ALT5 Sigma Corp: Why It’s a Fintech + Crypto Power Player Worth Watching

Source: ALT5

ALT5 Sigma isn’t your average fintech name. This lean, next-gen platform blends crypto infrastructure with regulated, institutional-grade tools—bridging payments, trading, settlement, and custody through slick APIs. It’s quietly powering the digital asset revolution for real players. You’ve probably heard the buzz — $1.5 billion raised for the WLFI token treasury strategy. But do you really know the force behind this powerhouse? Let’s dive in and uncover the story."

The Investment Thesis

Mission-critical infrastructure: ALT5 Pay and ALT5 Prime form a bundled powerhouse—serving tokenization, crypto payments, OTC trading, and custody seamlessly.

Under-the-radar volumes: Over $1.2 billion in crypto transactions processed by end of 2023, with Q3 2024 delivering $4.94 million in revenue and nearly 50% gross margins in the fintech vertical.

Dual-sector playbook: This isn’t just fintech; ALT5 is splitting off its biotech arm (Alyea Therapeutics), keeping investor focus razor-sharp.

Index tailwind: Recently added to the Russell Microcap Growth, Russell 3000E, and Russell 3000E Growth indexes, which typically attract index fund flows.

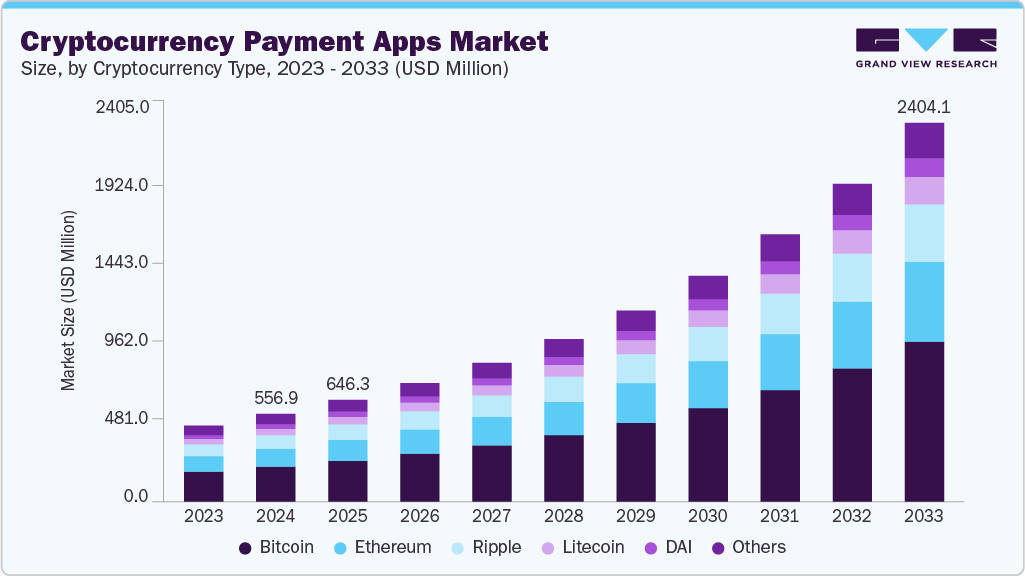

Massive Market opportunity in the crypto payment space! Something to look out for!

How They Make Money

ALT5 Sigma generates revenue by delivering cutting-edge, blockchain-powered solutions for tokenization, trading, clearing, settlement, payments, and the secure custody of digital assets. It does this by two main forms:

ALT5 Pay: Crypto payments gateway that lets merchants accept crypto—and cash out in fiat or keep digital—via WooCommerce plugins and API widgets.

ALT5 Prime: OTC trading suite that handles crypto-fiat transactions via browser, mobile (ALT5 Pro), FIX API, and Broadridge’s NYFIX—highly flexible.

Management & Expansion Moves

CEO Peter Tassiopoulos, appointed Aug 2024, is leading the fintech rally and the biotech spin-off. He has been vital for leading ALT 5 into becoming one of the best online payment service providers in 2025!

Big capital play ahead: Announced a $1.5 billion direct offering (plus a private placement) to fund a $WLFI token treasury strategy, pay down debt, and fuel business ops. New board seats include Eric Trump and WLFI execs.

Capital & Profitability Snapshot

Capital Allocation

ALT5 Sigma is playing a high-stakes game. The capital raise could be transformative—or it could erode value if mismanaged. The dual strategy of fintech scalability and biotech innovation is compelling, but hinges entirely on disciplined execution—especially around dilution control, strategic disclosure, and transparent capital use.

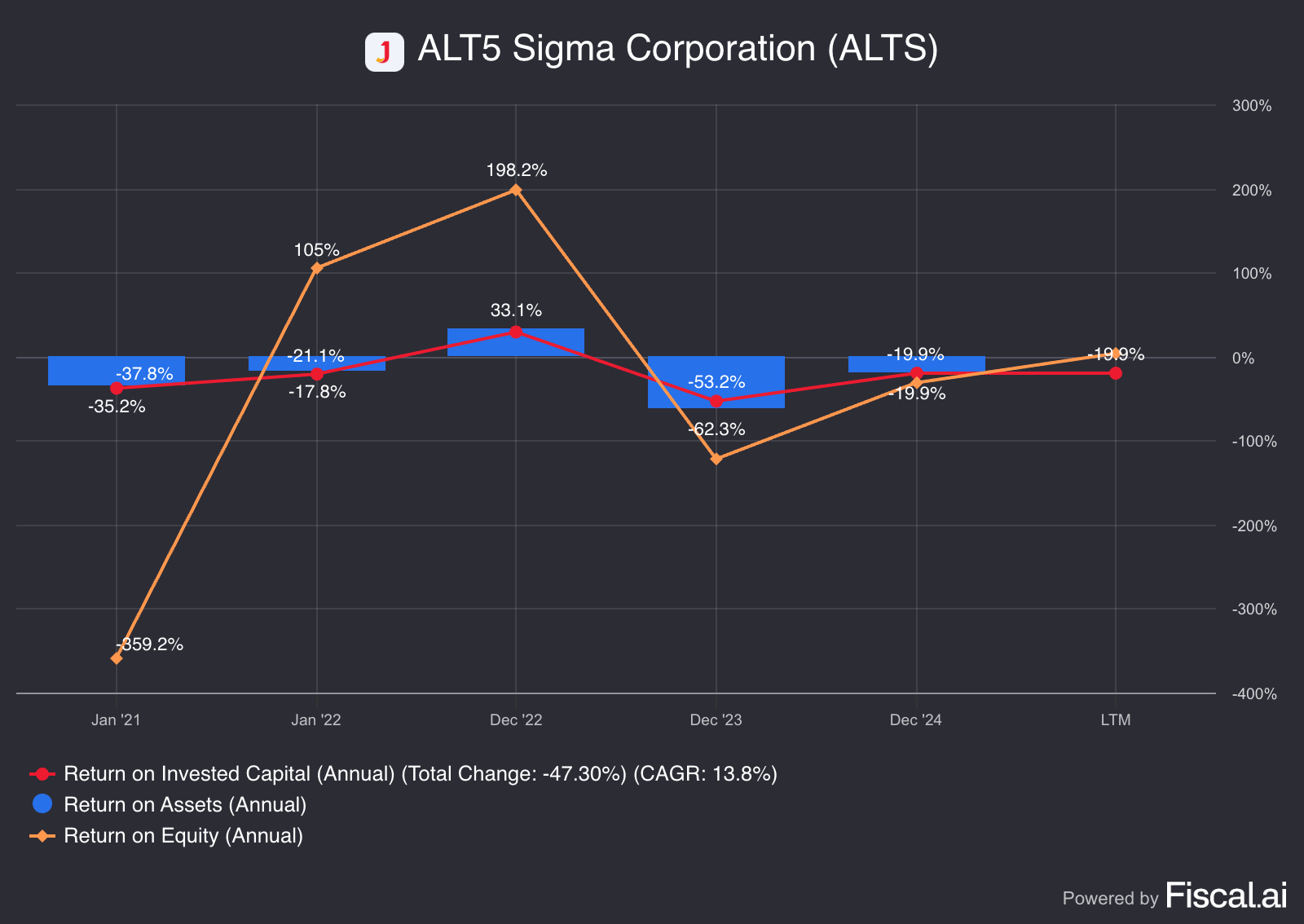

Alt 5 Corps 5 year returns:

ROIC: 54.9% – Strong capital efficiency, showing the company generates substantial returns on invested capital.

ROE: –206.6% – Alarmingly negative, reflecting heavy losses relative to shareholder equity.

ROA: –15.6% – Weak asset utilization, indicating the company isn’t yet converting its asset base into profits.

Profitability

FCF Margin: 4.3%

Operating Margin: -43.3%

Gross Margin: 49.2%

ALT5 Sigma’s core business is profitable at the product level, but heavy operating costs are eroding that strength, leaving only a thin layer of cash generation.

Competitive Advantage

Plug-and-Play Crypto-as-a-Service – Enables rapid integration for institutions without building infrastructure from scratch.

Built-In Compliance – AML/KYC, monitoring, and reporting baked into the system, easing regulatory navigation.

Proven Scale – Over $5B in transactions processed, serving 1,000+ businesses globally.

Regulatory Tailwind – Positioned to capitalize on new stablecoin legislation with infrastructure already aligned to requirements.

Valuation

P/E: -13.9%

P/FCF: 171.9%

Definitely not a cheap company but it’s also not generating any money, so watch the space as investors seem still optimistic!

Balance sheet

Net cash: $10.8 M

Interest coverage: N/A

Debt to equity: 0.56x

Goodwill /assets: 14.3%

Not the strongest, but it has some cash to play around with minimal debt.

Market Potential & Strategy

Niche but growing: Crypto payment market is expected to cross 2.4 Billion in the next couple years!.

Core vertical lift-off: Deposits in index funds and fintech tailwinds could boost visibility.

Biotech separation positions the company as lean and focused for fintech growth.

Performance

Seeing sign of improvement over the last 3 years but can it keep up with its competitors is another question!

Risks to Watch

Valuation & execution risks: High expectations baked in; must deliver flawlessly.

Crypto regulation turbulence: Digital asset regs remain volatile—pressure on operations.

Complex capital strategy: The WLFI token treasury could be a bold win—or distraction.

Final Take

ALT5 Sigma is following the Datadog blueprint: lean, founder-led, margin-hungry infrastructure that scales with client usage. It’s already processing serious volume, winning institutional trust, and gearing up for a liquidity and capital splash.

Expensive? Maybe. But like top compounders, it's building mission-critical tools for where money—and crypto—are headed.

SCC Rating: 50%

Recommendation: Watch this space as it could go either way!

Take Your Investments to the Next Level! We provide in-depth, research-driven insights on the leading companies shaping tomorrow’s wealth landscape—spot future leaders and grow your portfolio with us.

Risk Disclosure: This content is for informational purposes only and does not constitute investment advice. Investing carries risk, including potential loss of principal. Always consult with a professional financial advisor to evaluate your risk tolerance and financial goals before making any investment decisions.