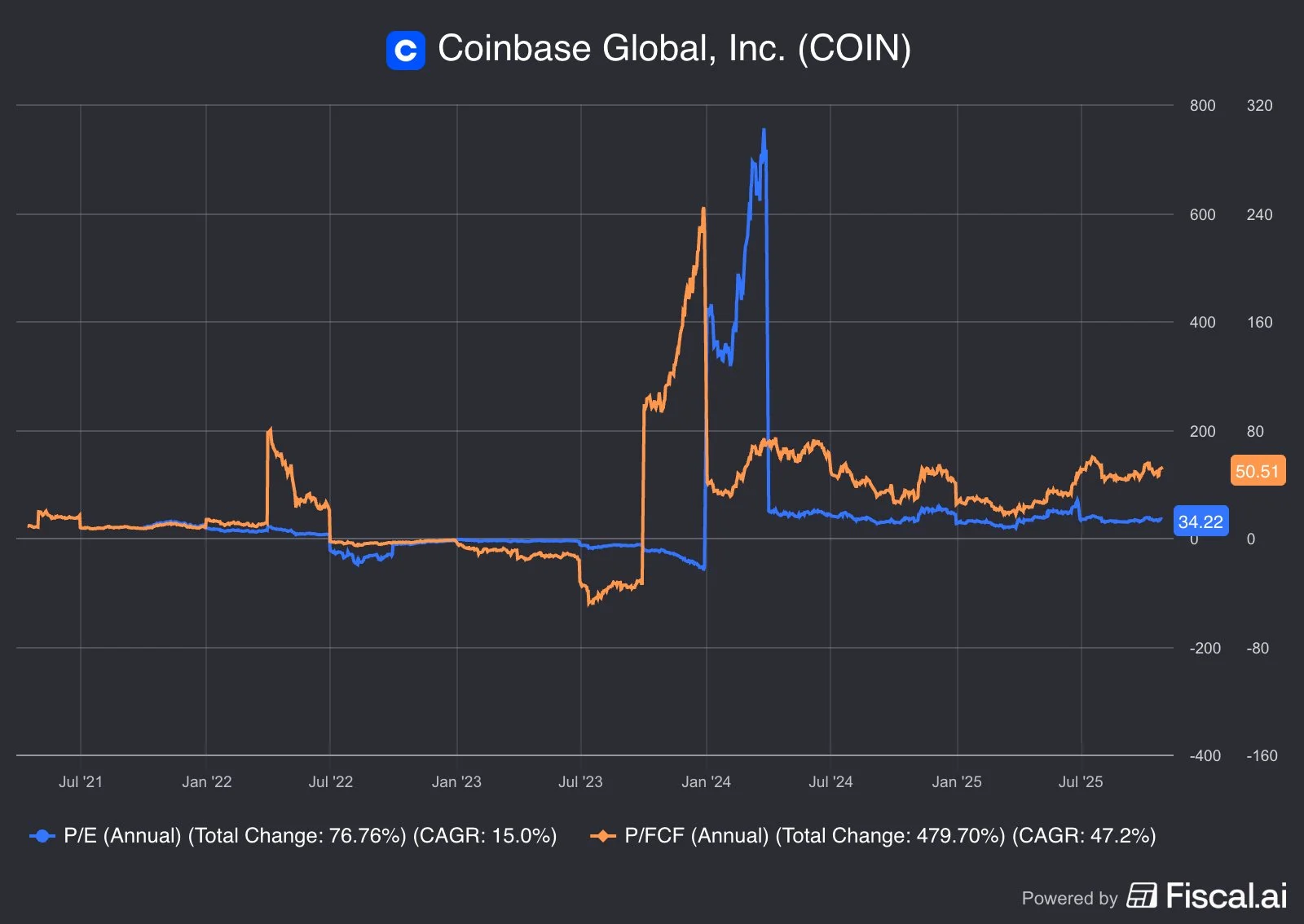

Valuation: ~34x P/E | ~51x FCF | ~0.08% FCF yield

Custody Footprint: Powers 80%+ of ETF issuers, 350+ infrastructure clients

The Premise: Coinbase Is Not a “Crypto Exchange” Anymore

Most investors still see Coinbase as a speculative trading hub.

That view is outdated.

The company has evolved into financial infrastructure — the rails powering custody, payments, tokenization, and onchain data.

It’s now the AWS + Visa of crypto, quietly embedded across the digital economy.

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase began as a one-screen app to buy Bitcoin.

The ambition is clear: build an “Everything Exchange” — where every asset, from Bitcoin to real estate, trades onchain.

Investment Thesis — Coinbase (COIN)

A hybrid powerhouse: Coinbase combines fintech scale, exchange liquidity, and infrastructure-as-a-service — a rare trifecta in finance.

Moat built on trust: Regulated, compliant, and secure — in an industry where credibility is scarce, Coinbase’s reputation is its edge.

The “Everything Exchange”: Management’s North Star — move every asset (crypto, equities, real-world) onchain using its integrated stack: trading, custody, staking, payments, and developer APIs.

Tokenization tailwind: Capturing just 3% of global equities trading could double the current crypto market size. This isn’t theory — it’s the next logical step in capital markets evolution.

Regulatory clarity unlocked: MiCA license in Europe secured; U.S. policy tone improving. The compliance-first strategy that once slowed growth now compounds it.

Explosive market backdrop: Global crypto market expected to jump from $2.5T (2023) to $6.8T by 2028 — Coinbase sits squarely at the center of that growth.

Expanding moat: Dominates ETF custody (80%+ market share) and institutional access. Its Base Layer 2 and USDC infrastructure make it the de facto “crypto OS.”

Payments flywheel spinning: USDC + Base + merchant APIs already live with Shopify — a credible step toward stablecoins becoming a mainstream payment rail.

Founder-led alignment: Brian Armstrong owns ~14.5% and controls the vote — vision and execution remain tightly linked.

Capital allocation discipline: $1B buyback approved (unused), minimal capex, and crypto held as strategic reserves. Proof of prudence, not speculation.

What They Do (and What They’re Becoming)

Coinbase enables users and institutions to buy, sell, store, stake, and build with crypto assets. It operates across three main segments

Retail Trading:

User-friendly app for individuals to buy/sell over 300 digital assets.Institutional & Custody Services:

Coinbase Prime and Custody serve hedge funds, corporations, and ETF providers — it now safeguards 17 of the 20 Bitcoin and Ethereum ETFs.Coinbase Cloud & Subscriptions:

Offers staking, custodial fees, developer APIs, and blockchain infrastructure services (comparable to AWS for crypto).

In short — the AWS + Visa of crypto.

Management, Ownership, Culture

Management is viewed as having consistently demonstrated its ability to navigate challenges and drive meaningful growth.

Founder-led: Brian Armstrong still runs the show.

Insider ownership: ~14.5%; controlling vote structure = long-term vision intact.

Culture: Rational, curious, relentlessly regulatory-first.

As an investor, I like when a CEO’s ego is aligned with the company’s survival — Armstrong’s is.

Capital Allocation (Built to Compound?)

Low cap-intensity: Asset-light model; scaling with software and custody, not hardware.

Derivatives push: U.S. perpetuals launched; Deribit acquisition to deepen options; focus is liquidity before margin.

Crypto investments: ~$1.8B crypto portfolio, fueled by weekly BTC purchases.

Subscriptions + payments rising while transaction take-rates compress — the right trade over a cycle.

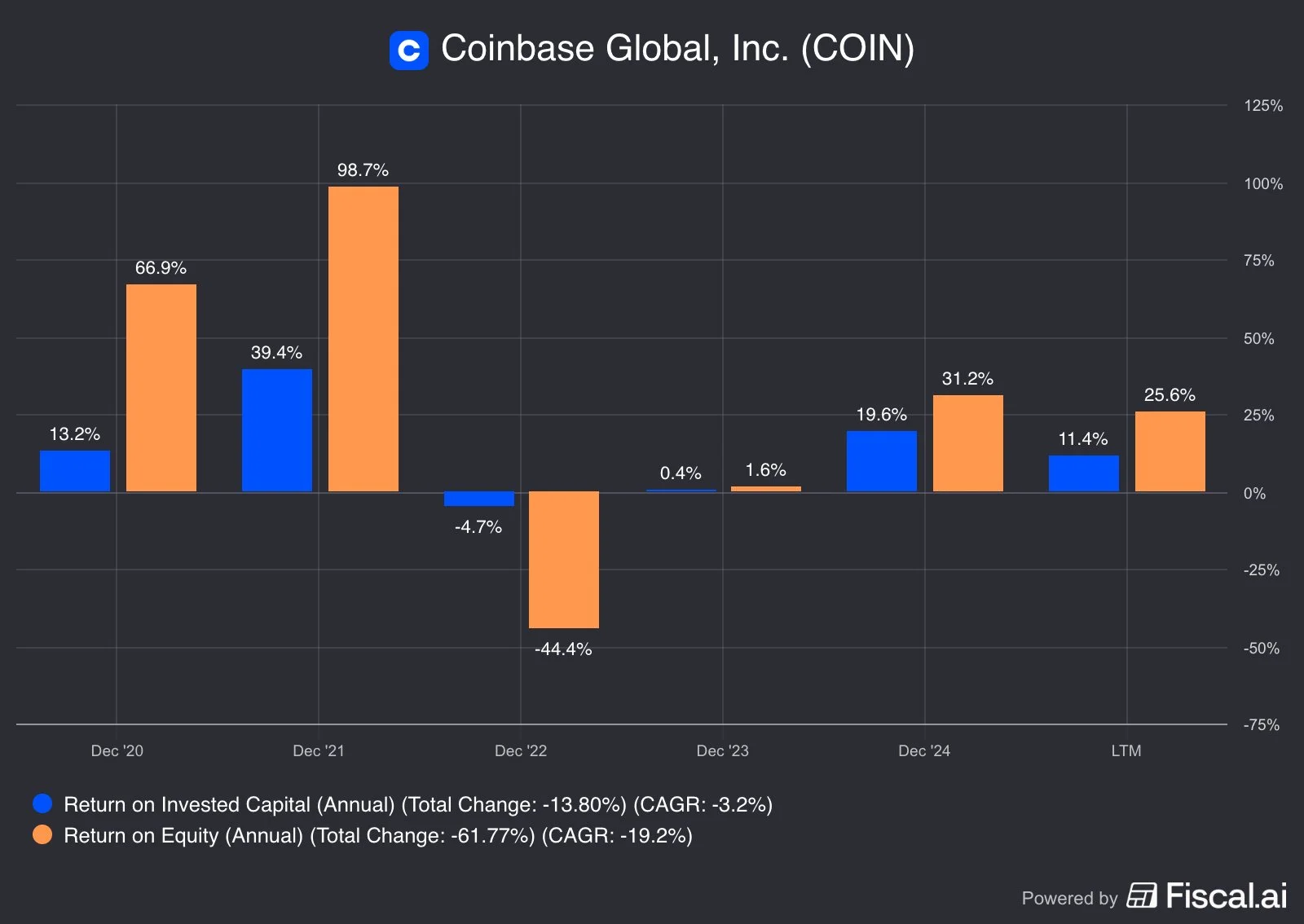

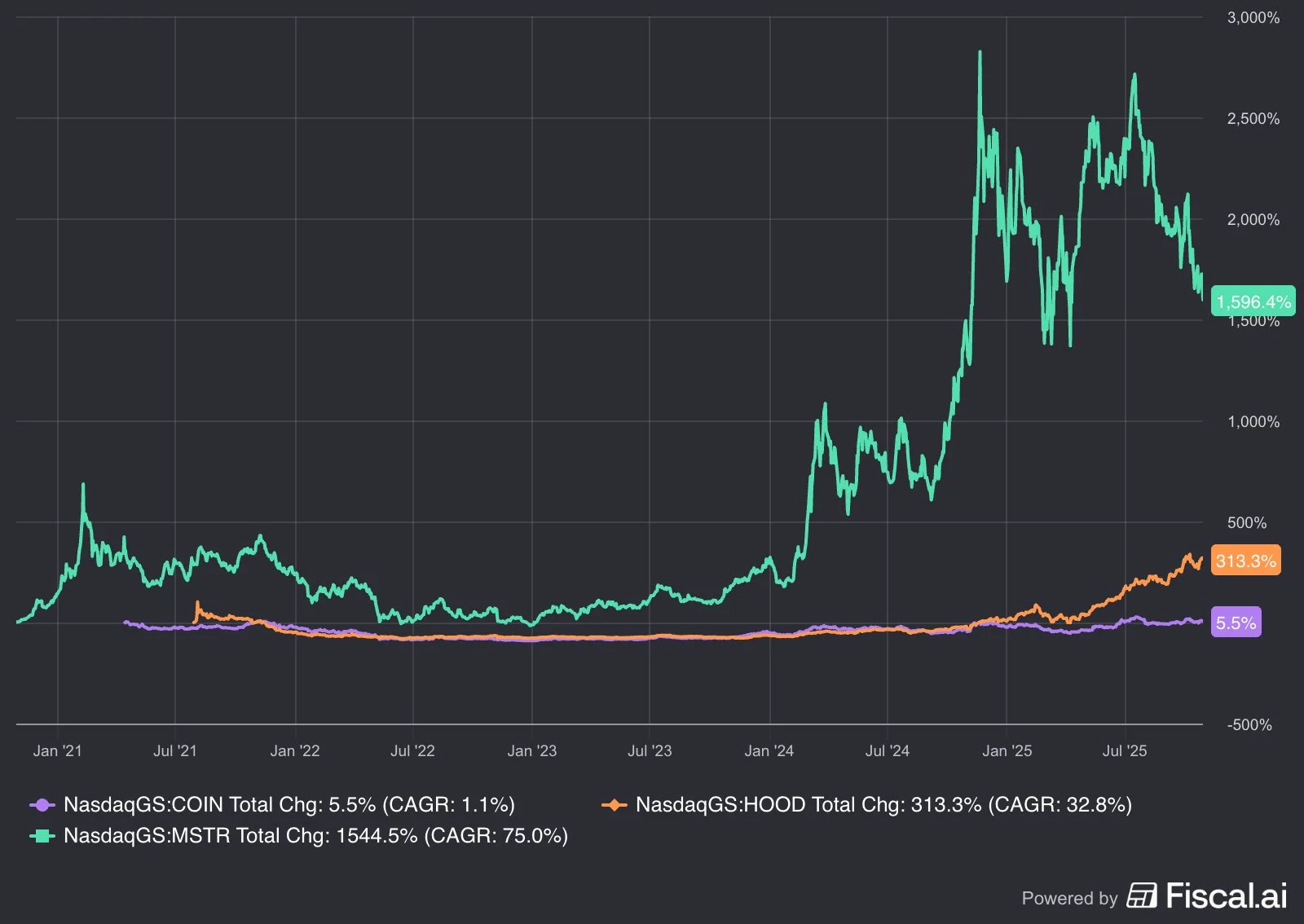

Look at the chart — it tells a story most earnings calls won’t.

Coinbase’s current Return on Equity (ROE) 25.5% exploded to nearly 99% in 2021, then cratered to –44% in 2022.

Return on Invested Capital (ROIC) 11.4% followed the same rhythm: +39% to –5% in a year.

Classic boom-and-bust behavior of a business tied to crypto cycles.

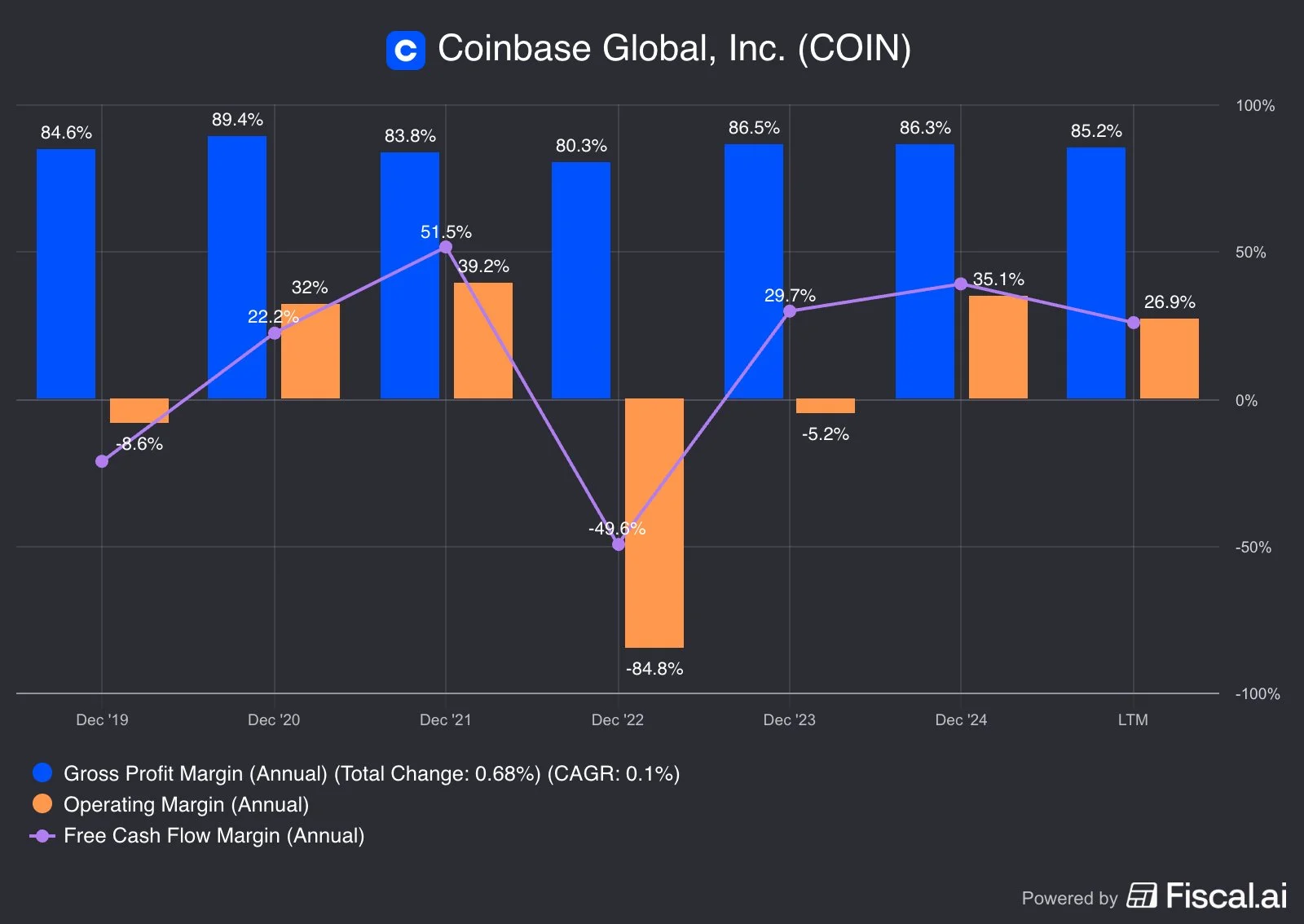

Profitability Snapshot

Stable Gross Margins (~85%) – Still strong through chaos, showing software-like resilience.

Operating Margin Recovery (–85% → +27%) – Cost discipline and subscription mix doing the heavy lifting.

Free Cash Flow Rebound (~27%) – From deep red to durable green — Coinbase is learning to make volatility pay.

The Competitive Edge

Visionary leadership is pursuing the Everything Exchange strategy including (stocks, commodities, real-world assets)

Regulatory + brand moat: Licensed, compliant, trusted; MiCA unlocks EU. ETF custody share cements institutional trust.

Scale: Management frames COIN as the “Everything Exchange,” expanding from spot into futures/options, then tokenized equities/RWAs.

Integrated stack: Brokerage + exchange + custody + Base L2 + USDC + payments APIs → high switching costs.

Scale: Coin based holds 65% U.S. market share.

Competitors can copy features, not reputation.

Valuation & Margin of Safety

Rich multiples: ~34x P/E, ~51x P/FCF. You’re paying up for optionality (tokenization, payments, custody).

What must go right: Subscriptions keep taking share; tokenization revenues show up; international mix grows.

DCF: The market is implying 22% growth rate

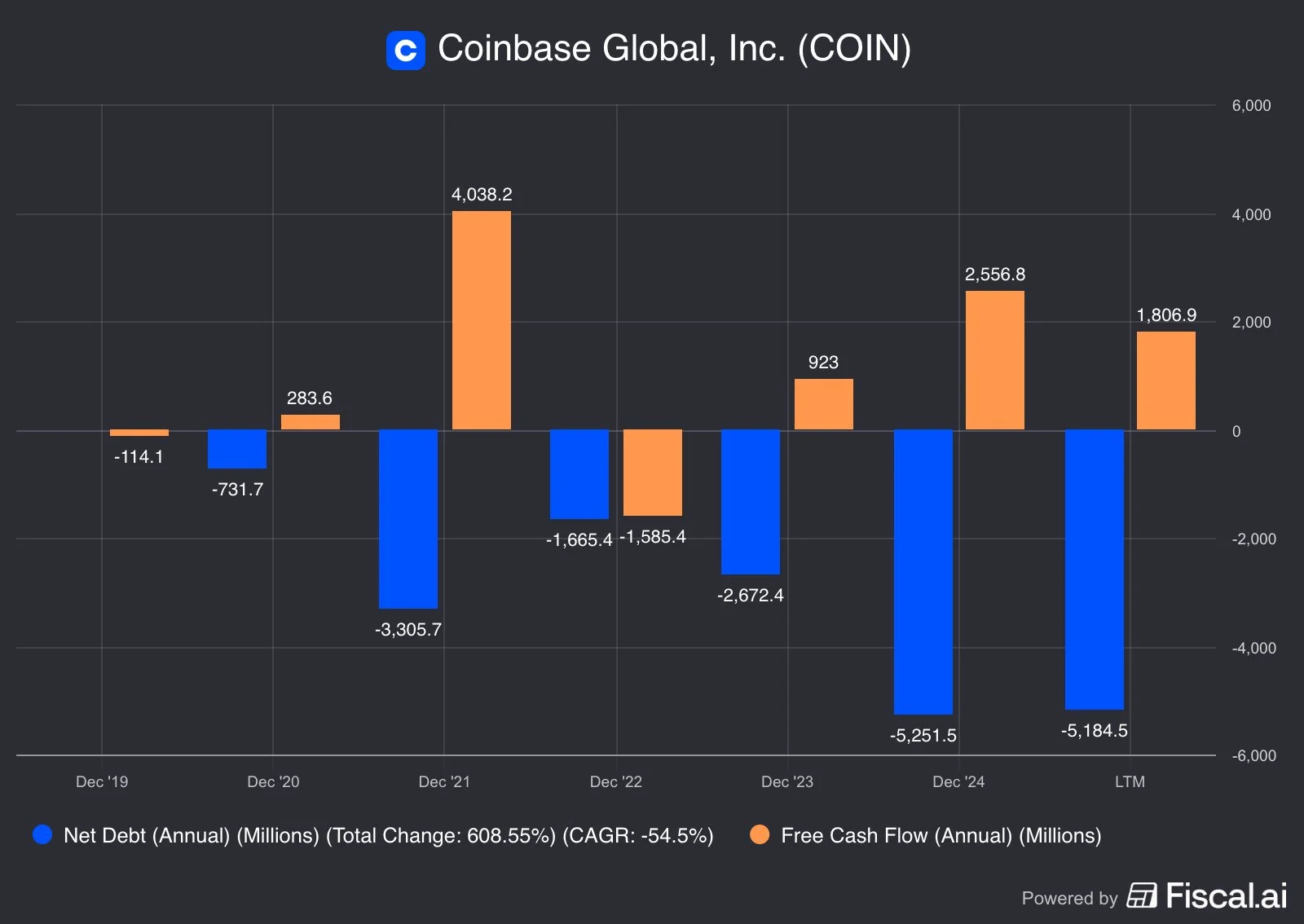

Balance Sheet & Liquidity

Cash is confidence. Debt is risky. Coinbase finally knows the difference.

Net cash fortress (~–$5.2B LTM): The company’s cash pile still dwarfs its debt — rare air in fintech. I’ve seen few firms in this space with that kind of liquidity buffer.

Debt-to-equity 0.4: Light leverage means flexibility. Coinbase can keep investing while others tighten belts.

Interest coverage 25x: Earnings easily cover interest — a strong signal of financial durability.

Growth Potential

The global crypto market ($2.5T in 2023) is expected to exceed $6.8T by 2028. Coinbase’s long-term growth drivers include:

Institutional adoption of crypto ETFs and tokenized assets.

Expansion of stablecoin payment APIs for businesses.

International growth beyond the U.S. market.

Monetization of Base and blockchain infrastructure services.

Coinbase is scaling into:

Tokenized assets (equities, real-world assets).

Stablecoin payments (Shopify, USDC).

Institutional adoption (BlackRock, PayPal, PNC).

Crypto-as-a-Service — the quiet engine underneath fintech’s next phase.

Risks

Policy/Regulatory turns (U.S. heavy revenue mix).

Operational security: Q2 data incident cost ~$307M; remediation underway.

Concentration: BTC/ETH mix; USDC rate sensitivity.

Crypto Volatility: Trading revenues tied to market activity.

Tech Disruption: Rapid AI or DeFi innovation could reduce centralized exchange relevance.

Competition: Fee wars from Binance, Kraken, and DeFi platforms.

Performance vs Peers

Coinbase has the fundamentals, but right now, the market prefers louder narratives.

COIN: 5.5% total change (CAGR 1.1%).

HOOD: 313.3% (32.8%).

MSTR: +1544.5% (+75%).

Conclusion

Ben Graham was right: in the short run, the market votes; in the long run, it weighs. Right now, the market still votes on crypto hype.

Coinbase, quietly, is adding weight — custody, payments, tokenization — the real infrastructure beneath the noise.

Founder-led, disciplined, and trusted, Coinbase sits at the crossroads of fintech scale, exchange liquidity, and infrastructure-as-a-service — a rare trifecta.

Its regulatory moat, institutional reach, and balance sheet strength make it one of the few credible bridges between traditional finance and the onchain economy.

But let’s be clear: the unknowability of crypto’s short-term cycles makes timing this stock nearly impossible.

At least the opportunity for Coinbase isn’t in predicting the next rally — it’s in owning the rails that will carry value long after the shouting stops.

Is Coinbase worth buying?

Not today. But it’s worth watching closely.

Coinbase has the DNA — founder-led, disciplined, visionary — but not yet the asymmetry.

SCC Rating: 74% | Neutral

At SilverCross Capital, our Outlier Portfolio is built on one truth:

A handful of companies create nearly all long-term wealth.